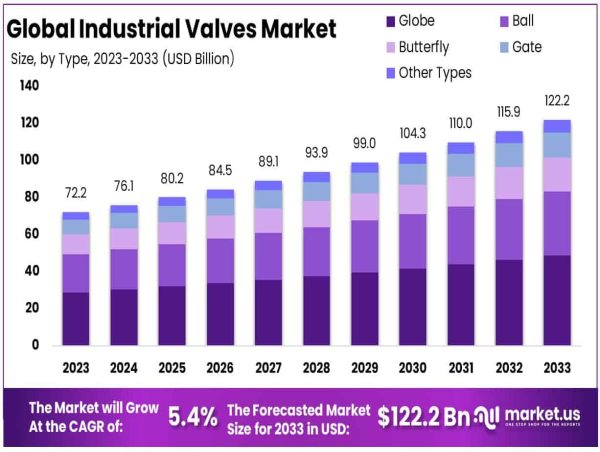

According to the report by Market.us, the Global Industrial Valves Market is projected to experience significant growth, expanding from USD 72.2 Billion in 2023 to approximately USD 122.2 Billion by 2033. This growth is driven by a steady compound annual growth rate (CAGR) of 5.40% during the forecast period from 2024 to 2033.

Industrial valves, essential mechanical devices that control the flow and pressure within various systems and processes, play a critical role in industries such as oil and gas, water and wastewater treatment, chemicals, power generation, and manufacturing. These valves regulate the flow of fluids, gases, slurries, or powders through openings by opening, closing, or partially obstructing passageways, thereby ensuring the efficient and safe operation of industrial processes.

The market is predominantly fueled by increasing industrialization and urbanization in emerging economies, which necessitate expansive water and wastewater management systems. Additionally, the continuous expansion of the energy sector, encompassing both traditional and renewable energy sources, demands robust valve solutions for efficient operations. Technological advancements in valve manufacturing, including the development of smart valves equipped with sensors and real-time data analytics, present significant growth opportunities by enhancing operational efficiency and predictive maintenance capabilities.

Asia Pacific leads the market with a dominant 36% share in 2023, generating USD 25.9 Billion in revenue. This leadership is driven by rapid industrial growth, extensive infrastructure development, and substantial investments in vehicle innovation and sustainable building practices in countries like China, Japan, and South Korea.

Government initiatives, such as the Production Linked Incentive (PLI) schemes and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program, further bolster market growth by promoting sustainable automotive technologies. Despite challenges such as high production costs and stringent environmental regulations, the Industrial Valves Market remains poised for robust expansion, supported by continuous technological advancements and the increasing adoption of electric and autonomous vehicles worldwide.

🔴 𝗙𝗼𝗿 𝗮 𝗯𝗲𝘁𝘁𝗲𝗿 𝘂𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴, 𝗿𝗲𝗳𝗲𝗿 𝘁𝗼 𝘁𝗵𝗶𝘀 𝘀𝗮𝗺𝗽𝗹𝗲 𝗿𝗲𝗽𝗼𝗿𝘁, 𝘄𝗵𝗶𝗰𝗵 𝗶𝗻𝗰𝗹𝘂𝗱𝗲𝘀 𝗰𝗼𝗿𝗿𝗲𝘀𝗽𝗼𝗻𝗱𝗶𝗻𝗴 𝘁𝗮𝗯𝗹𝗲𝘀 𝗮𝗻𝗱 𝗳𝗶𝗴𝘂𝗿𝗲𝘀 @ https://market.us/report/industrial-valves-market/request-sample/

Key Takeaways

- The Global Industrial Valves Market is expected to grow from USD 72.2 Billion in 2023 to USD 122.2 Billion by 2033, achieving a CAGR of 5.40%, driven by increasing industrialization, urbanization, and advancements in valve technology.

- In 2023, Globe Valves dominated the By Type segment with a substantial 40% share, highlighting their essential role in regulating flow and pressure across various industrial applications.

- Steel held the leading position in the By Material segment of the Industrial Valves Market in 2023, capturing a 35% share, due to its durability, corrosion resistance, and suitability for high-pressure environments.

- The Oil and Power sector led the By Application segment in 2023, securing a 43% share, underscoring the critical demand for reliable valve solutions in energy infrastructure and power generation.

- Asia Pacific maintained its leadership in the Industrial Valves Market with a 36% share in 2023, valued at USD 25.9 Billion, driven by rapid industrial growth, extensive infrastructure projects, and significant investments in sustainable and smart building practices.

- Key players such as Yura Corporation, Lear Corporation, and Delphi Automotive LLP are pivotal in shaping the Industrial Valves Market’s landscape through their extensive product portfolios, technological advancements, and strategic market positioning.

