Reinsurance Market Research Report By, Coverage Type, Line of Business, Risk Type, Underwriting Technique, Regional

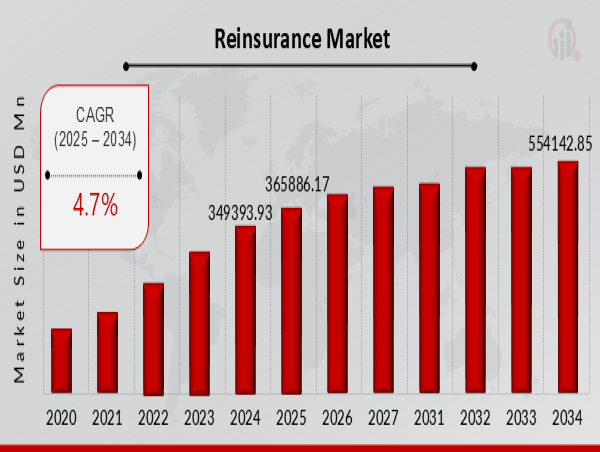

OR, UNITED STATES, January 20, 2025 /EINPresswire.com/ -- The global Reinsurance Market has been experiencing steady growth and is expected to continue expanding in the coming years. In 2024, the market size was valued at USD 349,393.93 million and is projected to grow from USD 365,886.17 million in 2025 to USD 554,142.85 million by 2034, exhibiting a compound annual growth rate (CAGR) of 4.7% during the forecast period (2025–2034). This growth is driven by the increasing demand for risk management solutions, the growing complexity of global risks, and the need for insurers to manage their exposure to large-scale events and catastrophes.

Key Drivers of Market Growth -

➤ Increasing Demand for Risk Management Solutions As the world faces more unpredictable risks, such as natural disasters, pandemics, and economic disruptions, the demand for reinsurance to help insurers manage these risks is rising. Reinsurance helps primary insurers manage their exposure to large losses by distributing risk and protecting against potential financial instability.

➤ Global Economic Growth and Rising Insurance Penetration Economic growth, particularly in emerging markets, is leading to an increase in insurance penetration. As insurance markets expand globally, especially in regions like Asia-Pacific and Africa, the demand for reinsurance solutions to back these growing insurance markets is also on the rise.

➤ Complexity of Global Risks The complexity and scale of global risks, such as cyber-attacks, climate change, and geopolitical tensions, are making reinsurance more critical for insurers. Reinsurers provide expertise and financial protection for insurers dealing with complex and large-scale risks that go beyond their capacity.

➤ Natural Disasters and Catastrophes Natural disasters, including hurricanes, earthquakes, and floods, have become more frequent and severe, driving the need for reinsurance. Reinsurers play a key role in covering the financial impact of such events and helping insurers maintain financial stability.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23064

Key Companies in the Reinsurance Market Include

• Transatlantic Reinsurance Company

• Swiss Re

• Everest Re Group

• Zurich Re

• SCOR

• Reinsurance Group of America

• Munich Re

• PartnerRe

• Berkshire Hathaway Reinsurance Group

• AIG Reinsurance

• Arch Reinsurance Company

• XL Catlin Reinsurance

• Validus Reinsurance

• Hannover Re

• Lloyd's of London

Browse In-Depth Market Research Report: https://www.marketresearchfuture.com/reports/reinsurance-market-23064

Market Segmentation

By Type of Reinsurance

• Facultative Reinsurance: Covers specific risks or policies, typically for large or complex cases, providing tailored coverage for individual risks.

• Treaty Reinsurance: Provides coverage for a group of policies or an entire portfolio of business, typically involving a long-term agreement between the insurer and the reinsurer.

• Proportional Reinsurance: Reinsurers share a fixed percentage of the premiums and losses, allowing insurers to mitigate their risk exposure in exchange for a portion of the premium.

• Non-Proportional Reinsurance: Reinsurers cover losses that exceed a certain threshold, typically used to protect insurers from extreme or catastrophic events.

By Application

• Life Reinsurance: Covers the life insurance sector, helping insurers manage risks associated with mortality, morbidity, and longevity.

• Non-Life Reinsurance: Covers general insurance policies, including property, casualty, and liability insurance, helping insurers manage risks associated with claims from events like accidents, disasters, or medical expenses.

• Health Reinsurance: Provides protection against large or unexpected health claims, supporting health insurers in managing the financial risk associated with high-cost medical treatments.

• Reinsurance for Emerging Risks: This includes coverage for new and emerging risks such as cyber threats, environmental risks, and pandemics, areas where reinsurers are increasingly providing specialized solutions.

By Distribution Channel

• Direct Sales: Reinsurance companies sell policies directly to primary insurers.

• Brokers: Insurance brokers act as intermediaries, helping insurers and reinsurers connect and negotiate terms for reinsurance agreements.

• Online Platforms: Digital platforms are growing in prominence, allowing for more efficient matching of insurers and reinsurers and making it easier for businesses to access reinsurance products.

By Region

• North America: The largest market for reinsurance, driven by the high level of insurance penetration, economic development, and the growing number of natural disasters.

• Europe: A mature market with strong demand for reinsurance in both life and non-life sectors, supported by well-established insurance and reinsurance companies.

• Asia-Pacific: The fastest-growing region, driven by economic expansion, increasing insurance penetration, and the rising frequency of natural disasters in countries like China, India, and Japan.

• Rest of the World (RoW): Growth is expected in Latin America, the Middle East, and Africa, where the insurance sector is expanding, and the need for reinsurance solutions is increasing.

Procure Complete Research Report Now - https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23064

The Reinsurance Market is set to experience steady growth, supported by the increasing complexity of global risks, the rise in insurance penetration, and the growing demand for risk management solutions. As insurers continue to seek protection against large-scale, unpredictable events, reinsurance companies will play a crucial role in ensuring the stability of the global insurance industry. With technological advancements, product innovation, and regional expansion, the market is positioned to meet the evolving needs of insurers worldwide.

Related Report –

Robot Preventive Maintenance Market

https://www.marketresearchfuture.com/reports/robot-preventive-maintenance-market-24120

Server Microprocessor Market

https://www.marketresearchfuture.com/reports/server-microprocessor-market-24124

Seven Segment Display Market

https://www.marketresearchfuture.com/reports/seven-segment-display-market-24129

Smart Home M2M Market

https://www.marketresearchfuture.com/reports/smart-home-m2m-market-24133

Smart Led Lighting Market

https://www.marketresearchfuture.com/reports/smart-led-lighting-market-10117

About Market Research Future (MRFR)

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()