Fine Art Insurance Market Research Report By, Coverage Type, Collection Size, Ownership, Purpose of Insurance, Regional

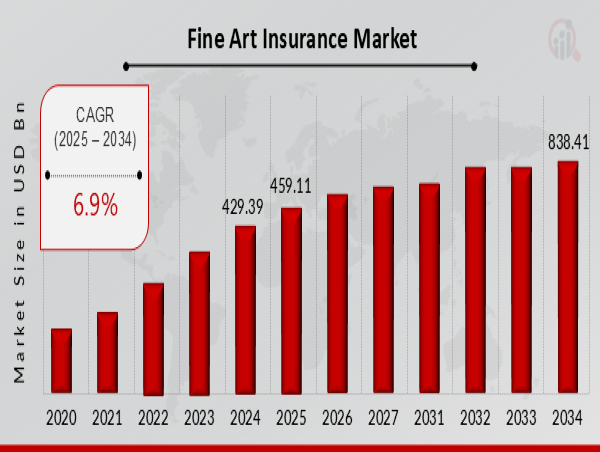

GA, UNITED STATES, March 18, 2025 /EINPresswire.com/ -- The global Fine Art Insurance market has been witnessing steady growth in recent years and is projected to expand significantly in the coming decade. In 2024, the market size was valued at USD 429.39 billion and is expected to grow from USD 459.11 billion in 2025 to an impressive USD 838.41 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.9% during the forecast period (2025–2034). This growth is primarily driven by the increasing value of fine art collections, rising art investments, and the growing need for specialized insurance coverage against damage, theft, and loss.

Key Drivers of Market Growth

Increasing Value of Fine Art Collections

With the art market booming globally, collectors, museums, and galleries are seeking comprehensive insurance policies to protect high-value assets. The appreciation of fine art pieces over time has necessitated enhanced risk management solutions.

Rising Art Investments

The growing interest of high-net-worth individuals (HNWIs) and institutional investors in fine art as an alternative asset class is fueling market demand. As more investors acquire valuable artwork, the need for robust insurance coverage increases.

Growing Risk of Damage and Theft

The risks associated with transportation, storage, and display of fine art have led to heightened demand for specialized insurance products. High-profile thefts and accidental damages have reinforced the necessity for comprehensive coverage.

Advancements in Risk Assessment and Technology

The integration of artificial intelligence (AI), blockchain, and data analytics is improving risk assessment and fraud detection in fine art insurance. These technologies enable better valuation, authentication, and claims processing, enhancing the overall efficiency of the industry.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23912

Key Companies in the Fine Art Insurance Market Include

• Christie's Insurance Services

• Marsh

• Phillips

• Zurich

• JLT

• Sotheby's International Realty

• AXA ART

• Chubb

• Willis Towers Watson

• BMS Group

• AIG

• Bonhams

• Hiscox

• Lloyds of London

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/fine-art-insurance-market-23912

Market Segmentation

To provide a comprehensive analysis, the Fine Art Insurance market is segmented based on coverage type, distribution channel, end-user, and region.

1. By Coverage Type

o Physical Loss & Damage: Covers accidental damage, fire, water damage, and transit-related risks.

o Theft & Fraud Protection: Provides financial protection against stolen or fraudulent transactions.

o Title & Ownership Risk Insurance: Covers disputes related to the ownership and provenance of artworks.

o Exhibition & Transit Insurance: Secures artworks while being transported or displayed at galleries and museums.

2. By Distribution Channel

o Direct Insurance Providers: Insurers directly offering policies to collectors, galleries, and institutions.

o Brokers & Agents: Intermediaries facilitating fine art insurance policies for clients.

o Online Platforms: Digital solutions offering seamless policy comparisons and underwriting processes.

3. By End-User

o Private Collectors: Individuals insuring personal fine art collections.

o Museums & Galleries: Institutions securing extensive artwork portfolios.

o Auction Houses: Businesses requiring coverage for high-value art transactions.

o Corporate Art Programs: Companies with art collections in offices and public spaces.

4. By Region

o North America: Leading market due to high art investments and insurance penetration.

o Europe: Strong growth driven by established auction houses and a flourishing art industry.

o Asia-Pacific: Fastest-growing region, fueled by increasing wealth accumulation and art appreciation.

o Rest of the World (RoW): Emerging opportunities in Latin America, the Middle East, and Africa as the art market expands.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23912

The global Fine Art Insurance market is poised for significant growth, driven by rising art valuations, increasing risks, and evolving insurance solutions. As collectors and institutions prioritize asset protection, the demand for specialized fine art insurance is expected to surge. With technological advancements and expanding regional markets, the industry is set to play a crucial role in securing valuable artworks worldwide.

Related Report:

Exchange Traded Fund Market

Factory and Warehouse Insurance Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()