Summary

- Global dealmaking has picked up heavily in 2021.

- The increase in the dealmaking is leading to a massive spike in investment banking revenues.

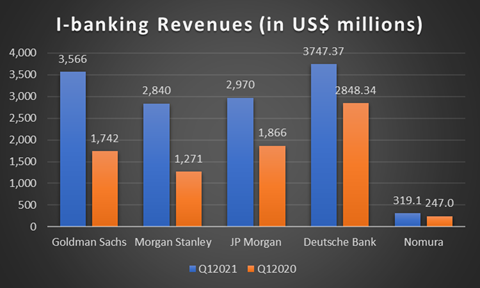

- The combined investment banking revenue of Goldman Sachs, Morgan Stanley, and JP Morgan grew by 92% in the March quarter.

The global banks are seeing a massive surge in the revenues generated from their investment banking division as the global dealmaking is booming.

European and Asian Banks, like Deutsche Bank and Nomura Holdings, have reported a surge in excess of 25% in their investment banking revenues.

But the things are surreal on Wall Street. The three bulge-bracket banks of New York – Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and JP Morgan Chase (NYSE:JPM) – saw their cumulative investment banking revenues surge by a mind-boggling figure of 92% to US$9.4 billion in the March 2021 quarter, from US$4.9 billion in the year-ago period.

Source: Company Filings. Kalkine Graphics

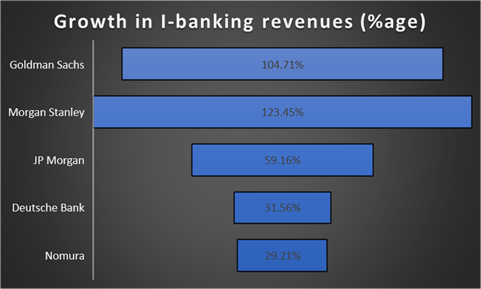

Individually speaking, Morgan Stanley cornered most gains in investment banking with divisional revenues surging by 123%, followed by Goldman Sachs (105%). The world’s fifth-largest bank, JP Morgan Chase, despite a 59% growth, seems like a laggard in the face of such numbers.

Source: Company Filings. Kalkine Graphics

In the second half of 2020, as the world started coming out of lockdowns, dealmaking rebounded with vengeance globally. The data available with Price Waterhouse Coopers (PwC) shows that deal values were up by 18% in the December 2020 quarter, compared with the year-ago period. In those six months, 57 megadeals – deals in excess of US$5 billion in value – were signed.

The data available with Refinitiv shows that in the past one month alone, some 4,000 deals – big and small – amounting to US$588.5 billion have been signed – almost three-fourth of whom have been in the form of acquisition.

There are multiple factors driving this phenomenon – with Biden Administration in charge, there is a high probability of tax hike in the next four years in the US; and the fatigue from the prolonged coronavirus pandemic will drive a lot of entrepreneurs to the negotiation table, especially ones who were already mooting to sell their holdings.

To add to it, there has been a huge spike in special purpose acquisition company (SPAC) deals this year – raising US$100.6 billion in 309 initial public offerings.

So, it comes as no surprise that many experts are calling 2021 as the banner year in global dealmaking.