Download Sample Report: https://www.alliedmarketresearch.com/request-sample/6640

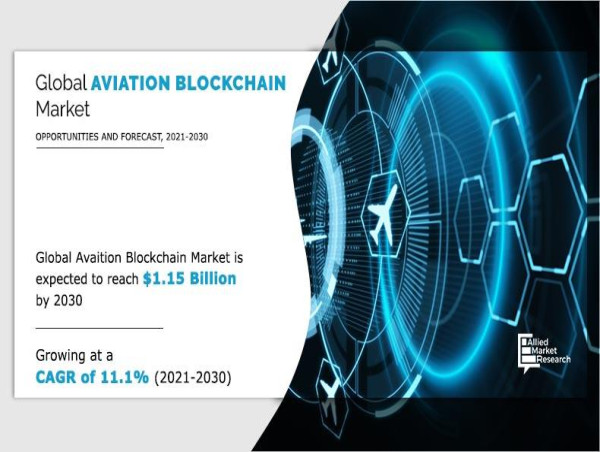

The growth of the global aviation blockchain market is driven by surge in demand for AI based recording of the movement transactions and tracking of the aviation assets. Growing adoption of the air transportation creates complexity of the data and activities which create a requirement for the smart technology to ensure and update the aviation transactions. Growing requirement for improved safety, tracking and transparency for aviation logs is the key factor support the growth for aviation blockchain market over the forecast period. In 2020, aviation blockchain market for passenger identity management has witnessed leading market share. Cargo and baggage tracking is expected to witness rapid growth and dominate the market share by end of the forecast period.

Increase in number of airline passengers, rise in disposable income of individuals, and improved safety, tracking, and transparency for aviation logs fuel the growth of the global aviation blockchain industry. On the other hand, high installation cost of the technology restrains the growth to some extent. However, several contracts and agreements with aviation industry players are expected to create lucrative opportunities in the industry.

In addition, market participants are entering into long term agreements and contracts with airport operators, MRO organization to gain competitive advantage in the global market. Asia-Pacific dominates the aviation blockchain market in the year 2020 owing to growing adoption of the air transportation in the region. China, India, Japan, the U.S. and Germany are expected to witness as emerging countries in the global aviation blockchain market, owing to increase in inclination toward safety and security transportation and adoption of AI based technologies in the respective countries. The global aviation blockchain market is a fairly consolidated market with limited number of players holding majority of share.

Based on functions, the transactions segment contributed to more than half of the total market revenue in 2020, and is expected to lead the trail by 2030. The record keeping segment, however, would grow at the fastest CAGR of 11.4% from 2021 to 2030.

Based on geography, Asia-Pacific held the major share in 2020, garnering around one-third of the global aviation blockchain market. The same region would also exhibit the fastest CAGR of 12.6% by 2030. The other three provinces discussed in the report include North America, Europe, and LAMEA.

Buy This Research Report: https://www.alliedmarketresearch.com/checkout-final/7c67efc213ba5da0ade18e4296a46e20

𝐇𝐞𝐫𝐞'𝐬 𝐚 𝐠𝐞𝐧𝐞𝐫𝐚𝐥 𝐨𝐯𝐞𝐫𝐯𝐢𝐞𝐰 𝐨𝐟 𝐡𝐨𝐰 𝐛𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐭𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐜𝐚𝐧 𝐰𝐨𝐫𝐤 𝐢𝐧 𝐭𝐡𝐞 𝐜𝐨𝐧𝐭𝐞𝐱𝐭 𝐨𝐟 𝐚𝐯𝐢𝐚𝐭𝐢𝐨𝐧:

➢ Immutable Ledger: Blockchain operates as a decentralized and distributed ledger that records transactions across a network of computers. Each block in the chain contains a list of transactions, and once a block is added, it cannot be altered or deleted. This immutability ensures the integrity of the data.

➢ Decentralization: Instead of relying on a central authority, blockchain relies on a network of nodes (computers) that validate and agree on the transactions. This decentralization reduces the risk of a single point of failure and enhances the security of the system.

➢ Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In aviation, smart contracts can automate and enforce the execution of agreements between parties. For example, a smart contract could automatically trigger payment upon the completion of certain milestones in an aviation service or leasing agreement.

➢ Supply Chain Management: In aviation, blockchain can be applied to create a transparent and traceable supply chain for aircraft parts. Each component's information, including manufacturing details, maintenance history, and ownership changes, can be recorded on the blockchain. This reduces the risk of counterfeit parts entering the supply chain and ensures the authenticity of components.

