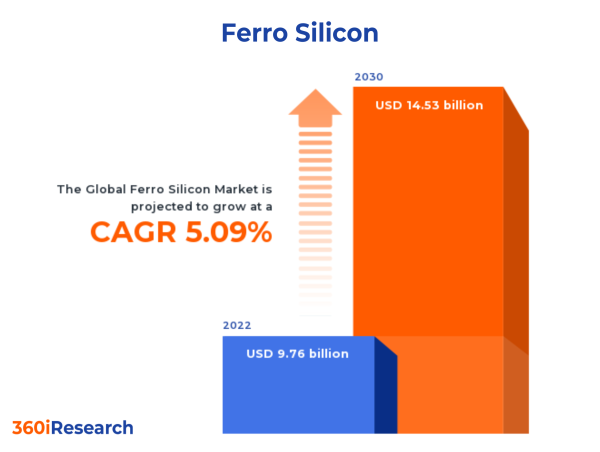

The Global Ferro Silicon Market to grow from USD 9.76 billion in 2022 to USD 14.53 billion by 2030, at a CAGR of 5.09%.

PUNE, MAHARASHTRA, INDIA , December 8, 2023 /EINPresswire.com/ -- The "Ferro Silicon Market by Type (45%, 65%, 70%), Function (Deoxidizer, Inoculants), Application - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Ferro Silicon Market to grow from USD 9.76 billion in 2022 to USD 14.53 billion by 2030, at a CAGR of 5.09%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/ferro-silicon?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Ferro silicon, often abbreviated as FeSi, is a type of ferroalloy, an alloy of iron-enriched with a high proportion of silicon. Constituting approximately 15% to 90% of its total composition, silicon is an indispensable element within ferro silicon. The ferro silicon market represents a sector within the metals industry where commodities such as ferro silicon, an iron silicate alloy, are produced, distributed, bought, and used. It encompasses various aspects such as manufacturers, suppliers, customers, marketing strategies, and product portfolios. Growing construction and infrastructure development activities worldwide and an increase in the production of high-quality steel are creating demand for ferro silicon. In addition, increasing focus on developing energy-efficient transformers also fuels the market growth. Fluctuations in raw material prices of ferrosilicon and the availability of various substitutes are hindering market development. The growing development of novel ferro silicon manufacturing processes is a potential market growth area. The rising transition toward renewable energy sources is expected to create significant opportunities in the ferro silicon market.

Application: Wider application of ferro silicon for enhanced performance for semiconductor devices

Ferro silicon is mainly used in chemical processing as a silicon source to decrease metals from their oxides and deoxidize steel and other ferrous alloys. Its high melting point and corrosion resistance render it an excellent fit for these applications. The most common application of ferro silicon remains within the metallurgical industry. It serves as an essential deoxidizing agent in the steel manufacturing process and enhances the overall quality and strength of the final product. Ferro silicon's role becomes significant in producing solar panels, contributing to the photovoltaic solar energy sector. It offers a cost-efficient method to extract solar energy and improves power conversion efficiency. Semiconductor industries utilize ferro silicon to enhance silicon properties and fabrication processes. The addition of ferro silicon helps permit low-temperature combining and eliminates undesirable elements in semiconductor production. While ferro silicon's usage spans these sectors, the proportion of application differs markedly. Metallurgy remains the prime segment due to the rapid development of infrastructure globally. Chemical processing and the semiconductor industry follow closely due to their high-tech, evolving needs. Although the photovoltaic sector currently accounts for a smaller share, new advancements and collaborations indicate a promising future.

Function: Increasing use of ferro silicon in steel industry, which is largely dependent on the deoxidizing properties

Ferro silicon is prominently used as a deoxidizer in the steel manufacturing process. These substances remove and repress the formation of oxygen, thereby minimizing oxidation levels in the finished product. As part of its function, the deoxidizer enhances the steel's strength, making it more resilient and durable. As the demand for quality steel increases globally, the need for ferro silicon deoxidizers also escalates. Ferro silicon finds ample usage as an innoculants in cast irons. This contributes to increased nucleation points, refining graphite, and matrix structures, enhancing mechanical properties, and reducing defective casts. While deoxidizers and inoculants possess unique properties, usage and preference depend largely on industry requirements. The steel industry largely depends on the deoxidizing properties of ferro silicon to enhance steel quality, whereas the foundry industry prefers ferro silicon for its inoculating properties, which refine iron structures and increase mechanical strength.

