Litigation Funding Investment Market Research Report By, Type of Dispute, Stage of Funding, Funding Structure, Litigation Outcome, Regional

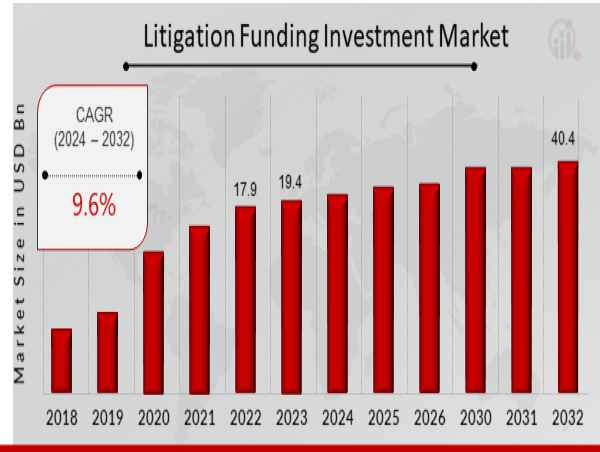

VA, UNITED STATES, January 20, 2025 /EINPresswire.com/ -- The global Litigation Funding Investment Market is experiencing significant growth and is poised to continue expanding in the coming years. In 2022, the market size was estimated at USD 17.9 billion and is projected to grow from USD 19.4 billion in 2023 to an impressive USD 40.4 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of approximately 9.6% during the forecast period (2024–2032). Factors such as increasing awareness of litigation funding, expanding legal markets, and rising demand for alternative financing solutions are driving market growth.

Key Drivers of Market Growth

Increasing Awareness of Litigation Funding Litigation funding, which involves third-party investment in legal cases in exchange for a share of the settlement or award, is gaining popularity as businesses and individuals seek ways to mitigate financial risks in high-stakes legal battles. As awareness of this funding option grows, more entities are turning to litigation finance as a way to pursue justice without incurring the high costs typically associated with legal proceedings.

Rising Demand for Alternative Financing Solutions As traditional financing options become more stringent, litigation funding has emerged as a viable alternative. Investors see the opportunity to diversify their portfolios by funding lawsuits, offering a low-risk investment avenue with the potential for substantial returns. The expansion of the litigation funding industry is further propelled by this growing demand for non-traditional financial solutions.

Growth in Legal and Commercial Disputes With an increase in the number of commercial disputes and complex legal cases across various sectors, the demand for litigation funding is expected to surge. Companies facing significant lawsuits are increasingly turning to third-party investors for financial support, particularly in cases where they are unable to afford the upfront costs associated with lengthy legal proceedings.

Expanding Legal Markets The global expansion of legal markets, particularly in emerging economies, is contributing to the rise in litigation funding investments. As developing nations continue to enhance their legal frameworks and embrace economic reforms, litigation funding is becoming an integral part of their judicial processes.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/22886

Key Companies in the Litigation Funding Investment Market

• Woodsford Litigation Funding

• Fortress Investment Group

• Fairmount Funds Management

• Aquila Litigation Fund

• Omni Bridgeway

• Burford Capital

• Epiq

• Validity Finance

• IMF Bentham

• Pretium Law Funding

• Harbour Litigation Funding

• Donerail Group

• Echelon Capital Partners

• Rosewood Legal Finance

Browse In – Depth Market Research Report : https://www.marketresearchfuture.com/reports/litigation-funding-investment-market-22886

Market Segmentation

To provide a detailed analysis, the litigation funding investment market is segmented based on type, case type, investor type, and region.

1. By Type

Pre-Settlement Funding: Provides financial support to plaintiffs before the conclusion of a case.

Post-Settlement Funding: Offered after a settlement is reached, helping parties meet immediate financial needs.

2. By Case Type

Commercial Litigation: Investment in high-value business disputes.

Personal Injury: Financing provided for individuals involved in injury-related lawsuits.

Class Action: Funding for large-scale lawsuits involving a group of claimants.

Intellectual Property: Investments in patent and trademark disputes.

3. By Investor Type

Institutional Investors: Large firms and financial institutions backing high-stakes cases.

Private Investors: Individuals investing in specific cases or portfolios.

4. By Region

North America: Leading market, driven by a mature legal system and a high number of commercial disputes.

Europe: Steady growth fueled by increasing legal disputes and institutional investment in litigation funding.

Asia-Pacific: Fastest-growing region due to expanding legal markets and increasing commercial litigation in developing economies.

Rest of the World (RoW): Moderate growth in regions like Latin America, the Middle East, and Africa, as litigation funding gains popularity.

Procure Complete Research Report Now : https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22886

The litigation funding investment market is expected to grow robustly, driven by increasing awareness, the rising demand for alternative financing solutions, and the expansion of global legal markets. As businesses and individuals seek ways to navigate the high costs of legal disputes, litigation funding offers a viable solution, with institutional and private investors capitalizing on the potential for significant returns. With a projected CAGR of 9.6% from 2024 to 2032, the litigation funding market is poised for continued success, particularly in emerging markets where legal systems are evolving.

Related Report -

Car Insurance Market

Cloud Computing Banking Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()