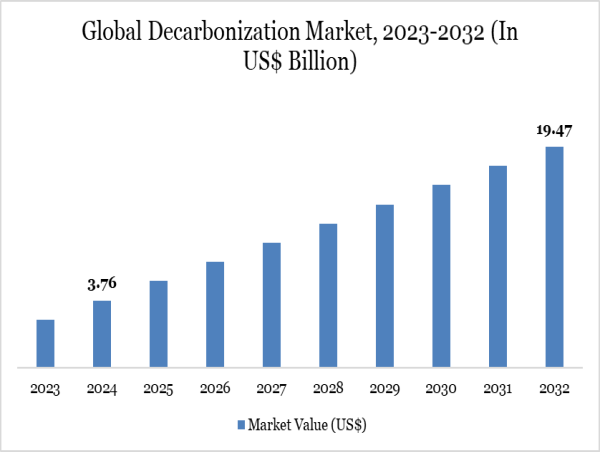

The Global Decarbonization Market Size was valued at USD 3.76 Billion in 2024 and is projected to surge to approximately USD 19.47 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 22.82% from 2025 to 2032.

This growth is being driven by a blend of policy mandates, technological breakthroughs, ESG investment inflows, and shifting consumer demand toward low-emission solutions.

To Download Sample Report:https://datamintelligence.com/download-sample/decarbonization-market

Market Trends Driving Decarbonization

Several key trends are shaping the current and future landscape of the decarbonization market:

Electrification of Transportation: With EV adoption accelerating worldwide, the transition from fossil fuels to clean electricity in transportation is a major driver.

Carbon Capture and Storage (CCS): Advancements in CCS technologies are allowing industries like steel, cement, and power generation to manage and reduce emissions.

Green Hydrogen Projects: Hydrogen produced from renewable energy is emerging as a clean energy carrier, especially in hard-to-abate sectors.

Corporate Net-Zero Commitments: More companies are setting science-based targets to reduce emissions across their operations and value chains.

Regional Insights

North America

The United States and Canada are aggressively rolling out incentives and policies to reduce greenhouse gas emissions. U.S. federal investments under programs like the Inflation Reduction Act are catalyzing large-scale clean energy projects and low-carbon technology rollouts. State-level climate action plans, especially in California, New York, and Washington, are driving demand for renewable energy, CCS, and sustainable manufacturing.

Europe

Europe remains a global leader in decarbonization, with strong regulatory frameworks such as the EU Green Deal, Fit for 55, and the Carbon Border Adjustment Mechanism (CBAM). Countries like Germany, France, and the Netherlands are investing in offshore wind, electrified rail, and carbon-neutral buildings.

Asia-Pacific

Asia-Pacific is catching up quickly, with nations like China, Japan, South Korea, and India making bold commitments toward carbon neutrality. China leads in solar and EV production, while Japan and South Korea are focused on hydrogen and energy efficiency in manufacturing.

Key Companies in the Market

Several global players are actively involved in decarbonization through clean technologies, consulting, carbon offsetting, and innovation:

Ernst & Young Global Limited

DNV

Armstrong International Inc.

Boston Consulting Group

ABB

Deloitte

Arup

MAN

Siemens

Wärtsilä

Market Segmentation:

By Service: Carbon Accounting & Reporting Services, Sustainable Transportation Services, Waste Reduction & Circular Economy Services, Others

By Technology: Renewable Energy, Energy Storage, Carbon Capture, Utilization and Storage (CCUS), Hydrogen Technologies, Electrification, Others

By Deployment: On-premises, Cloud

By End-User: Oil & Gas, Energy & Utility, Agriculture, Government, Automotive & Transportation, Aerospace & Defense, Manufacturing, Others

Buy Now & Unlock 360° Market Intelligence: https://datamintelligence.com/buy-now-page?report=decarbonization-market

Latest Developments in the Market

The market is witnessing a surge in collaborative projects, public-private partnerships, and pilot programs aiming at decarbonizing industrial clusters, urban infrastructure, and energy supply chains. Digital technologies like AI and blockchain are being increasingly used for carbon footprint monitoring and transparent ESG reporting.

Moreover, banks and institutional investors are prioritizing green bonds and sustainability-linked loans, further accelerating decarbonization across industries.

Latest News of USA

In the United States, the Department of Energy recently announced over $1.2 billion in funding for two large-scale direct air capture hubs—one in Texas and another in Louisiana. These projects are expected to remove up to 2 million metric tons of CO₂ annually from the atmosphere and create thousands of green jobs.

Additionally, multiple American utility companies have rolled out updated net-zero transition roadmaps, focusing on decarbonizing power generation through advanced nuclear, large-scale battery storage, and solar farms.

Ford and General Motors have also increased investment in domestic EV battery production and pledged carbon neutrality in manufacturing by the end of the decade.

Latest News of Japan

Japan has been making strategic moves to lead in the hydrogen economy. The government recently approved a new Hydrogen Strategy 2024, allocating around JPY 15 trillion (USD 100 billion) in public and private investment over the next 15 years. The plan includes scaling up both green and blue hydrogen supply chains and deploying hydrogen-fueled power plants.

Japanese industrial giants like Mitsubishi Heavy Industries and Toyota have ramped up their R&D in zero-emission engines, carbon recycling, and smart grid systems. Furthermore, Japan’s Ministry of the Environment announced a national carbon pricing mechanism expected to take effect in 2026, reinforcing corporate decarbonization goals.

Conclusion

The decarbonization market is poised for exponential growth as climate commitments become non-negotiable for industries, policymakers, and consumers. With evolving technologies, robust investments, and global collaboration, decarbonization is not just a trend it’s a transformation that will define the coming decades. Regions like the USA and Japan are setting compelling examples, with innovation and government backing at the forefront.

As we move into 2025 and beyond, the focus will likely intensify on cross-border initiatives, standardization of carbon measurement, and the evolution of carbon credit markets making this a space to watch for businesses and investors alike.

Most Recent Researched Related Repots By DataM Intelligence

Carbon Capture, Utilization and Storage Market Size

Green Hydrogen Market Size

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Competitive Landscape

Sustainability Impact Analysis

Technology Road Map Analysis

KOL / Stakeholder Insights

Unmet Needs & Positioning, Pricing & Market Access Snapshots

Market Volatility & Emerging Risks Analysis

Quarterly Industry Report Updated

Live Market & Pricing Trends

Consumer Behavior & Demand Analysis

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

[email protected]

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()