As a rare congenital blood disorder, DBA affects the bone marrow's ability to produce red blood cells. Historically, treatment options have been limited, but recent breakthroughs in gene therapy, targeted drug development, and stem cell transplantation are reshaping the therapeutic landscape and offering hope to patients worldwide.

𝐆𝐚𝐢𝐧 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐊𝐧𝐨𝐰𝐥𝐞𝐝𝐠𝐞: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭! https://www.futuremarketinsights.com/report-sample#5245502d47422d3136343333

𝐊𝐞𝐲 𝐆𝐫𝐨𝐰𝐭𝐡 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐒𝐡𝐚𝐩𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

𝖲𝖾𝗏𝖾𝗋𝖺𝗅 𝗉𝗂𝗏𝗈𝗍𝖺𝗅 𝖿𝖺𝖼𝗍𝗈𝗋𝗌 𝖺𝗋𝖾 𝗂𝗇𝖿𝗅𝗎𝖾𝗇𝖼𝗂𝗇𝗀 𝗍𝗁𝖾 𝖣𝖡𝖠 𝗌𝗒𝗇𝖽𝗋𝗈𝗆𝖾 𝗍𝗁𝖾𝗋𝖺𝗉𝖾𝗎𝗍𝗂𝖼𝗌 𝗆𝖺𝗋𝗄𝖾𝗍:

• 𝗔𝗱𝘃𝗮𝗻𝗰𝗲𝗺𝗲𝗻𝘁𝘀 𝗶𝗻 𝗚𝗲𝗻𝗲 𝗧𝗵𝗲𝗿𝗮𝗽𝘆: Emerging gene-editing technologies, such as CRISPR, have opened new avenues in the treatment of genetic diseases like DBA. These therapies offer the potential for long-term cures rather than temporary symptom management.

• 𝗜𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝗱 𝗔𝘄𝗮𝗿𝗲𝗻𝗲𝘀𝘀 𝗮𝗻𝗱 𝗗𝗶𝗮𝗴𝗻𝗼𝘀𝗶𝘀: Global health initiatives and patient advocacy groups have helped spread awareness, leading to earlier and more accurate diagnoses. This increases the patient pool receiving effective treatment and encourages pharmaceutical investment.

• 𝗜𝗺𝗽𝗿𝗼𝘃𝗲𝗱 𝗕𝗼𝗻𝗲 𝗠𝗮𝗿𝗿𝗼𝘄 𝗧𝗿𝗮𝗻𝘀𝗽𝗹𝗮𝗻𝘁 𝗧𝗲𝗰𝗵𝗻𝗶𝗾𝘂𝗲𝘀: Hematopoietic stem cell transplantation (HSCT) remains a cornerstone of treatment, and continuous improvements in donor matching and transplantation success rates are enhancing outcomes.

• 𝗚𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁 𝗮𝗻𝗱 𝗜𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 𝗦𝘂𝗽𝗽𝗼𝗿𝘁: Orphan drug designations, faster regulatory pathways, and dedicated research funding are significantly boosting the pace of innovation and therapeutic development.

𝐎𝐯𝐞𝐫𝐜𝐨𝐦𝐢𝐧𝐠 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐃𝐁𝐀 𝐓𝐡𝐞𝐫𝐚𝐩𝐞𝐮𝐭𝐢𝐜𝐬 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦

𝖣𝖾𝗌𝗉𝗂𝗍𝖾 𝖺 𝗉𝗈𝗌𝗂𝗍𝗂𝗏𝖾 𝗈𝗎𝗍𝗅𝗈𝗈𝗄, 𝗍𝗁𝖾 𝗆𝖺𝗋𝗄𝖾𝗍 𝖿𝖺𝖼𝖾𝗌 𝗇𝗈𝗍𝖺𝖻𝗅𝖾 𝗁𝗎𝗋𝖽𝗅𝖾𝗌:

• 𝗛𝗶𝗴𝗵 𝗧𝗿𝗲𝗮𝘁𝗺𝗲𝗻𝘁 𝗖𝗼𝘀𝘁𝘀: The expenses associated with gene therapies and stem cell transplants can be substantial, limiting access in low- and middle-income countries.

