Summary

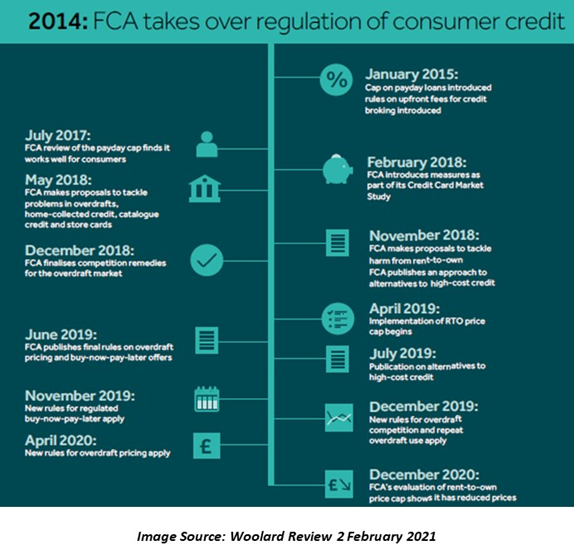

- Major regulatory checks in the unsecured credit market were proposed in the Woolard review, published in collaboration with the FCA board.

- Measures were introduced keeping in mind that the BNPL products should not land their consumers in a risky position.

- BNPL stock prices reacted to the news, with a 0.6% drop in Afterpay share prices, and a 2% drop in Openpay share prices on 3 February 2021.

The unsecured credit market has been expanding with each passing year. The growing need for credit has risen for the diverse range of goods, demanded by consumers. The popularity of digital lending in the recent past has further expanded the credit sector, with Buy-Now-Pay-Later products leading the way.

According to the Woolard review, BNPL sector needs some urgent changes to make credit fit for the future. In his review, the former interim chief executive of the Financial Conduct Authority, Christopher Woolard, expressed an urgent need to build a resilient credit market.

RELATED READ: How is 2021 panning out for BNPL space?

Why is Credit Sector Regulation needed?

The unsecured credit market has become a way of life for most people. There have been recent developments in the market with the rise of payday lenders, unregulated BNPL products, and advances to employees. (source: https://www.fca.org.uk/publication/corporate/woolard-review-report.pdf)

The pandemic outbreak made the credit market more susceptible, alongside risks posed to consumers. Well-functioning debt advice is a must to support the credit market. This debt advice sector would need long-term as well as equitable funding solutions. Thus, a shift in regulation is much needed following the virus outbreak. (PAGE 5)

An outcome-focused approach to regulate the credit sector is also required. The real-world usage of products would shed light not just on affordability but also on how the product is used throughout its lifetime. Moreover, issues like long-term debt advice strategies, availability of alternatives to high-cost credit, and the treatment of the lower-income groups, need to be addressed by the FCA.

Credit access is another challenge needed to be addressed by the FCA. According to the review, sub-prime customers lack mid-cost options, making credit inaccessible to them. These factors created the need for innovation in the credit market to make it healthy and sustainable.

The Review Recommendations

As a response to the issues discussed above, the review shed light on the following recommendations:

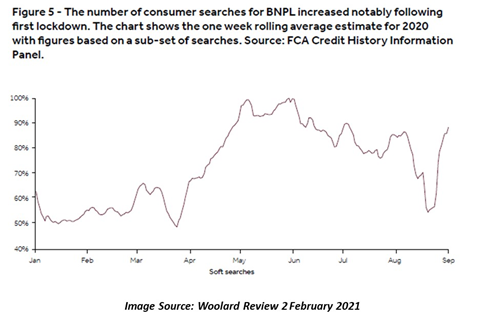

- Bringing unregulated BNPL products under the radar: According to the report, the unregulated BNPL market more than trebled in size in 2020. Any unobserved products and business models floating in the market, in addition to the ones that may be developed in the future, can be harmful.

Regulation of such products would ensure that the end consumer is not at a disadvantage. Alternatives to such unregulated products exist, including the Employer Salary Advance Scheme (ESAS), which offers low-cost credit as opposed to payday loans, overdrafts, etc.

The FCA must keep regular checks on the market for any developments to help prevent risks to consumers. Alongside these changes, tracking developments in the digital credit markets is another challenge that the FCA must overcome.

- Strong debt advice: The report suggests that around 1.5 million additional people may need debt advice in the coming periods. People in need of debt advice have a few options available to them. The FCA can reduce the barriers faced by these people in accessing debt solutions.

The report gave an example in the context of the UK, where a fee of £90 is charged for a DRO application. In working towards the reduction of this fee for the marginalised sector, the FCA can build an emergency fund.

A long-term multi-year strategy needs to be in place to provide consumers with debt advice. The FCA might look at the not-for-profit sector to provide these multi-year settlements.

- Building a response to COVID-19: During the early stages of the pandemic-related economic crisis, the government and the FCA acted quickly to ensure that people had adequate credit available by not having a mark on their credit profiles.

Arrangements to report any forbearance agreements thus made would be investigated. The masking of credit files would also be assessed thoroughly. A more descriptive and defined approach needs to be developed towards all forbearance agreements, so that consumers can benefit fully and quickly from them.

- Increased alternatives to high-cost credit: Analysing the impact of different social policies on the demand for high-cost credit could shed light on the risks faced by consumers. Given the alternatives to high-cost credit like credit unions, there is not enough demand for these in credit space. FCA can try to increase the provision of these alternatives, giving them better outreach in the market.

- Building better credit information market: Credit information is necessary to ensure good outcomes in lending markets. Increased credit information also increases the access to credit for different types of consumers in the market.

- Outcome-focused analysis: How consumers use credit is another aspect that needs to be analysed to make a sustainable market. The FCA can take an outcome-based approach to regulate the market and set out clearly what the market must achieve at each stage of the consumer’s borrowing process.

The effect on Afterpay and Openpay

Afterpay welcomed the regulations to provide a more sustainable and secure environment to their customers. Clearpay, which is Afterpay’s subsidiary in the UK, claims that it has always acted in the best interest of the consumers with strong safeguards and industry regulation in place.

ALSO READ: Afterpay (ASX:APT) On Unbeaten Success Path?

Openpay also “embraced” the new guidelines towards market regulation and suspects that these would not have an adverse impact on Openpay’s operations. Other BNPL providers like Laybuy, Zip, and Klarna also were in favour of the review’s recommendations and believed they would not face any challenges even with increased scrutiny.

However, BNPL stocks prices showed immediate impact following the review release. Afterpay shares, decreased by 0.6%, reach a value of A$145.67, whereas Openpay share prices declined by 2% to trade at A$2.51 per share on 3 February 2021.

In the aftermath of these proposed regulations being implemented, many players might even contemplate leaving the market to avoid these checks.

.jpg)