Financial hardship may still be below pre-pandemic levels but the head of the Australian Banking Association warns borrowers could suddenly reach a breaking point.

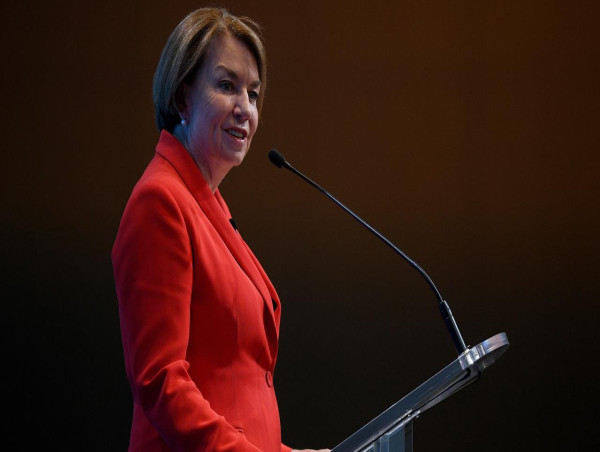

ABA chief executive officer Anna Bligh said rates of financial hardship, repossessions and defaults were still low compared to historical averages but banks had started recording a "slight uptick" in the 90-day default rate.

She said there were also signs of stress across unsecured lending, such as credit cards and personal loans, with Australian borrowers typically prioritising their mortgage repayments over other types of debt.

The last Australian Prudential Regulation Authority data on the 90-day default rate, which indicates three missed payments, fell slightly for both individuals and businesses in the December quarter.

But based on what banks were telling her, she said they were expecting this rate to lift modestly in the first three months of 2023.

Ms Bligh likened the build-up of financial stress to a rubber band.

"Everybody can stretch, you know, they can stretch for the next payment they can stretch for the next interest rate rise," she said.

"And then something happens to the car, you know, and the elastic band breaks."

She said banks were "very aware" that they might start seeing this at a "slightly bigger scale".

The CEO of the banking industry group also said Australian banks were ready to help customers facing hardship and said repossessing properties was "an absolute last resort measure".

"If they don't get a repayment of a loan, that's a bad commercial outcome for them."

She said keeping customers in their principal place of residence was the starting point for any hardship case.

"They'll probably, to be honest, think a little bit differently about people who've got five or six investment properties - you know, that's a different set of financial circumstances."

She said there were all sorts of ways banks would help people in trouble, such as deferring payments until unemployed people found work again or reducing the size of their repayments for a period.

While Ms Bligh did not comment directly on the Australian Competition and Consumer Commission's investigation of bank interest rate settings, she said deposit rates were as high as they had been for a decade.

"In the December quarter of 2022, authorised deposit institutions paid $18.8 billion in interest to deposit holders - more than they have paid in any single quarter since March 2012."

The consumer watchdog launched an investigation into deposit products earlier this year following concerns banks weren't passing cash rate hikes on evenly to savings customers.

The regulator released an issues paper on the subject on Friday, calling on consumers and consumer organisations to offer their insights.

ACCC chair Gina Cass-Gottlieb said banks tended to pass on interest rate hikes to variable home loan customers in full but increases to savings interest rates had often been smaller or conditional.

"This inquiry will closely examine how banks make decisions on interest rates, and any barriers consumers face in getting a better deal," she said.