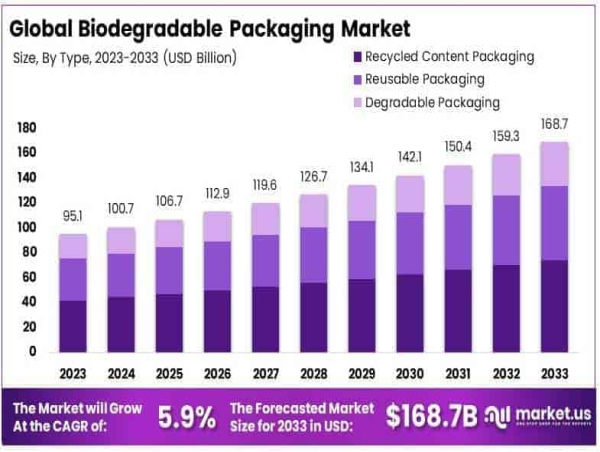

The Global Biodegradable Packaging Market is projected to reach USD 168.7 Billion by 2033, up from USD 95.1 Billion in 2023, expanding at a CAGR of 5.9% from 2024 to 2033.

Biodegradable packaging refers to materials used for packaging that are capable of breaking down naturally through biological processes, such as microbial activity, into non-toxic components. These materials are typically derived from renewable sources such as plant-based polymers, starch, or cellulose, as opposed to traditional petroleum-based plastics. The primary advantage of biodegradable packaging is its ability to reduce environmental impact, particularly by minimizing long-term pollution and waste accumulation in landfills and oceans. This market encompasses a range of products, including biodegradable films, containers, and wraps, which serve a variety of industries such as food and beverages, consumer goods, pharmaceuticals, and e-commerce.

The biodegradable packaging market is currently experiencing significant growth driven by increased environmental awareness, stringent government regulations, and a shift toward sustainability. As businesses seek to reduce their carbon footprints and meet consumer demand for eco-friendly products, biodegradable packaging is seen as a crucial step in aligning with these evolving expectations. The market's expansion is further supported by technological advancements that enhance the performance and cost-effectiveness of biodegradable materials, making them viable alternatives to conventional plastics.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/biodegradable-packaging-market/request-sample/

The growing demand for sustainable packaging solutions, particularly in sectors like food and beverage, is accelerating the adoption of biodegradable alternatives. Consumer preferences for eco-conscious products are prompting companies to invest in packaging innovations. Moreover, regulatory pressures on plastic use are creating a clear opportunity for growth in this sector. With continued innovation and a favorable regulatory environment, the biodegradable packaging market is poised for substantial expansion, offering both environmental and business advantages.

**Key Takeaways**

~~ The Biodegradable Packaging Market was valued at USD 95.1 billion in 2023 and is expected to reach USD 168.7 billion by 2033, growing at a CAGR of 5.9%.

~~ In 2023, Recycled Content Packaging led the market, driven by the rising consumer demand for eco-friendly packaging solutions.

~~ Plastic remained the dominant material in 2023 due to its flexibility and innovations in biodegradable plastic alternatives.

~~ The Food & Beverages sector led the market with a 44% share in 2023, reflecting the industry’s emphasis on sustainable packaging.

~~ Asia Pacific accounted for 38.2% of the market in 2023, propelled by increasing regulatory support for sustainable packaging initiatives.

**Market Segmentation**

Recycled content packaging leads the biodegradable packaging market due to its significant environmental benefits, reducing the need for virgin materials and supporting sustainability efforts. This type uses previously processed materials to create new packaging, making it a preferred choice in industries focused on waste reduction and resource conservation. Reusable packaging, while less dominant, is growing in popularity for its potential to be used multiple times, especially in consumer goods and food service. Degradable packaging, designed to break down under specific conditions, helps reduce landfill impact and is essential for environmentally sensitive disposal.