Regional Analysis

Asia Pacific dominates the Global Industrial Valves Market with a commanding 36% market share in 2023, valued at USD 25.9 Billion. This dominance is fueled by rapid industrialization, extensive infrastructure development, and substantial investments in vehicle innovation and sustainable building practices in key economies such as China, Japan, and South Korea. The region benefits from a robust manufacturing base, advanced technological adoption, and a strong focus on sustainability, which enhances the performance and durability of industrial valves.

Government initiatives like the Production Linked Incentive (PLI) schemes and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program further support market growth by promoting sustainable automotive technologies. Additionally, the increasing integration of smart valve technologies, which offer enhanced monitoring and predictive maintenance capabilities, drives demand across various industries in the region, ensuring sustained growth throughout the forecast period.

Report Segmentation

By Type

In 2023, Globe Valves held a dominant position in the “By Type” segment of the Industrial Valves Market, commanding a 40% market share. This dominance is attributed to Globe valves' superior ability to regulate flow and pressure, making them indispensable across diverse industries such as oil and gas, water and wastewater treatment, and chemicals. Globe valves offer precise control and are highly versatile, capable of handling various fluid types under different pressure conditions. The significant market share is further reinforced by technological advancements and increasing investments in infrastructure projects globally.

Government funding, such as the DOE’s allocation of USD 46 million for energy-efficient projects, promotes the adoption of advanced Globe valve technologies in energy-critical applications. As industries continue to prioritize energy optimization and sustainable practices, the demand for Globe valves is expected to grow, leveraging their efficiency and adaptability to meet stringent environmental and operational requirements. This trend positions Globe valves as a key component in the future expansion and technological evolution of the Industrial Valves Market.

By Material

In 2023, Steel maintained a dominant market position in the “By Material” segment of the Industrial Valves Market, securing a 35% share. Steel’s prominence is primarily due to its exceptional durability, corrosion resistance, and suitability for high-pressure environments, making it indispensable in critical sectors such as oil and gas, petrochemicals, and utilities. The robust performance of steel valves is supported by ongoing innovations aimed at enhancing efficiency and sustainability in industrial operations.

Government initiatives, including the DOE’s USD 46 million funding for energy-efficient projects, drive the development of more durable and environmentally friendly steel valve solutions, boosting their adoption across industries striving for operational excellence and reduced environmental impact. As industries continue to evolve towards more sustainable practices, the demand for steel valves is projected to rise, further cementing their position as a fundamental component of the industrial valves landscape. Additionally, advancements in steel alloy compositions are enhancing valve performance, catering to the increasing complexity and demands of modern industrial applications.

By Application

In 2023, the Oil and Power sectors held a dominant market position in the “By Application” segment of the Industrial Valves Market, capturing a 43% share. This dominance is driven by extensive investments in energy infrastructure and the critical need for reliable valve performance in these industries. Oil and Power sectors require robust valve solutions to manage the flow and pressure of various fluids and gases, ensuring efficient and safe operations in energy production, refining, and distribution. Technological advancements and regulatory pressures aimed at enhancing efficiency and reducing environmental impact further bolster the demand for advanced industrial valves in these sectors.

The significant allocation of USD 46 million by the DOE for projects that enhance energy efficiency underscores the growing emphasis on sustainability and operational efficiency within the Oil and Power industries. As the global energy landscape evolves with a sharper focus on renewable sources and energy conservation, the role of innovative valve solutions in the Oil and Power sectors becomes increasingly pivotal, ensuring their continued market dominance and driving the adoption of high-performance, environmentally compliant industrial valves.

🔴 𝗚𝗲𝘁 𝘁𝗵𝗲 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁 𝗧𝗼𝗱𝗮𝘆 𝗮𝗻𝗱 𝗦𝗮𝘃𝗲 𝗨𝗽 𝘁𝗼 𝟯𝟬%! @ https://market.us/purchase-report/?report_id=28590

Key Market Segments

By Type

- Ball

- Butterfly

- Gate

- Globe

- Other Types

By Material

- Steel

- Cast Iron

- Alloy based

- Plastic

- Other Materials

By Application

- Chemical

- Food and Beverage

- Oil and Power

- Water and wastewater

- Other Applications

Driving Factors

The industrial valves market is driven by the expanding manufacturing and oil & gas industries, which require efficient fluid control solutions. Increasing infrastructure development and the rise in demand for energy-efficient systems propel the need for advanced valve technologies. Additionally, the adoption of automation and Industry 4.0 practices enhances operational efficiency, boosting the demand for smart and automated valves. Regulatory standards focusing on safety and environmental compliance also encourage the use of high-performance valves, further accelerating market growth.