• 𝗟𝗶𝗺𝗶𝘁𝗲𝗱 𝗔𝘃𝗮𝗶𝗹𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗼𝗳 𝗗𝗼𝗻𝗼𝗿𝘀: Stem cell transplants require close donor-patient matches, which are often difficult to find, delaying or limiting treatment options for many patients.

• 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗖𝗼𝗺𝗽𝗹𝗲𝘅𝗶𝘁𝗶𝗲𝘀: Navigating the approval process for rare disease drugs continues to be challenging, with stringent safety and efficacy requirements that may delay time-to-market.

To address these challenges, pharmaceutical companies and healthcare institutions are prioritizing personalized medicine, patient support programs, and collaborative research. Partnerships between biopharmaceutical firms and academic centers are accelerating innovation and making treatments more accessible.

𝐂𝐨𝐮𝐧𝐭𝐫𝐲-𝐰𝐢𝐬𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤: 𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐚𝐧𝐝 𝐆𝐫𝐨𝐰𝐭𝐡 𝐏𝐚𝐭𝐭𝐞𝐫𝐧𝐬

𝗨𝗻𝗶𝘁𝗲𝗱 𝗦𝘁𝗮𝘁𝗲𝘀 (𝗖𝗔𝗚𝗥: 𝟯.𝟵%)

The U.S. is at the forefront of DBA syndrome therapeutics. The presence of strong regulatory frameworks, financial backing for rare disease research, and healthcare coverage through insurance policies drive growth. Treatments like corticosteroids, HSCT, and gene therapies are widely available. Moreover, the country leads in clinical trials, research funding, and biotech innovations.

𝗨𝗻𝗶𝘁𝗲𝗱 𝗞𝗶𝗻𝗴𝗱𝗼𝗺 (𝗖𝗔𝗚𝗥: 𝟯.𝟱%)

The UK boasts a solid healthcare infrastructure and consistent government funding focused on rare diseases. With the National Health Service (NHS) facilitating access to cutting-edge therapies, the country is seeing steady adoption of novel DBA treatments, backed by policy frameworks supporting rare disease management.

𝗘𝘂𝗿𝗼𝗽𝗲𝗮𝗻 𝗨𝗻𝗶𝗼𝗻 (𝗖𝗔𝗚𝗥: 𝟯.𝟴%)

Within the EU, countries such as Germany, France, and Italy spearhead innovation in DBA therapeutics. The European Medicines Agency's (EMA) Orphan Drugs Committee plays a vital role in expediting drug approvals. Collaborative efforts between biotech companies and research institutions are fostering gene therapy innovation across the region.

𝗝𝗮𝗽𝗮𝗻 (𝗖𝗔𝗚𝗥: 𝟯.𝟲%)

Japan is leveraging its strengths in regenerative medicine and biologic research to push the boundaries of DBA therapy. Backed by government R&D grants, Japanese firms are investing heavily in HSCT techniques and gene editing. The nation's precision medicine approach aims to enhance patient outcomes through tailored therapies.

𝗦𝗼𝘂𝘁𝗵 𝗞𝗼𝗿𝗲𝗮 (𝗖𝗔𝗚𝗥: 𝟯.𝟳%)

South Korea’s dynamic biotech ecosystem is catalyzing growth in rare disease treatment. Government-backed programs, strong university partnerships, and increased access to orphan drugs are fostering a robust research and therapeutic environment for DBA. Advanced diagnostics and targeted therapies are being adopted quickly, contributing to the country's strong CAGR.

𝐑𝐢𝐬𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐚𝐭𝐚: 𝐎𝐮𝐫 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐎𝐟𝐟𝐞𝐫𝐬 𝐃𝐞𝐞𝐩 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐚𝐧𝐝 𝐓𝐫𝐞𝐧𝐝 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬! https://www.futuremarketinsights.com/reports/diamond-blackfan-anemia-syndrome-therapeutics-market

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤: 𝐖𝐡𝐨'𝐬 𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐂𝐡𝐚𝐫𝐠𝐞?

