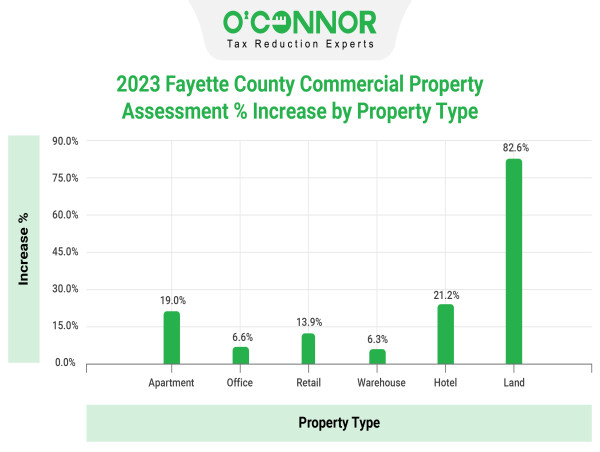

The average commercial property tax assessment for Fayette County, GA is up by over 15% for 2023.

ATLANTA, GEORGIA, UNITED STATES, August 23, 2023/EINPresswire.com/ -- Property tax assessments for commercial property owners in Fayette for 2023 were 15.8% higher than 2022. The biggest hikes in 2023 went to hotels and landowners; both were over 20%. Land assessments for property taxes rose 82.6% in a single year, from $95.4 million in 2022 to $174.2 million in 2023. Fayette’s property tax assessments for hotels rose from $49.6 million in 2022 to $60.1 million in 2023, a 21.2% increase. In Fayette County, the total value of commercial property climbed from $1.68 billion in 2022 to $ 1.94 billion in 2023. Apartments, offices, shops, warehouses, hotels, and land are included in these property types.O’Connor, who is among the nation’s largest property tax consultants, studied data provided by Fayette County, GA to develop this analysis.

Comparing Fayette County commercial increase to the analysis of the Green Street real estate firm. Commercial property value trends, according to Green Street, are 15% lower for 2023, while there is a 15.8% Fayette County Tax Assessor assessment rise, creating a disparity of over 30 points between the two values.

Apartments built between 1961 and 1980 and 1981 to 2000 saw the biggest increases in valuation. In 2023, assessments for apartments in Fayette County constructed between 1981 and 2000 increased by 31.7%, but not for those constructed before 1960. When considering apartment property in general there is an average increase of 19%.

In Fayette County, the tax assessment for retail structures climbed by 13.9% for 2023. In 2022, market value for property constructed between 1961 and 1980 totaled $25 million. The 2023 total market value for this same retail age range has swelled to over $34.5 million, an increase of almost 35%.

Based on the Fayette County Tax Assessor values, warehouses went up in value by 18.8%. However, for property built between 1961 and 1980, the assessed value of warehouses climbed by 86.1%, and for those constructed from 1981 to 2000 and beyond, it increased by 7.7%. There was no assessment increase for warehouses built before 1960, however, there was an 11.1% rise for those built after 2001.

Property owners in Fayette County are urged to consider contesting their property tax assessment every year, especially in years when values are reassessed. The valuation staff for the assessor works arduously to appraise property fairly and accurately, but with such massive numbers to value there is room for miscalculation.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Georgia, Texas, and Illinois, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube