Laundry Detergent Market Overview

The Laundry Detergent market is currently experiencing active growth owing to the increasing number of health-oriented consumers, the rise of urbanization, and the growing demand for effective and sustainable cleaning products. Importantly, detergents serve both household and commercial use, and although there are forms of detergents such as powder, liquid, and otherwise. Formulation innovation is driven by a demand for high-efficiency washing machines and trends towards washing with cold water. The market benefits from technological advancement and brand differentiation, although a lack of consistent access to raw materials and compliance with regulatory obligations may constrain growth. Active growth opportunities continue in online channels, the development of green products, and growing consumer markets such as Asia Pacific, Latin America, and Africa.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/Laundry-Detergent-Market/372

Laundry Detergent Market Dynamics

Drivers

Health and Hygiene Awareness

An overall increase in health awareness is prompting buyers to be more diligent about maintaining a germ-free, odorless, and clean environment. This shift is leading to higher demand for potent, scented detergents in particularly in the residential space. In emerging economies, demand will also be stimulated by a greater uptake of automatic washing machines.

Demand for Premium Products and Technological Innovation

The growth of the market is being driven by technology-based innovations like cold-water formulations, better stain-targeting, and bio-based surfactants. Liquid detergents are more popular now that consumers understand the convenience and solubility, and performance in high-efficiency machines. Premium and branded products are increasingly growing in demand from middle-income and urban consumer segments.

Restraints

Fluctuating Raw Material Prices

Detergent production is highly dependent on petrochemical derivatives, which makes the industry subject to price volatility in oil. As prices fluctuate, manufacturing costs go up, and manufacturers and retailers are looking for ways to become cost-effective and sustainable in their practices, such as using plant-based ingredients instead of petrochemical derivatives. The shift can be long and costly.

Regulatory and Environmental Pressures

Manufacturers are facing significant environmental regulations relating to phosphate levels, wastewater contamination, and packaging materials. Governments are placing bans or restrictions on some ingredients, forcing manufacturers to increase research costs to determine compliance.

Innovations and Developments

Concentrated and Sustainable Detergents (Henkel, October 2021 & Unilever, April 2022): Henkel introduced concentrated Persil-branded detergents and laundry detergents in October 2021 to reduce CO₂ emissions and plastic use. Unilever was the second company to launch the “Dilute at Home" detergents with its Omo and Persil brands, and reduce plastic by 70% in April 2022. With Dilute at Home products, there is also the potential for reduced water usage, reduced weight for logistics, and decreased total packaging waste in retail and delivery supply chains.

Bio-Enzyme & Plant-Based Scents (Method, March 2020 & Seventh Generation, June 2021): Method launched enzyme-based laundry detergents with biodegradable ingredients that are non-toxic and suitable for sensitive skin in March 2020. Seventh Generation had launched plant-based, USDA-certified laundry detergents with stain-lifting enzymes in US stores in June 2021. Both brands appeal to the eco-conscious consumer who wants a cruelty-free, hypoallergenic, sustainable choice when cleaning their home with non-synthetic dyed, fragrance-free, alkylphenol-free, and petroleum-free cleaning products.

Sustainable Packaging (Procter & Gamble, January 2019 & May 2022): P&G launched Tide Eco-Box in January 2019 with recyclable cardboard packaging to reduce plastic formative materials and reduce greenhouse gas emissions while transporting. P&G was also the first household products company to launch refillable piwds base product containers for Tide, in May 2022, in alignment with Wash's "Ambition 2030" vision for sustainability. These packaging innovations, mostly aimed at the household detergent aisle, are focused on reducing the amount of plastic in the waste stream, improving recyclability, and taking a step towards sustainable circular economy practices in consumer product detergent packaging.

Laundry Detergent Market Segmentation

By Product

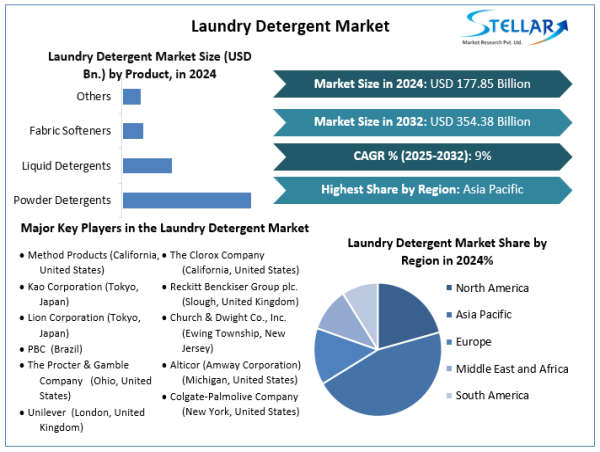

Powder Detergents: With a phenomenal 33% share, powder detergents have been popularized in rural as well as urban markets in regions across Asia, Africa, and Latin America.