Type: Growing demand for ferro silicon 75% in advanced chip manufacturing

The ferro silicon, with 45% silicon content, is primarily used as a deoxidizer during steel production. Its low silicon content makes it suitable for applications that do not require higher silicon content. Ferro silicon with 65% silicon content is employed in manufacturing transformer cores due to its optimal electrical conductivity. It is also favored in the production of high-strength, low-alloy steels. Ferro silicon 70% is predominantly used in manufacturing pre-alloyed powders for metal injection molding (MIM), which serves the automotive, defense, and medical industries. Ferro silicon 72% serves effectively in the production of magnesium ferro silicon and other similar pre-alloys. Ferro silicon 75%, having a generous 75% silicon content, is widely accepted in manufacturing electronics and semiconductors due to its semiconductor properties.

Regional Insights:

In the Americas, the United States and Canada constitute the major economic zones for the ferro silicon market within the Americas. The region encounters a high demand for ferro silicon due to its substantial steel and cast iron production utilization. Consumers primarily lean towards quality and cost-effectiveness while making purchasing decisions. Several new research projects, patents, and initiatives are taking place, supported by significant investments in this region, fostering technological advancements and sustainability in ferro silicon production. Europe shows a robust ferro silicon market, driven by its established industrial sector. Countries such as Germany, France, and the UK are the key players contributing to the growth. The consumer needs here predominantly revolve around a consistent supply of high-quality ferro silicon for diverse industrial uses. The Middle East and Africa region show great potential with increasing investments in industrial development. Patents and novel research on environmentally friendly production and disposal methods of ferro silicon can be observed increasingly in this region. The Asia-Pacific region, from India to China, is the most significant player in the demand for ferro silicon, owing to its dominant steel industry. Rapid industrialization and urbanization in countries such as China, India, Japan, and South Korea drive demand for ferro silicon.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Ferro Silicon Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Ferro Silicon Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Ferro Silicon Market, highlighting leading vendors and their innovative profiles. These include Ambica Refractories Pvt. Ltd., Anyang Lishi Industrial Co., Ltd, Arab Alloys, Bharat Engineering Works Pvt Ltd., Capstone Alloys & Steel Industries Ltd, Elkem ASA, Eurasian Resources Group, Ferro Alloys Corporation Limited, Ferroglobe PLC, Ferrotec Holdings Corporation, FINNFJORD AS, FirstAlloys, Gulf Ferro Alloys Company, Imerys S.A., Lionas Metals Company Limited, MARUBENI TETSUGEN CO., LTD., Metals & Alloys UK, METRACO NV, Osaka Special Alloy Co.,LTD, Pertama Ferroalloys, Sarojini Ferro Alloys LLC, Shree Bajrang Sales (P) Ltd., Tata Steel Limited, Toyo Denka Kogyo Co.,Ltd., and Vedanta Limited.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/ferro-silicon?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Ferro Silicon Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across 45%, 65%, 70%, 72%, and 75%. The 70% is projected to witness significant market share during forecast period.

Based on Function, market is studied across Deoxidizer and Inoculants. The Deoxidizer is projected to witness significant market share during forecast period.

Based on Application, market is studied across Chemical Processing, Metallurgy, Photovoltaic Solar Energy, and Semiconductors. The Chemical Processing is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Asia-Pacific commanded largest market share of 35.22% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Ferro Silicon Market, by Type

7. Ferro Silicon Market, by Function

8. Ferro Silicon Market, by Application

9. Americas Ferro Silicon Market

10. Asia-Pacific Ferro Silicon Market

11. Europe, Middle East & Africa Ferro Silicon Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Ferro Silicon Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Ferro Silicon Market?

3. What is the competitive strategic window for opportunities in the Ferro Silicon Market?

4. What are the technology trends and regulatory frameworks in the Ferro Silicon Market?

5. What is the market share of the leading vendors in the Ferro Silicon Market?

6. What modes and strategic moves are considered suitable for entering the Ferro Silicon Market?

Read More @ https://www.360iresearch.com/library/intelligence/ferro-silicon?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

[email protected]