MAXE: The Revolutionary AI Financial Management App

NEW YORK, NY, U.S, August 9, 2024 /EINPresswire.com/ -- Global stock investors may be feeling heightened anxiety these days.

Last week, the Bank of Japan raised its policy rate from 0% to 0.25%, the first hike since abandoning its negative interest rate policy in March. The yen subsequently appreciated, exacerbating the decline in Japanese corporate performance and stocks.

On August 5, the Japanese and South Korean stock markets saw a fierce sell-off at the opening, triggering a global panic. The Nikkei 225 index fell 12.4%, wiping out 2024 gains and setting a record for the largest single-day decline, surpassing the 1987 "Black Monday" crash. The South Korean Composite Index recorded its largest drop since 2008, with Japan, South Korea, and Turkey triggering circuit breakers. Sell-offs spread to Asia-Pacific and European markets. and U.S. Stocks opened sharply lower, with the Dow, Nasdaq, and S&P 500 all closing down over 2.5%. Technology stocks, including Nvidia, Intel, Apple, Tesla, and Google, fell more than 4-6%.

Concurrently, the jobs report released last Friday by the U.S. Department of Labor painted a concerning picture of the employment landscape. The data showed the addition of only 114,000 non-farm payrolls in July, falling far short of market expectations. Furthermore, the unemployment rate unexpectedly ticked to 4.3%, reaching its highest level since October 2021. This triggering of the Sahm Rule is a notable development, as it suggests the U.S. economy may enter the early stages of a recession. (The Sahm Rule, named after economist Claudia Sahm, states that a recession is typically signaled when the 3-month moving average of the unemployment rate rises 0.5 percentage points or more above its 12-month low. Since 1950, the Sahm Rule has been triggered 11 times, and in each instance, subsequent data confirmed the U.S. was indeed in the nascent phases of an economic downturn.)

While the evolving market and economic conditions may pose challenges for ordinary investors, industry elites are still able to make sound choices in this complex financial environment.

As an example, Berkshire Hathaway, the company founded by renowned investor Warren Buffett, recently announced its Q2 2024 financial results. The conglomerate reported a net profit of $30.35 billion for the quarter, significantly exceeding the market consensus estimate of $17.786 billion.

Berkshire's ability to deliver such strong financial performance, even amidst broader market volatility and economic uncertainty, underscores the advantages that seasoned, sophisticated investors can leverage. Their deep industry knowledge, access to resources, and proven investment acumen can enable them to navigate turbulent times more effectively than the average individual investor.

So the key question becomes: how can ordinary investors emulate the effective and timely investment strategies employed by industry elites?

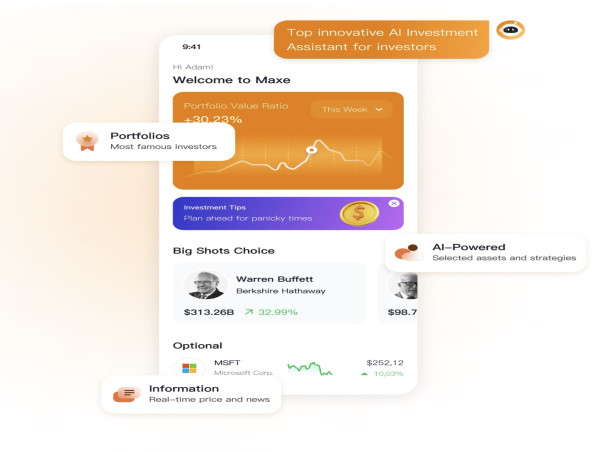

In response to the points raised above, a leading investment tracking app, MAXE, offers a solution to help investors make better investment decisions

One of the standout features of MAXE is its ability to grant users get to the portfolio holdings and trading activities of top industry experts across a range of sectors.

This unprecedented level of transparency allows MAXE users to observe, in real-time, the specific asset allocations and investment decisions made by the market's renowned and successful investors. By closely studying the portfolio compositions and trading patterns of these elite fund managers and analysts, MAXE users can glean invaluable insights that can inform and enhance their investment decision-making.

Rather than relying solely on generalized market analysis or second-hand commentary, MAXE empowers its users with a window into the actual investment strategies and risk management practices employed by the industry's foremost authorities. This unique visibility grants MAXE users a distinct advantage, enabling them to potentially emulate the proven techniques and allocation models of these accomplished investors.

Finally, complementing its transparency-enhancing capabilities, the MAXE platform harnesses advanced artificial intelligence to generate personalized investment recommendations tailored to each user's unique risk profile and portfolio performance.

This AI-powered feature empowers MAXE users with timely, data-driven guidance that is calibrated to the evolving market environment. By factoring in an individual's investment objectives and risk tolerance, the recommendation system delivers targeted, actionable insights to inform their decision-making.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE. For more information, visit our website at www.maxeai.com and follow us on social media for updates and tips on financial management.

Ying Wang

MAXE AI

+65 6991 2300

email us here

![]()