Liquid Detergents: Registered for an expected growth of 4.8% CAGR is liquid detergents continued urban preference, performance, and premiumization.

Fabric Softeners: Fabric softeners are projected to advance at a 2.6% CAGR, with growth attributed to consumer demand for improved fragrance additives and perfected softening qualities.

Others: Includes detergent pods and sheets, "hitting the big time" due to ease of use and sustainability.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/Laundry-Detergent-Market/372

By Application

Residential: Accounted for 59% in 2024. Increased washing machine use and hygiene awareness in developing countries a key factors.

Commercial: Expected to have a 5% CAGR. Demand is coming from hospitals, hotels, laundromats, and other institutional users.

By Distribution Channel

Offline: Dominates sales, especially in rural and semi-urban areas.

Online: Growing fast due to the rise of e-commerce, subscription models, and urban digital penetration

Laundry Detergent Market Regional Analysis

Asia-Pacific:

The Asia-Pacific region has 41% of the global market in 2024 driven significantly by population density, urbanization, an increase in disposable incomes, and increased brand development in the region, as well as China and India, which are both large contributors to growth, with significant demand in both powder detergent and liquid format.

North America:

North America is forecasted to have a growth rate of 6% CAGR due to consumers showing a preference for eco-friendly products, fragrant detergents, and skin-safe detergents. Innovation is prevalent in these areas with a wide industry push from government regulation for sustainability, and has clearly defined routes for product distribution, which establishes regional strengths in the North American market.

Europe:

Europe will have growth very closely with trends for biodegradable and phosphate-free detergents. Various governments are encouraged to promote green-minded products, and consumers are paying a premium for ethical and plant-based products.

Latin America, the Middle East, and Africa:

Latin America, the Middle East, and Africa will all increasingly see more experienced, memorable consumers, and urbanized cities, and demand for branded laundry care. The retail network of stores containing laundry care products has significantly expanded, and improvements in affordability and markets in developing societies are allowing for better penetration.

Laundry Detergent Market Competitive Landscape

The Laundry Detergent Market is competitive, with global players focusing on innovation, sustainability, and regional expansion. Key strategies include mergers, eco-friendly launches, and strategic partnerships. Notable players include:

The Procter & Gamble Company (USA)

Unilever (UK)

Henkel AG & Co. KGaA (Germany)

Kao Corporation (Japan)

Lion Corporation (Japan)

The Clorox Company (USA)

Reckitt Benckiser Group plc (UK)

Church & Dwight Co., Inc. (USA)

Alticor (Amway Corporation) (USA)

Colgate-Palmolive Company (USA)

Method Products (USA)

PBC (Brazil)

These companies maintain their share through deep R&D, digital marketing, and supply lines worldwide. Local brands in Asia and Africa are rapidly scaling by offering value and regionally based detergent products.

Summary – Laundry Detergent Market (2025–2032)

In 2024, The Global Laundry Detergent Market was estimated at USD 177.85 billion and is expected to reach USD 354.38 billion by 2032, at a CAGR of 9% in the forecast period. The Laundry Detergents Market growth is driven by an increase in hygiene awareness, a rise in the use of washing machines in developing economies, and a positively skewed performance expectation for powders, sprays, scents, and eco-friendly products. Overall, powder detergents are the leading in rural areas, with liquid-based formats being driven due to convenience. Residential is the lead consumer sector, with an increase in commercial consumption due to hospitality and healthcare services, leading to the use of products for domestic and machine use. The Asia-Pacific region has the largest market share of the laundry detergents market due to population and urbanization. North America and Europe have an increase in consumers seeking organic and sustainably approved products. The market is competitive with large players: Procter & Gamble, Unilever, Henkel, and Kao Corporation all investing in "green" innovations, formulations, and strategic partnerships, as part of their focus for global reach.

Related Reports:

Floating Shelves Market: https://www.stellarmr.com/report/Floating-Shelves-Market/2127

Eyeliner Market: https://www.stellarmr.com/report/Eyeliner-Market/2126

Kitchen Chimney Market: https://www.stellarmr.com/report/Kitchen-Chimney-Market/2122

Instant Pot Market: https://www.stellarmr.com/report/Instant-Pot-Market/2121

Halal Cosmetics Market: https://www.stellarmr.com/report/Halal-Cosmetics-Market/2120

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

[email protected]

Lumawant Godage

Stellar Market Research

+91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()