Debit Card Market Research Report By, Usage, Network, Payment Type, Technology, Regional

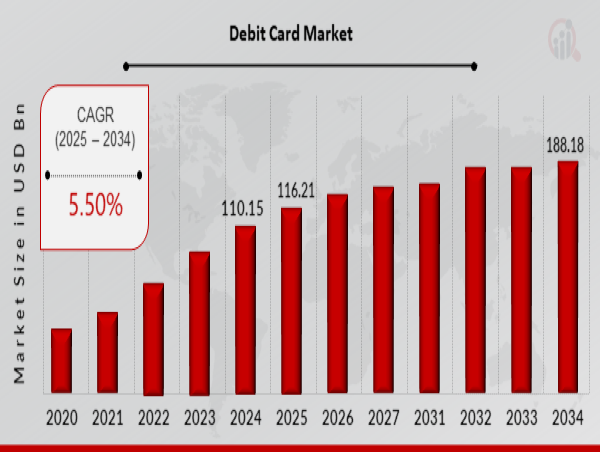

WI, UNITED STATES, February 17, 2025 /EINPresswire.com/ -- The global Debit Card market has experienced steady growth in recent years and is set to expand further over the coming decade. In 2024, the market size was valued at USD 110.15 billion and is projected to grow from USD 116.21 billion in 2025 to an impressive USD 188.18 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.50% during the forecast period (2025–2034). The growth is primarily driven by increasing consumer preference for cashless transactions, the expansion of digital banking, and rising financial inclusion initiatives worldwide.

Key Drivers of Market Growth

Increasing Adoption of Cashless Payments

With the global shift toward digital payments, debit card usage has surged as consumers prefer secure, convenient, and contactless transaction methods. The widespread acceptance of debit cards at retail stores, e-commerce platforms, and service providers is further accelerating market growth.

Growth in Digital Banking and Fintech Innovations

The rise of digital banking services and fintech startups has led to the introduction of innovative debit card offerings, including virtual debit cards, biometric authentication, and real-time transaction monitoring. These advancements enhance security and user experience, making debit cards more appealing.

Financial Inclusion and Government Initiatives

Governments and financial institutions worldwide are promoting debit card adoption as part of financial inclusion programs. Initiatives such as no-frills banking accounts, direct benefit transfers, and subsidy disbursements through debit cards are increasing card penetration, particularly in emerging markets.

Contactless and Mobile Payment Integration

The integration of debit cards with mobile wallets and contactless payment technologies (such as NFC and QR codes) has further boosted usage. Consumers now prefer tap-to-pay options, enhancing transaction speed and convenience while reducing dependency on cash.

Rising E-commerce Transactions

The growing e-commerce industry has significantly contributed to debit card market expansion, with consumers increasingly using debit cards for online shopping, subscription services, and bill payments. Secure payment gateways and fraud detection mechanisms have further strengthened consumer confidence in digital transactions.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23925

Key Companies in the Debit Card Market Include

• JCB International

• Payoneer

• UnionPay International

• China UnionPay

• Visa International

• Mastercard

• PayPal

• GoodData Corporation

• eftpos

• Discover Financial

• Hypercom

• Diners Club International

• American Express

• Interac

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/debit-card-market-23925

Market Segmentation

To provide a detailed analysis, the Debit Card market is segmented based on type, usage, end-user, and region.

1. By Type

• Standard Debit Cards: Linked directly to bank accounts for everyday transactions.

• Prepaid Debit Cards: Loadable cards used for budgeting, travel, and gifting.

• Business Debit Cards: Designed for corporate and SME expense management.

• Virtual Debit Cards: Digital-only cards used for online transactions and security.

2. By Usage

• Contact-Based Debit Cards: Require physical insertion into POS terminals.

• Contactless Debit Cards: Enable tap-to-pay transactions using NFC technology.

• Mobile-Linked Debit Cards: Integrated with digital wallets for seamless mobile payments.

3. By End-User

• Individuals: Retail consumers using debit cards for personal transactions.

• Businesses: Organizations utilizing business debit cards for expense management.

4. By Region

• North America: A well-established market with high debit card penetration and advanced digital payment infrastructure.

• Europe: Strong growth driven by regulatory push for digital payments and fintech adoption.

• Asia-Pacific: Fastest-growing region due to rising financial inclusion, smartphone penetration, and government-led digital payment initiatives.

• Rest of the World (RoW): Steady expansion expected in Latin America, the Middle East, and Africa with increasing debit card adoption and mobile banking services.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23925

The global Debit Card market is on a steady growth path, driven by technological advancements, evolving consumer preferences, and government-led initiatives promoting digital transactions. As financial institutions and fintech companies continue to innovate and enhance debit card offerings, the market is poised for sustained expansion, transforming the global payment landscape.

Related Report –

Income Protection Insurance Market

Claims Processing Software Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()