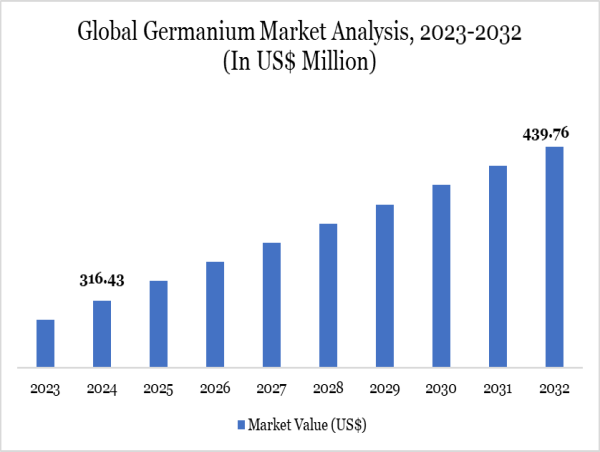

The Germanium Market is quietly powering some of the most essential technologies of our time spanning semiconductors, fiber optics, infrared optics, and solar energy systems. Thanks to its distinct semiconductor and optical qualities, germanium serves as a vital material across telecommunications, electronics, and defense industries.. In 2024, the market was valued at US$ 316.43 million, and it's Projected to reach US$ 439.76 million by 2032, growing at a CAGR of 4.20% during the forecast period from 2025 to 2032. As demand for high-efficiency devices increases, germanium’s relevance is expected to grow steadily.

Get Premium Sample Report : https://www.datamintelligence.com/download-sample/germanium-market

Market Drivers are ;

Rising Demand for Fiber Optic Networks: Germanium is widely used in fiber optic systems due to its optical clarity and performance in high-speed communications.

Growth in Infrared Optics for Military and Industrial Use: Its ability to transmit infrared light makes it ideal for night-vision goggles, thermal imaging, and sensors.

Growth in Solar Cell Technologies: Germanium substrates are essential for producing high-efficiency solar cells, especially those used in aerospace and satellite systems.

Increased Semiconductor Usage in Consumer Electronics: Germanium-based transistors and chips are gaining traction in advanced electronics.

Government Focus on Critical Mineral Security: Strategic interest in germanium has increased as countries seek to reduce reliance on limited international sources.

Recycling and Reuse of Germanium Materials: New techniques for reclaiming germanium from used electronics and optical devices are improving supply sustainability.

Key Market Players Include :

Yunnan Chihong Zinc & Germanium Co., Ltd.

Umicore

Teck Resources Limited

JSC Germanium

PPM Pure Metals GmbH

Indium Corporation

China Germanium Co., Ltd.

AXT, Inc.

5N Plus

Noah Chemicals

These players are investing in production capacity, recycling initiatives, and R&D to meet growing demand while ensuring supply chain security.

Market Segmentation :

The Germanium market is segmented across several key dimensions:

By Type: Germanium Tetrachloride, High-Purity Germanium, Germanium Dioxide

By Application: Fiber Optics, Infrared Optics, Electronics & Semiconductors, Solar Panels, Catalysts

By End-User Industry: Telecommunications, Renewable Energy, Consumer Electronics, Defense, Aerospace, Telecommunications, Consumer Electronics, Renewable Energy

By Region: South America, North America, Europe, Asia-Pacific,Middle East & Africa

Asia-Pacific currently leads the market, particularly due to China's dominance in germanium production. However, North America and Europe are increasing investments in domestic supply chains.

Latest News - USA :

In 2024, the U.S. Department of Defense designated germanium a critical mineral, launching a national stockpiling strategy and funding domestic recycling efforts. Additionally, 5N Plus expanded its germanium refining capabilities at its U.S. facility to support semiconductor and solar applications, responding to surging defense and renewable energy demand.

Latest News - Japan :

In Japan, Sumitomo Electric collaborated with a local university to develop next-gen germanium-based semiconductors for quantum computing and space-grade solar cells. The Japanese Ministry of Economy, Trade and Industry (METI) also included germanium in its 2024 Rare Metal Strategy, pledging funding for recycling R&D and local sourcing initiatives.

Key Developments :

Umicore introduced a sustainable germanium supply program, focusing on closed-loop recycling.

Teck Resources completed an upgrade of its Trail Operations to enhance germanium output capacity.

AXT, Inc. launched ultra-high-purity germanium wafers targeting next-gen chip fabrication.

PPM Pure Metals GmbH developed a new method to refine germanium with reduced carbon footprint.

Indium Corporation expanded its product line with germanium-based thermal management materials for high-performance computing.

Conclusion :

As demand for high-performance and energy-efficient technologies continues to rise, the Germanium market is poised for stable, long-term growth. Its unique properties make it indispensable in strategic sectors like defense, renewable energy, and communications. With governments recognizing its importance and companies innovating in recycling and refining, germanium is transitioning from a niche metal to a cornerstone of future-ready technologies. The market outlook remains strong, especially as global focus sharpens on sustainable and secure critical mineral supply chains.

Browse for more Reports :

Rhenium Market

Zirconium Market

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()