Plastics dominate the material segment due to their versatility, particularly in packaging, with biodegradable options like starch-based plastics, PLA, PHB, and PHA gaining traction for their environmental benefits. Starch-based plastics are cost-effective and easy to produce, while cellulose-based plastics offer strong air and oil barriers, ideal for food packaging. PLA is favored for its clarity and protection of perishable goods, and PHB/PHA are emerging for specialty packaging with biodegradability and strength. Paper and paperboard materials, such as kraft paper, flexible paper, and corrugated fiberboard, are crucial for reducing plastic use, enhancing recyclability, and offering durable, lightweight solutions for packaging.

The biodegradable packaging market is predominantly driven by the food & beverages sector, which holds a 44% share in 2023, due to stringent regulations on packaging waste and a growing demand for eco-friendly products. This segment is crucial for reducing food waste and enhancing shelf life while meeting environmental goals. Other significant applications include consumer products, where brands adopt biodegradable packaging to align with sustainability strategies and boost consumer loyalty, and shipping, which uses biodegradable materials to reduce environmental impact in logistics. Additionally, sectors like chemicals, pharmaceuticals, and cosmetics are increasingly adopting biodegradable packaging to meet product sensitivity, safety, and environmental standards.

**Key Market Segments**

By Type

~~ Recycled Content Packaging

~~ Reusable Packaging

~~ Degradable Packaging

By Material

~~ Plastic

~~ ~~ Starch-Based Plastics

~~ ~~ Cellulose-Based Plastics

~~ ~~ Polylactic Acid (PLA)

~~ ~~ Poly-3-Hydroxybutyrate (PHB)

~~ ~~ Polyhydroxyalkanoates (PHA)

~~ ~~ Other Plastics

~~ Paper & Paperboard

~~ ~~ Kraft Paper

~~ ~~ Flexible Paper

~~ ~~ Corrugated Fiberboard

~~ ~~ Boxboard

~~ ~~ Other Materials

By Application

~~ Food & Beverages

~~ Consumer Product

~~ Shipping

~~ Chemicals

~~ Pharmaceuticals

~~ Cosmetics & Personal Care

~~ Other Applications

**Driving factors**

Growing Environmental Awareness

In 2024, the global Biodegradable Packaging Market is witnessing significant growth driven by increasing environmental awareness among consumers and businesses. As concerns over plastic pollution intensify, there is a shift toward sustainable packaging alternatives. Consumers are actively seeking eco-friendly products, and governments are implementing stricter regulations on plastic usage, making biodegradable packaging an attractive solution. This surge in demand for sustainable materials is expected to drive market expansion, as companies strive to meet evolving environmental standards.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=60739

**Restraining Factors**

High Production Costs

Despite the growing interest in biodegradable packaging, the market faces a significant restraint in the form of high production costs. Biodegradable materials, such as plant-based plastics and biopolymers, often require more expensive raw materials and advanced manufacturing processes compared to conventional plastic. This price disparity makes it challenging for businesses to adopt biodegradable solutions, particularly in cost-sensitive industries. High production costs may limit the widespread adoption of biodegradable packaging in the short term, especially for smaller enterprises.

**Growth Opportunity**

Technological Advancements in Materials

The continuous development of innovative materials presents a promising opportunity for the biodegradable packaging market in 2024. New technologies and research are leading to the creation of more efficient and cost-effective biodegradable materials, such as algae-based and mushroom-based packaging. These advancements can reduce production costs and improve the functionality of biodegradable products, opening up new avenues for market growth. As these technologies mature, they will likely enable broader adoption across industries, enhancing the sustainability profile of the packaging sector.

**Latest Trends**

Increased Use of Compostable Packaging

A prominent trend in 2024 within the biodegradable packaging market is the growing preference for compostable packaging solutions. This trend reflects a shift toward packaging that not only biodegrades but can also be effectively composted at home or industrial facilities. As consumers and businesses look for packaging that fits seamlessly into circular economies, compostable materials are becoming more popular. This trend highlights a broader commitment to reducing waste and environmental impact, further driving demand for biodegradable packaging options globally.

