The head of gas and oil giant Woodside has warned the government to resist reaching for a bandaid solution to its budget woes by lifting or altering the petroleum resource rent tax.

Chief executive Meg O'Neill recognised the temptation to alter the tax settings for fossil fuel companies given the budget position but warned such efforts could jeopardise new supply.

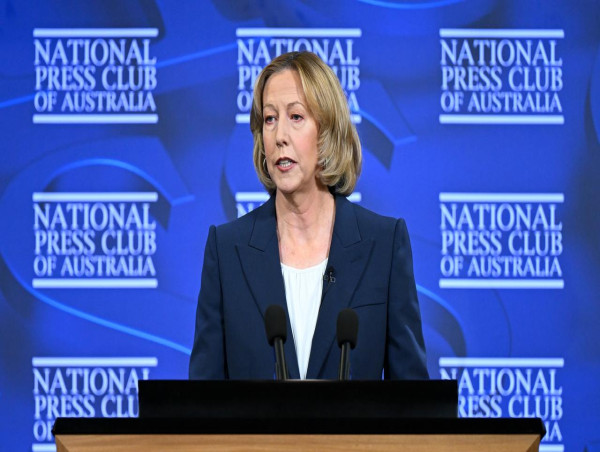

"The risk that we run, though, is to try to do something in the near term that's a bit of a Band-Aid, but it's going to cause long-term harm," she told the National Press Club on Wednesday.

"It's going to cause investment again to be under additional pressure, and opportunities we may pursue to bring new projects to bear may be under pressure," she added.

But the federal treasurer is also under pressure to trim spending and raise extra revenue to help fund growing spending priorities, such as defence and aged care, without adding to government debt.

Recent modelling by think tank the Grattan Institute found changing the method for pricing gas in the tax arrangements, one of the commonly cited issues with the scheme, would deliver as much as $4 billion annually to government coffers.

Treasurer Jim Chalmers has kept reforms to the petroleum resource rent tax on the table, telling reporters on Monday he is concerned the system is not up to scratch.

Mr Chalmers in the process of reviewing advice from Treasury on the tax on the profits of fossil fuel extractors, and is working through options to improve how the tax applies to gas producers.

The review was first commissioned by the former coalition government and after stalling during the pandemic, was restarted by Labor last year.

Ms O'Neill said the PRRT was a type of "super profits tax" applied to the offshore oil and gas industry that kicks in after companies have recouped their investment from the cost of exploration, development and production.

She said when Woodside is bringing in revenue, it pays the 30 per cent corporate tax rate as well as the additional 40 per cent levy, leaving its effective tax rate at 58 per cent.

"Woodside is the biggest payer of PRRT in Australia since coming into the Bass Strait joint venture last year, and we're proud of the contribution that we make and we're proud of the fact that when prices are high we make us a more significant contribution to Australia's coffers," she told reporters on Wednesday.

Ms O'Neill also said commodity prices fluctuate from year to year, with the high prices seen last year following three years of record low prices during the pandemic.

"We need to make sure that our investment decisions are resilient throughout the cycle."

She said the company was working closely with the government to articulate the "long-term impact of any sort of short-term change" to tax settings, including the possibility of less government revenue in the future.