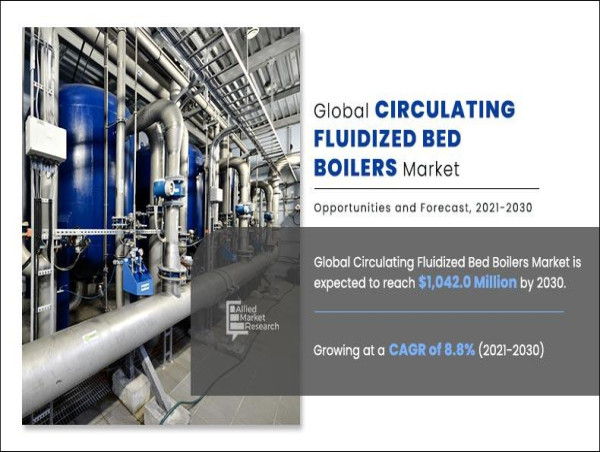

WILMINGTON, DE , UNITED STATES, June 3, 2024 /EINPresswire.com/ -- The global circulating fluidized bed boiler market was valued at $450.4 million in 2020, and is projected to reach $1,042.0 million by 2030, growing at a CAGR of 8.8% from 2021 to 2030.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗦𝗮𝗺𝗽𝗹𝗲 𝐏𝐃𝐅 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.alliedmarketresearch.com/request-sample/239

In this report, the revenue (US$ Mn) and volume (Megawatt) represents total number of installed circulating fluidizing bed boilers and their installed capacities globally.

Circulating fluidized bed boiler are capable of combusting different types of fuels such as wet coal, brown coal, and coke.

Supercritical CFB boiler is designed to meet EU emission limits and they are affordable & efficient type of boilers that are used in energy & power plants. In addition, CFB boilers are capable of cofiring biofuels with different coal grades that further reduces carbon dioxide emissions. In addition, since the commercialization of worlds supercritical CFB boiler In Poland, it has gained immense popularity around the world owing to its benefits such as safety, reliability, and balanced reheat capability. All these factors are predicted to notably contribute toward the global market.

However, factors such as wear and tear of water-cooled wall tubes in CFB boilers and cause analysis factors are predicted to hamper the market growth during the forecast period.

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://www.alliedmarketresearch.com/checkout-final/545325cb888be92dce8ee2114420237d

CFB boiler offers several advantages over other convectional boilers such as minimal bed area, owing to utilization of high velocity of fluidizers, enhanced rate of combustion efficiency, and high sulfur retention to use of finer & smaller particles and minimal number of feed points for fuel. This factor is anticipated to create remunerative opportunities for the expansion of the circulating fluidized bed boiler market.

The circulating fluidized bed boiler market is segmented on the basis of product, capacity, fuel type, application, and region.

By product, the market is segregated into subcritical, supercritical, and ultra-supercritical. The subcritical type segment dominated the global market, in terms of revenue in 2020, with over two-thirds of the total share. Subcritical circulating fluidized bed boiler require minimal temperature around 500 degree Celsius to combust the fuel. In addition, petroleum coke, culm, oil pitches, and fuel with ash level can be used as fuel.

By capacity, the circulating fluidized bed boiler market is classified into less than 100 MW, 100–200 MW, 200–300 MW, and 300 MW & above. The 100–200 MW segment dominated the global market, in terms of revenue in 2020, with over four-ninths of the total share. 100-150 MW capacity circulating fluidized bed boiler are widely employed in thermal power plants owing to its advantages such as low caloric ignite value, anti-erosion, and minimal environmental emission.

By fuel type, the circulating fluidized bed boiler market is classified into coal, biomass, and others. The coal fuel type segment dominated the global market, in terms of revenue in 2020, with over three-fourths of the total share. Circulating fluidized bed boiler that uses coal as fuel offers several advantages over other fuel types such as enhanced firing capability, minimal emission, improved heat absorption, and anti-erosion.

𝐄𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : https://www.alliedmarketresearch.com/purchase-enquiry/239

By application, the market is divided into energy & power, industrial, and others. The energy & power application segment dominated the global market in terms of revenue in 2020, with over four-fifths of the total share. Establishment of new coal powered thermal power plant are set up across developing nations and other developed nations to overcome the growing demand for energy & power source.

Region-wise, the circulating fluidized bed boiler market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific circulating fluidized bed boiler market size is projected to grow at the highest CAGR during the forecast period and accounted for 60% circulating fluidized bed boiler market share in 2020. Constant technological advancement in Asia-Pacific has led to development of new circulating fluidized bed boiler. For instance, ANDRITZ has developed a new circulating fluidized bed boiler that offer maximum efficiency and it is powered with biomass as fuel. This circulating fluidized bed boiler has been supplied to Japan.

𝐊𝐄𝐘 𝐅𝐈𝐍𝐃𝐈𝐍𝐆𝐒 𝐎𝐅 𝐓𝐇𝐄 𝐒𝐓𝐔𝐃𝐘:

The supercritical product type is estimated to display the highest growth rate, in terms of revenue, registering a CAGR of 9.6% from 2021 to 2030.

The 200-300 MW capacity type is anticipated to register the highest CAGR of 9.7% during the forecast period.

The biomass fuel type is estimated to display the highest growth rate, in terms of revenue, registering a CAGR of 9.2% from 2021 to 2030.

The energy & power application is estimated to display the highest growth rate, in terms of revenue, registering a CAGR of 9.0% from 2021 to 2030.

Asia-Pacific garnered the highest share of 60.7% in 2020, in terms of revenue, growing at a CAGR of 9.5%.

𝐓𝐡𝐞 𝐤𝐞𝐲 𝐩𝐥𝐚𝐲𝐞𝐫𝐬

JFE Engineering Corporation

Industrial Boilers America

Sumitomo Heavy Industries Limited

Alstom

Valmet

Thermodyne Engineering Systems

Andritz

Mitsubishi Power

EBARA Environmental Plant Co. Ltd.

Babcock & Wilcox Enterprises Inc.

David Correa

Allied Market Research

+ 18007925285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

![]()