**Regional Analysis**

Lead Region: Asia Pacific with Largest Market Share of 38.2% in the Biodegradable Packaging Market

The Asia Pacific region dominated the global biodegradable packaging market in 2023, accounting for 38.2% of the market share, valued at USD 36.33 billion. The region is expected to maintain its leadership due to increasing government initiatives promoting eco-friendly packaging solutions, along with a rapidly growing consumer base concerned about sustainability. China and India, as key contributors, are witnessing substantial growth in demand for biodegradable packaging, particularly in food and consumer goods industries.

In North America, the market is growing steadily with a focus on eco-conscious consumer behavior and government regulations favoring sustainable packaging. The market in this region is forecasted to experience significant growth, driven by the U.S. leading initiatives for a cleaner environment and packaging innovation. Europe is also showing a strong upward trajectory in the adoption of biodegradable packaging solutions, owing to stringent regulations on plastic usage, especially in the European Union, which is pushing for sustainability and plastic waste reduction.

The Middle East & Africa (MEA) is experiencing gradual growth as demand for sustainable packaging rises in response to global environmental movements and regulatory pressures. In Latin America, the biodegradable packaging market is gaining traction due to increasing consumer preference for environmentally friendly products, albeit at a slower pace compared to other regions.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, the Global Biodegradable Packaging Market is witnessing strong competition and innovation from several industry leaders. Amcor Limited continues to drive sustainable packaging solutions, focusing on reducing environmental impact. Ardagh Group SA and Ball Corporation are both making strides with eco-friendly innovations in glass and aluminum packaging, respectively. Braskem SA is leveraging its expertise in bio-based polymers, while Cargill Incorporated and Caraustar Industries emphasize renewable materials. BASF SE offers advanced biodegradable plastics, contributing to sustainability efforts. Mondi Group PLC and Reynolds Group Holding Limited are expanding their portfolios with environmentally friendly packaging. Tetra Pak International SA remains a key player in providing sustainable, efficient food packaging solutions. These companies are aligned with growing consumer demand for eco-conscious, biodegradable options.

Top Key Players in the Market

~~ Amcor Limited

~~ Ardagh Group SA

~~ Ball Corporation

~~ Braskem SA

~~ Cargill Incorporated

~~ Caraustar Industries Incorporated

~~ BASF SE Company Profile

~~ Mondi Group PLC

~~ Reynolds Group Holding Limited

~~ Tetra Pak International SA

~~ Other Key Players

**Recent Developments**

In 2024 Barley-Based Bioplastic: A breakthrough in bioplastic technology led to the development of 100% biodegradable material from barley, offering a sustainable alternative for food packaging.

In 2024 DRDO: The Defence Research and Development Organisation (DRDO) created PBAT-based biodegradable packaging that decomposes within three months, for use in food and medical waste bags.

In 2024 Bioelements: Bioelements expanded into the U.S. market, providing biodegradable, biobased, and compostable packaging solutions to reduce plastic waste.

In 2024 BioPowder: BioPowder launched olive stone-derived powders, Olea FP, for biodegradable packaging, supporting circular economy practices.

**Conclusion**

The global biodegradable packaging market is projected to grow from USD 95.1 billion in 2023 to USD 168.7 billion by 2033, expanding at a CAGR of 5.9%. This growth is driven by increasing environmental awareness, regulatory pressures, and a shift towards sustainable packaging in industries like food and beverages. Biodegradable packaging, made from renewable materials such as plant-based polymers and starch, is gaining traction as a solution to reduce plastic waste and environmental impact.

However, high production costs and technological challenges remain key restraints. Despite these hurdles, advancements in material innovation, particularly in compostable and algae-based packaging, offer significant growth opportunities. Asia Pacific leads the market, accounting for 38.2% of the share, driven by strong government support and rising consumer demand for eco-friendly products. Major players like Amcor, BASF, and Tetra Pak are leading the charge in sustainable packaging innovations.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()