Again, from the Urban Institute: "Credit can be a lifeline during emergencies and a bridge to education and homeownership. But debt, which can stem from credit or unpaid bills, often burdens families’ and communities’ financial well-being." These same words could apply to federal debt, though the amount of federal debt is an order of magnitude greater than the amount of household debt, excluding mortgage debt.

The most obvious harm caused by the large federal debt is from the interest payments, which according to https://fiscaldata.treasury.gov are now 14% of federal spending. Only Social Security spending is higher. High interest payments displace spending on social welfare, national defense, and other urgent priorities of government.

Another harm of persistent deficit spending is born by future generations who are obligated to pay it back despite much of the benefit going to recipients today. Just as interest payments displace beneficial spending today, the repayment obligations of debt can displace future spending on essential programs.

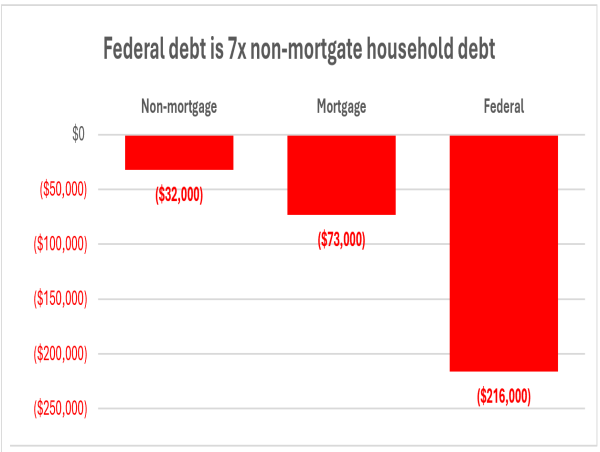

These harms are why people, when given the choice of taking on debt individually, take on far less debt than the government imposes on them. According to the New York Federal Reserve and other sources, the average household debt in the U.S. is about $32,000, excluding mortgages. This number, $32,000, represents the collective wisdom of over 170 million American households as to the amount of non-mortgage debt they are each willing to assume.

In his 2004 book "The Wisdom of Crowds," author James Surowiecki showed how collective knowledge can be superior to biased or conflicted experts. The case of the federal debt may be a case where the wise crowd gives a better answer. The so-called experts in this case include biased Keynesian economists and conflicted politicians who increase spending while paying with debt rather than increasing taxes.

Just how much has the federal debt diverged from the wisdom of the crowd? So much that in 2025 the expected U.S. federal debt per household is $216,000. That is seven times more than the $32,000 household average of non-mortgage debt.

Who in North Carolina ran up the debt?

All incumbent members of the U.S. Congress have responsibility for incurring federal debt. Special blame goes to the U.S. House Representatives, which is the only part of government that can introduce bills to raise revenue.

The two longest serving members of North Carolina's House delegation are representatives Alma Adams (NC 12) and David Rouzer (NC 7). They have both served over 10 years and voted for over $18 trillion in debt between them. That is over $10,000 in debt per year, every year, for each household in North Carolina.

During the tenures of both Adams and Rouzer, the national debt has more than doubled.

The example of these two representatives shows that both Democrats and Republicans are responsible for causing unprecedented federal debt. One party has historically been about helping the poor and building the middle class. The other has a brand built on fiscal responsibility and low taxes. Yet the climbing federal debt displaces spending for the poor, pressures the middle class, is fiscally irresponsible, and increases future taxes.

The Department of the Treasury has laid out the discomforting facts on its fiscal data website: https://fiscaldata.treasury.gov. Discomforting, but nowhere on the website does it say, "debt crisis." These words are used by many others, including the centrist think tank the Brookings Institution. In a recent article by Wendy Edelberg, Ben Harris, and Louise Sheiner they state: "... Analysts warn, however, that our nation’s growing debt will inevitably lead to a crisis."

Rob Yates

Libertarian Party of North Carolina (lpnc.org)

+1 803-250-1075

[email protected]

Visit us on social media:

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()