Restraining Factors

Despite growth prospects, the industrial valves market faces several restraining factors. High initial costs for advanced valve systems can deter small and medium enterprises from adoption. Fluctuating raw material prices, particularly for metals used in valve manufacturing, impact profitability and pricing strategies. Additionally, the complexity of installation and maintenance requirements may limit market penetration in regions with limited technical expertise. Economic downturns and reduced capital expenditure in key industries like oil & gas can also negatively affect market demand.

🔴 𝗙𝗼𝗿 𝗮 𝗯𝗲𝘁𝘁𝗲𝗿 𝘂𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴, 𝗿𝗲𝗳𝗲𝗿 𝘁𝗼 𝘁𝗵𝗶𝘀 𝘀𝗮𝗺𝗽𝗹𝗲 𝗿𝗲𝗽𝗼𝗿𝘁, 𝘄𝗵𝗶𝗰𝗵 𝗶𝗻𝗰𝗹𝘂𝗱𝗲𝘀 𝗰𝗼𝗿𝗿𝗲𝘀𝗽𝗼𝗻𝗱𝗶𝗻𝗴 𝘁𝗮𝗯𝗹𝗲𝘀 𝗮𝗻𝗱 𝗳𝗶𝗴𝘂𝗿𝗲𝘀 @ https://market.us/report/industrial-valves-market/request-sample/

Trending Factors

Current trends in the industrial valves market include the integration of smart technologies, such as IoT-enabled valves that offer real-time monitoring and predictive maintenance. There is a growing preference for environmentally friendly valves that reduce emissions and energy consumption. The shift towards lightweight and corrosion-resistant materials, like stainless steel and advanced polymers, enhances valve performance and longevity. Additionally, the demand for modular and customizable valve solutions is increasing, allowing for greater flexibility and scalability in various industrial applications.

Investment Opportunities

The industrial valves market presents significant investment opportunities in the development of smart and automated valve technologies that enhance operational efficiency and safety. Investing in research and development for eco-friendly and energy-efficient valves can cater to the rising demand for sustainable industrial solutions. Expanding manufacturing capabilities in emerging markets with growing industrial activities offers substantial growth potential. Additionally, strategic partnerships with key industries such as oil & gas, chemical processing, and water treatment can drive market expansion and increase revenue streams.

Market Companies

The Global Industrial Valves Market is highly competitive, featuring a blend of established industry leaders and innovative new entrants striving to capture market share. Prominent companies such as Yura Corporation, Lear Corporation, and Delphi Automotive LLP dominate the landscape with their extensive product portfolios that emphasize durability, efficiency, and technological advancement.

These companies invest heavily in research and development to introduce cutting-edge valve solutions that cater to diverse industrial applications, including oil and gas, power generation, water treatment, and chemical processing. Their strong global presence, robust distribution networks, and commitment to sustainability enable them to effectively meet the evolving needs of the market. Additionally, these market leaders focus on strategic partnerships and acquisitions to enhance their technological capabilities and expand their market reach, ensuring their continued dominance and influence in the Industrial Valves Market.

Key Players

- Yura Corporation

- Lear Corporation

- Delphi Automotive LLP

- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- Samvardhana Motherson Group

- SPARK MINDA

- THB Group

- Nexans Autoelectric

- Yazaki Corporation

- PKC Group

- Furukawa Electric Co. Ltd.

- Leoni AG

Conclusion

The industrial valves market is poised for robust growth driven by advancements in valve technology, increasing industrialization, and the demand for efficient fluid control systems. While challenges such as high costs and material price volatility exist, emerging trends like smart valves and sustainable solutions offer substantial opportunities. Strategic investments in innovation, regional expansion, and partnerships with key industries can enhance market positioning and drive future growth. Overall, the market presents a dynamic landscape with significant potential for stakeholders to capitalize on evolving industrial demands.

Related Reports

Stepper Motors Market - https://market.us/report/stepper-motors-market/

LCR Meter Market - https://market.us/report/lcr-meter-market/

Volute Pump Market - https://market.us/report/volute-pump-market/

Axial Flow Pump Market - https://market.us/report/axial-flow-pump-market/

Piling Machine Market - https://market.us/report/piling-machine-market/

Centrifugal Pumps Market - https://market.us/report/centrifugal-pump-market/

Cotton Candy Machines Market - https://market.us/report/cotton-candy-machines-market/

Slitting Machine Market - https://market.us/report/slitting-machine-market/

Beer Dispensers Market - https://market.us/report/beer-dispensers-market/

Compaction Machines Market - https://market.us/report/compaction-equipment-market/

Engineering Plastics Market - https://market.us/report/engineering-plastics-market/

Hypercharger Market - https://market.us/report/hypercharger-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()