Forex Cards Market Research Report By, Type, Transaction Type, Merchant Participation, End User, Application, Regional

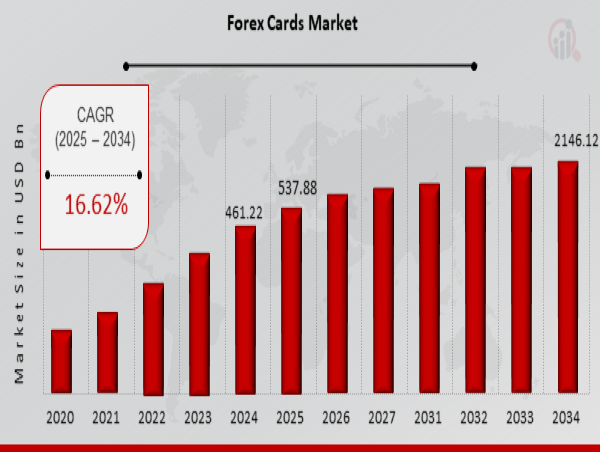

WA, UNITED STATES, March 18, 2025 /EINPresswire.com/ -- The global Forex Cards market has been witnessing rapid growth and is expected to expand significantly in the coming years. In 2024, the market size was valued at USD 461.22 billion and is projected to grow from USD 537.88 billion in 2025 to an impressive USD 2146.12 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 16.62% during the forecast period (2025–2034). This growth is primarily driven by increasing international travel, rising adoption of digital payments, and the demand for cost-effective foreign exchange solutions.

Key Drivers of Market Growth

Increasing International Travel

The surge in global travel for tourism, education, and business has significantly boosted the demand for forex cards. Travelers prefer forex cards over cash due to their security, convenience, and competitive exchange rates.

Rising Adoption of Digital Payments

The increasing penetration of digital banking and fintech solutions has enhanced the accessibility of forex cards. Contactless payments and integration with mobile wallets further contribute to market growth.

Cost-Effective Foreign Exchange Solutions

Forex cards offer better exchange rates compared to cash and traveler’s checks. Additionally, they come with lower transaction fees and multi-currency capabilities, making them an attractive option for international travelers.

Growth in E-Commerce and Cross-Border Transactions

With the expansion of global e-commerce, forex cards are increasingly used for international online shopping, fueling market demand. Businesses and freelancers engaged in cross-border trade also contribute to market expansion.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23847

Key Companies in the Forex Cards Market Include

• MoneyGram International

• TransferWise

• WorldRemit

• WorldFirst

• Revolut

• Paysend

• Travelex

• OFX

• Xoom

• Wise Plc

• Western Union

• Euronet Worldwide

• Currencycloud

• Ria Money Transfer

• American Express

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/forex-cards-market-23847

Market Segmentation

To provide a comprehensive analysis, the Forex Cards market is segmented based on card type, end-user, usage, and region.

1. By Card Type

o Single Currency Forex Cards: Designed for transactions in a single foreign currency.

o Multi-Currency Forex Cards: Support multiple foreign currencies, making them ideal for frequent travelers.

o Prepaid Forex Cards: Reloadable cards offering flexibility and security.

2. By End-User

o Individual Travelers: Tourists, students, and business travelers.

o Corporate Users: Businesses providing forex cards for employee travel expenses.

o E-Commerce Shoppers: Individuals using forex cards for international online transactions.

3. By Usage

o ATM Withdrawals: Cash withdrawals in foreign countries.

o Point of Sale (POS) Transactions: In-store purchases in different currencies.

o Online Transactions: Cross-border payments and international e-commerce shopping.

4. By Region

o North America: Leading market due to high international travel and digital banking adoption.

o Europe: Strong growth driven by increased business travel and fintech innovations.

o Asia-Pacific: Fastest-growing region, fueled by rising disposable income and outbound tourism.

o Rest of the World (RoW): Emerging opportunities in Latin America, the Middle East, and Africa with expanding global trade.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23847

The global Forex Cards market is set for substantial growth, driven by rising international travel, evolving digital payment solutions, and the increasing preference for secure foreign exchange alternatives. As financial institutions and fintech companies continue to innovate, the demand for forex cards is expected to surge, creating new opportunities in the global payment landscape.

Related Report:

Guaranteed Auto Protection Insurance Market

Hong Kong Mobile Phone Insurance Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()