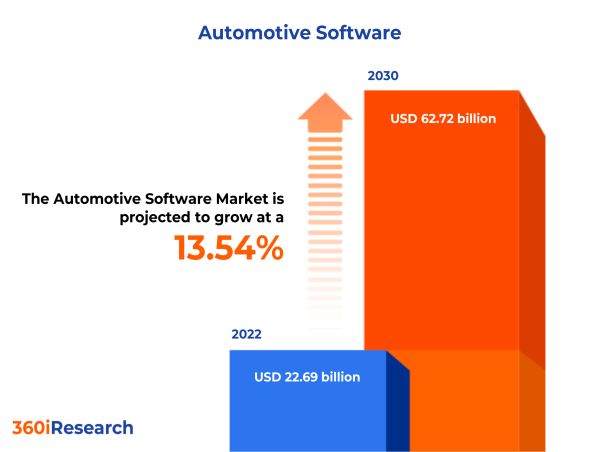

The Global Automotive Software Market to grow from USD 22.69 billion in 2022 to USD 62.72 billion by 2030, at a CAGR of 13.54%.

PUNE, MAHARASHTRA, INDIA , December 7, 2023 /EINPresswire.com/ -- The "Automotive Software Market by Product (Application Software, Middleware, Operating System), Application (Infotainment & Telematics, Powertrain, Safety System), Vehicle, End-User - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Automotive Software Market to grow from USD 22.69 billion in 2022 to USD 62.72 billion by 2030, at a CAGR of 13.54%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/automotive-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The automotive software market is a dynamic and rapidly evolving sector central to modernizing and enhancing vehicle capabilities. It encompasses a range of applications and systems integral to the operation and user experience of vehicles, such as engine management systems, infotainment systems, connectivity solutions, autonomous driving technologies, and vehicle management and control systems. The escalating demand for enhanced user experience and comfort has necessitated the development of sophisticated infotainment systems and connectivity features. The global push towards electric vehicles (EVs) as a sustainable transportation method is another significant driver, as these vehicles heavily rely on software for managing battery systems, range, and overall performance. The automotive software sector boasts a highly competitive landscape, constituted by a mix of established automotive giants and emerging technology firms. Players in this field aggressively invest in research and development to enhance their product offerings and integrate cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) into their automotive solutions. Cybersecurity threats are a substantial concern as the reliance on automotive software increases, necessitating robust security solutions. Furthermore, the complexity of software integration and the need for standardization across various automotive platforms also pose significant challenges for industry players. Rapid advancements in technology, such as AI, machine learning, and cloud computing, combined with the increasing demand for electric and autonomous vehicles, will likely help overcome challenges and support market expansion. Regulatory approval for safer and more fuel-efficient vehicles will also contribute to the growing need for advanced automotive software solutions.

Rising demand for advanced safety systems such as anti-lock braking systems (ABS) and stability control systems

The infotainment and telematics segment has emerged as a core application area in the contemporary automotive software landscape. It encompasses software functionalities for entertainment, interaction, and vehicle-to-driver communication features. The components include navigation, multimedia streaming, real-time vehicle diagnostics, hands-free connectivity, and telematics services for remote control and software updates. Automotive software has revolutionized the powertrain segment with innovative engine management, transmission control, and emission control applications. The goal is to optimize energy usage and control the vehicle's operation for optimal power and efficiency. Through sophisticated algorithms and diagnostics, automotive powertrain software ensures seamless operation while maximizing fuel efficiency, reducing carbon emissions and adhering to stringent regulatory standards. The safety systems are software applications that protect drivers, passengers, and pedestrians. Integral components include anti-lock braking systems (ABS), stability control systems, adaptive cruise control, parking assistance, and collision detection systems. As safety regulations become more stringent around the globe, there is increasing pressure on automakers to integrate advanced safety systems. Furthermore, technologically savvy consumers emphasize safety features in their purchasing decisions, contributing to the growth of the safety systems segment within the automotive software market.