➢ Maintenance and Repair Records: Blockchain can be used to create a secure and unchangeable record of maintenance and repair activities for aircraft. Maintenance events, repairs, and inspections can be recorded on the blockchain, providing a transparent and auditable history of an aircraft's maintenance.

➢ Identity Management: Blockchain can enhance identity management in aviation by securely recording and verifying the identity of passengers, crew members, and other stakeholders. This can streamline security processes, such as boarding and immigration checks.

➢ Flight Data Management: Blockchain can be used to securely store and manage flight data, including information related to flight routes, fuel consumption, and aircraft performance. This ensures the integrity and reliability of critical flight-related information.

➢ Tokenization of Assets: Blockchain allows for the tokenization of aviation assets, such as aircraft. This involves representing ownership or shares of an asset as digital tokens on the blockchain. Tokenization can make it easier to buy and sell shares in an aircraft, potentially increasing liquidity and democratizing investment opportunities.

The global aviation blockchain market size is analyzed across application, end use, function, and region. Based on end use, the airports segment accounted for nearly two-fifths of the total market share in 2020, and is projected to rule the roost by the end of 2030. The airlines segment, on the other hand, would cite the fastest CAGR of 12.1% throughout the forecast period.

𝗟𝗲𝗮𝗱𝗶𝗻𝗴 𝗖𝗼𝗺𝗽𝗮𝗻𝘆 / 𝗚𝗿𝗼𝘂𝗽 -

➢International Business Machine Corporation

➢Infosys Limited

➢Leewayhertz

➢➢Moog Inc.

➢Safeflights Inc.

➢Aeron Labs

➢Sweetbridge Inc.

➢Winding Tree

➢Zamna Technologies Limited.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A06275

Key Benefits For Stakeholders

➢ This study presents analytical depiction of the global aviation blockchain market analysis along with the current trends and future estimations to depict imminent investment pockets.

➢ The overall aviation blockchain market opportunity is determined by understanding profitable trends to gain a stronger foothold.

➢ The report presents information related to key drivers, restraints, and opportunities of the global aviation blockchain market with a detailed impact analysis.

➢ The current aviation blockchain market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

➢ Porter's five forces analysis illustrates the potency of the buyers and suppliers in the industry.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐀𝐌𝐑'𝐬 𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐨𝐧𝐠𝐨𝐢𝐧𝐠 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐨𝐧 𝐀𝐞𝐫𝐨𝐬𝐩𝐚𝐜𝐞 & 𝐃𝐞𝐟𝐞𝐧𝐬𝐞 𝐃𝐨𝐦𝐚𝐢𝐧:

➢ Satellite Market Opportunity Analysis and Industry Forecast, 2023-2032

https://www.alliedmarketresearch.com/satellite-market

➢ LEO and GEO Satellite Market Opportunity Analysis and Industry Forecast, 2021-2031

https://www.alliedmarketresearch.com/leo-and-geo-satellite-market-A09227

➢ Satellite Manufacturing Market Opportunity Analysis and Industry Forecast, 2021-2031

https://www.alliedmarketresearch.com/satellite-manufacturing-market-A13678

➢ Space Launch Services Market Opportunity Analysis and Industry Forecast, 2023-2032

https://www.alliedmarketresearch.com/space-launch-services-market

➢ Aircraft Cabin Interior Market Opportunity Analysis and Industry Forecast, 2021-2031

https://www.alliedmarketresearch.com/aircraft-cabin-interior-market

➢ Aerospace Parts Manufacturing Market Opportunity Analysis and Industry Forecast, 2021-2031

https://www.alliedmarketresearch.com/aerospace-parts-manufacturing-market-A09709

➢ Aircraft Electric Motor Market Opportunity Analysis and Industry Forecast, 2023-2032

https://www.alliedmarketresearch.com/aircraft-electric-motor-market-A84407

➢ Aviation Asset Management Market Opportunity Analysis and Industry Forecast, 2024-2033

https://www.alliedmarketresearch.com/aviation-asset-management-market-A13891

➢ Satellite Image Data Services Market Opportunity Analysis and Industry Forecast, 2023-2032

https://www.alliedmarketresearch.com/satellite-image-data-services-market-A09064

➢ Satellite-Based Earth Observation Market Opportunity Analysis and Industry Forecast, 2023-2032

https://www.alliedmarketresearch.com/satellite-based-earth-observation-market-A07765

➢ Satellite Based Augmentation Systems (SBAS) Market Opportunity Analysis and Industry Forecast

https://www.alliedmarketresearch.com/satellite-based-augmentation-systems-sbas-market-A10209

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()