𝙰𝚜 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚖𝚊𝚝𝚞𝚛𝚎𝚜, 𝚖𝚊𝚓𝚘𝚛 𝚙𝚑𝚊𝚛𝚖𝚊𝚌𝚎𝚞𝚝𝚒𝚌𝚊𝚕 𝚙𝚕𝚊𝚢𝚎𝚛𝚜 𝚊𝚛𝚎 𝚜𝚑𝚊𝚛𝚙𝚎𝚗𝚒𝚗𝚐 𝚝𝚑𝚎𝚒𝚛 𝚏𝚘𝚌𝚞𝚜 𝚘𝚗 𝚛𝚊𝚛𝚎 𝚑𝚎𝚖𝚊𝚝𝚘𝚕𝚘𝚐𝚒𝚌 𝚍𝚒𝚜𝚘𝚛𝚍𝚎𝚛𝚜 𝚕𝚒𝚔𝚎 𝙳𝙱𝙰. 𝚃𝚑𝚎 𝚔𝚎𝚢 𝚌𝚘𝚖𝚙𝚊𝚗𝚒𝚎𝚜 𝚊𝚛𝚎:

• Sumitomo Corporation

• Johnson & Johnson Private Limited

• Novartis AG

• Pfizer Inc.

• Sanofi

• Merck KGaA

• Bayer AG

• Cipla Inc.

• GlaxoSmithKline plc

• AstraZeneca

These firms are actively pursuing gene therapy development, enhancing stem cell transplantation protocols, and engaging in precision medicine initiatives. Their aim is not only to improve efficacy and safety but also to reduce the economic burden on patients and healthcare systems.

Notably, the backing of patient advocacy groups and government support mechanisms are instrumental in bringing these innovations to market faster and making them available to a broader patient population.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧: 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦

𝐁𝐲 𝐓𝐫𝐞𝐚𝐭𝐦𝐞𝐧𝐭:

• Corticosteroids – Often the first line of treatment, helping stimulate red blood cell production.

• Chelation Therapy – Used to remove excess iron from the blood due to frequent transfusions.

• Blood Transfusions – A cornerstone of symptom management in DBA patients.

• Stem Cell Transplant – Offers curative potential for eligible patients.

• Others – Including gene therapy, emerging biologics, and small molecule drugs.

𝐁𝐲 𝐄𝐧𝐝 𝐔𝐬𝐞𝐫:

• Hospitals – Primary treatment centers for advanced procedures like HSCT.

• Clinics – Offering corticosteroids and routine transfusions.

• Others – Including specialized treatment centers and research institutions.

𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧:

• North America

• Latin America

• Western Europe

• Eastern Europe

• East Asia

• South Asia Pacific

• Middle East and Africa

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧: 𝐀 𝐏𝐫𝐨𝐦𝐢𝐬𝐢𝐧𝐠 𝐃𝐞𝐜𝐚𝐝𝐞 𝐀𝐡𝐞𝐚𝐝 𝐟𝐨𝐫 𝐃𝐁𝐀 𝐓𝐡𝐞𝐫𝐚𝐩𝐞𝐮𝐭𝐢𝐜𝐬

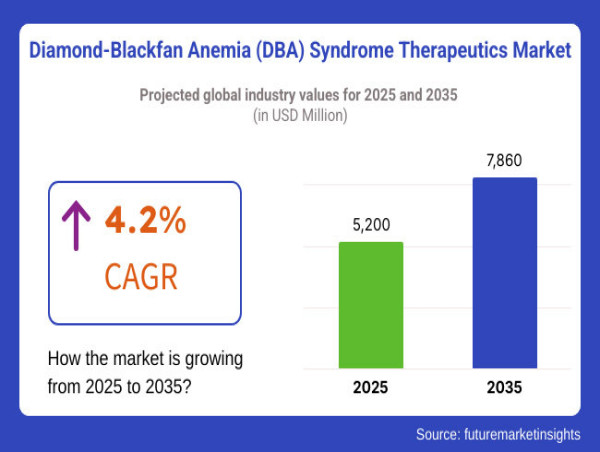

The next ten years promise to be transformative for the Diamond-Blackfan Anemia syndrome therapeutics market. As science unlocks new frontiers in gene therapy and stem cell medicine, the focus is shifting from merely managing DBA to potentially curing it. While economic and regulatory barriers persist, strong government support, increasing public awareness, and relentless innovation from pharmaceutical giants are expected to shape a healthier, more hopeful future for DBA patients worldwide.

With countries investing in rare disease research, and market players stepping up to the challenge, the DBA therapeutics industry is positioned not just for growth—but for meaningful impact in patient lives.

Ankush Nikam

Future Market Insights, Inc.

+91 90966 84197

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()