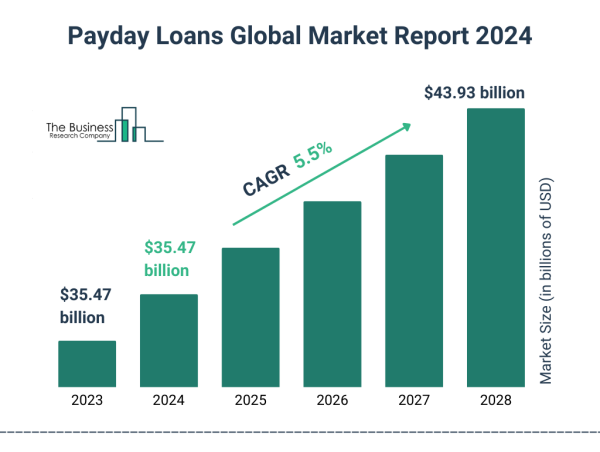

LONDON, GREATER LONDON, UNITED KINGDOM, October 12, 2024 /EINPresswire.com/ -- The payday loans market has also shown strong growth in recent years. It is expected to rise from $35.47 billion in 2023 to $35.47 billion in 2024, with a CAGR of 5.2%. Factors contributing to this growth include increased financial instability, limited access to traditional credit sources, economic downturns, high unemployment rates, regulatory changes, and the rise of digital lending platforms.

What Is The Estimated Market Size Of The Global Payday Loans Market And Its Annual Growth Rate?

The payday loans market is expected to grow significantly, reaching $43.93 billion by 2028, with a CAGR of 5.5%. Growth drivers include economic uncertainty, rising unemployment, shifting borrowing habits, and demand for short-term financial solutions. Trends include digital lending advancements, borrower education programs, AI-based risk assessment, and flexible repayment options.

Explore Comprehensive Insights Into The Global Payday Loans Market With A Detailed Sample Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18694&type=smp

Growth Driver of The Payday Loans Market

The escalating cost of living is projected to stimulate growth in the payday loan market moving forward. The cost of living encompasses the total expenses needed to cover essential costs such as housing, food, transportation, healthcare, and other daily necessities for maintaining a particular standard of living in a given area. The increase in living costs is driven by rising housing prices, local taxes, transportation expenses, healthcare costs, and the overall economic conditions of specific regions. Individuals facing heightened financial pressures may turn to payday loans for short-term, immediate financial relief to cover unexpected expenses or bridge gaps between paychecks.

Explore The Report Store To Make A Direct Purchase Of The Report:

https://www.thebusinessresearchcompany.com/report/payday-loans-global-market-report

Which Market Players Are Driving The Payday Loans Market Growth?

Major companies operating in the payday loans market are Check Into Cash, Kotak Mahindra Bank Limited, OneMain Holdings Inc., Advance America, ACE Cash Express, Opportunity Financial LLC, Check `n Go, AmeriCash Loans, Check City, LoanMart, NetCredit, MoneyKey, Rise Credit, Speedy Cash, Speedy Cash, Fig Loans, Possible Finance, Balance Credit, Plain Green Loans, Lending Bear, Spotloan, 24CashToday, Big Picture Loans, Cash America, CashNetUSA, Checksmart

What Are The Emerging Trends Shaping The Payday Loans Market Size?

In the payday loan market, companies are embracing online platforms to streamline their services for a digitally inclined consumer base. These platforms enable freelancers to apply for cash advances quickly and easily, with an efficient interface that allows for swift submission of information and immediate feedback, catering to the growing demand for online financial solutions.

How Is The Global Payday Loans Market Segmented?

1) By Type: Storefront Payday Loans, Online Payday Loans

2) By Marital Status: Married, Single

3) By Customer Age: Less Than 21, 21-30, 31-40, 41-50, More Than 50

Geographical Insights: North America Leading The Payday Loans Market

North America was the largest region in the payday loans market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the payday loans market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Payday Loans Market Definition

Payday loans are short-term, high-interest loans designed to provide quick cash to borrowers until their next paycheck. While intended for urgent expenses, these loans often carry high costs and risks, potentially trapping borrowers in a cycle of debt, making them a controversial financial product.

Payday Loans Global Market Report 2024 from The Business Research Company covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global payday loans market report covering trends, opportunities, strategies, and more

The Payday Loans Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on payday loans market size, drivers and trends, payday loans market major players, competitors' revenues, market positioning, and market growth across geographies. The market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Personal Loans Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/personal-loans-global-market-report

Loan Origination Software Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/loan-origination-software-global-market-report

Medical Device Cleaning Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/medical-device-cleaning-global-market-report

What Does the Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including a Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

[email protected]

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()