Some of the key players profiled in the study are Allianz Partners, American International Group , The Hartford, Chubb Limited , Assicurazioni Generali , Tokio Marine Holdings , AXA , Zurich Insurance , MetLife, Inc. , Nationwide Mutual Insurance Company

Get an Inside Scoop of Study, Request now for Sample Study @ https://www.htfmarketintelligence.com/sample-report/global-business-travel-accident-insurance-market?utm_source=Krati_EINnews&utm_id=Krati

Definition: Travel accident insurance is a specialized type of travel insurance plan. It acts as life insurance and it is insurance against accidental death and dismemberment in the case of a travel accident. The benefits are paid regardless of whether the traveler has other AD&D coverage and life insurance. Moreover, some of the insurance plans also cover emergency medical expenses. Limited insurance plans give the maximum reimbursements range to choose from and several are designed specifically for the regular business traveler and include coverage for non-medical emergency evacuations. Business travel can be defined as the traveling performed for the purpose of business between two or more parties. Some of the examples of business travel are traveling from one branch to another branch of the same company, traveling to different locations for meeting any suppliers or business partners, and traveling for a business conference or business event across different locations. Business travel accident insurance is an important benefit for many companies, particularly those with employees who frequently travel internationally on company business.

Market Trends:

Employees Concerns Regarding Business Travel at Present Scenario Pushing the Employers to Adopt Business Travel Insurance

Digitalization and Innovation Across the Insurance Sector

Market Drivers:

Growing Demand for Business Travel

The Rising Worldwide Business Travel Spending

Market Opportunities:

Opportunities Across Emerging Countries

The titled segments and sub-section of the market are illuminated below:

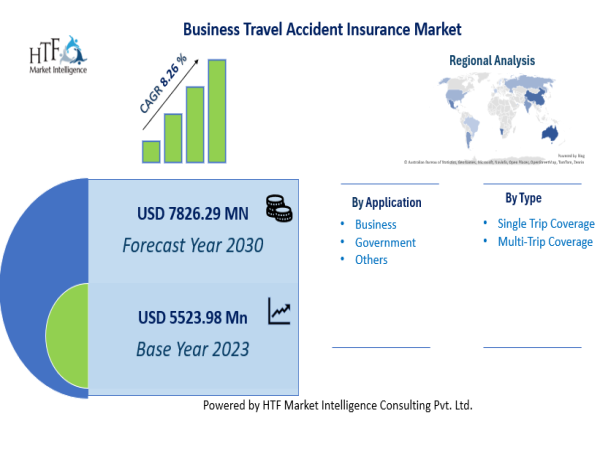

The Study Explore the Product Types of Business Travel Accident Insurance Market: Single Trip Coverage, Multi-Trip Coverage

Key Applications/end-users of Business Travel Accident Insurance Market: Business, Government, Others

Check for Best Quote @ https://www.htfmarketintelligence.com/buy-now?format=1&report=35?utm_source=Krati_EINnews&utm_id=Krati

With this report you will learn:

· Who the leading players are in Business Travel Accident Insurance Market?

· What you should look for in a Business Travel Accident Insurance

· What trends are driving the Market

· About the changing market behaviour over time with strategic view point to examine competition

Also included in the study are profiles of 15 Business Travel Accident Insurance vendors, pricing charts, financial outlook, swot analysis, products specification &comparisons matrix with recommended steps for evaluating and determining latest product/service offering.

Who should get most benefit from this report insights?

· Anyone who are directly or indirectly involved in value chain cycle of this industry and needs to be up to speed on the key players and major trends in the market for Business Travel Accident Insurance

· Marketers and agencies doing their due diligence in selecting a Business Travel Accident Insurance for large and enterprise level organizations

· Analysts and vendors looking for current intelligence about this dynamic marketplace.

· Competition who would like to benchmark and correlate themselves with market position and standings in current scenario.

Make an enquiry to understand outline of study and further possible customization in offering https://www.htfmarketintelligence.com/enquiry-before-buy/global-business-travel-accident-insurance-market?utm_source=Krati_EINnews&utm_id=Krati

Quick Snapshot and Extracts from TOC of Latest Edition

• Overview of Business Travel Accident Insurance Market

• Business Travel Accident InsuranceSize (Sales Volume) Comparison by Type (2024-2030)

• Business Travel Accident Insurance Size (Consumption) and Market Share Comparison by Application (2024-2030)

• Business Travel Accident Insurance Size (Value) Comparison by Region (2024-2030)

• Business Travel Accident Insurance Sales, Revenue and Growth Rate (2024-2030)

• Business Travel Accident Insurance Competitive Situation and Current Scenario Analysis Strategic proposal for estimating sizing of core business segments Players/Suppliers High Performance Pigments Manufacturing Base Distribution, Sales Area, Product Type Analyse competitors, including all important parameters of Business Travel Accident Insurance

• Business Travel Accident Insurance Manufacturing Cost Analysis Latest innovative headway and supply chain pattern mapping of leading and merging industry players

Get Detailed TOC and Overview of Report @ https://www.htfmarketintelligence.com/report/global-business-travel-accident-insurance-market

Thanks for reading this article, you can also make sectional purchase or opt-in for regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe or European Union.

Nidhi Bhawsar

HTF Market Intelligence Consulting Private Limited

+1 507-556-2445

email us here

Visit us on social media:

Facebook

X

LinkedIn

![]()