Deployment of automotive software in autonomous and semi autonomous passenger vehicle

The commercial vehicles segment incorporates a variety of software solutions tailored for vehicles used for business purposes, including trucks, vans, and buses. This segment prioritizes efficiency, safety, and compliance with regulations. Fleet management software is prominent in this category, offering route optimization, fuel management, and real-time vehicle tracking features. The passenger vehicle segment of the automotive software market is driven by consumer demand for safety, infotainment, and convenience features. Advanced Driver-Assistance Systems (ADAS) are becoming standard in many vehicles, requiring sophisticated software for lane keeping, adaptive cruise control, and collision avoidance functions. Infotainment systems, which integrate navigation, multimedia, and smartphone connectivity, rely heavily on software to provide a seamless user experience. Vehicle management software is also gaining traction, offering monitoring capabilities for vehicle health and maintenance reminders.

Increasing advancement in application software to enhancing vehicle connectivity, safety, and comfort

Application software in the automotive industry is fundamental to enhancing vehicle functionalities. Programs such as in-vehicle infotainment, autonomous driving software, and safety & security systems feature prominently in this spectrum. They offer immense growth, driven by the need for connectivity, safety, and comfort. IVI, for instance, has observed immense popularity, with consumers demanding superior entertainment, advanced navigation systems, and driver assistance apps. With its cutting-edge AI algorithms, next-generation autonomous driving software is paving the way toward self-driving cars, another significant trend contributing to the evolution of the application software space in the automotive industry. Middleware is the vital intermediary software enabling communication and data management between different automotive software applications. Central to this segment is the provision of standardized interfaces and synchrony in managing the intricacies of distributed environments. Middleware includes database middleware, message-oriented middleware, web middleware, and others, each contributing distinct benefits such as vulnerability thwarting and simplified debugging. Notably, the increased adoption of telematics and Internet of Things (IoT) devices in automobiles has amplified the relevance of middleware for seamless data flow, thus enhancing the overall driving experience. The Operating System (OS) forms the backbone of an automobile's software infrastructure. By managing hardware resources and providing requisite services for software applications, OS significantly influences a vehicle's performance and safety parameters.

Deployment of bespoke software solutions across OEM sector to meet industry demand

Dealers employ software for inventory management, customer relationship management (CRM), finance and insurance (F&I) handling, and sales and marketing. Software solutions aimed at dealers are designed to streamline the vehicle sales process, manage service operations, and enhance the overall customer buying experience. OEMs are leveraging software solutions to address challenges such as shortened product development cycles, regulatory compliance, and the need for product differentiation. Automotive software for OEMs spans various domains, such as design and simulation, manufacturing and supply chain, in-vehicle software, and after-sales services.

Regional Insights:

North America, particularly the United States and Canada, has historically been at the forefront of automotive innovation. The region's automotive software market is a vibrant space characterized by high levels of vehicle automation, connectivity, and electrification. The presence of major automotive players, coupled with favorable government policies aimed at promoting electric and autonomous vehicles, have catalyzed the market's growth. The European market for automotive software is underpinned by stringent regulatory standards concerning vehicle safety and emissions. The European Union's strong focus on environmental sustainability has led to a surge in the demand for electric vehicle (EV) software solutions to support a burgeoning fleet of EVs. In addition, Europe's robust automotive industry, with leading OEMs such as Volkswagen, Bayerische Motoren Werke AG, and Mercedes-Benz, is aggressively pushing the boundaries regarding autonomous driving technologies and software. Asia-Pacific (APAC) is recognized as one of the fastest-growing regions in the automotive software market due to the rapidly increasing vehicle production, particularly in China, India, Japan, and South Korea. The proliferation of internet users and tech-savvy consumers has accelerated the demand for advanced infotainment systems, facilitating the growth of the region's automotive software market. China, being the significant automotive market, is pivotal in driving the regional market dynamics with its hefty investments in vehicle electrification and autonomous driving initiatives.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Automotive Software Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Automotive Software Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Automotive Software Market, highlighting leading vendors and their innovative profiles. These include Adobe Inc., Airbiquity Inc., ANSYS, Inc., Autodesk, Inc., BlackBerry Limited, CDK Global, Inc., Cox Automotive, Inc., Ford Motor Company, Fullbay, Inc., General Motors Company, Green Hills Software LLC, KPIT Technologies Limited, LeddarTech Inc., Microsoft Corporation, MontaVista Software, LLC, Nvidia Corporation, NXP Semiconductors N.V., Oracle Corporation, Renesas Electronics Corporation, Robert Bosch GmbH, SAP SE, Texas Instruments Incorporated, The Reynolds and Reynolds Company, Waymo LLC by Alphabet Inc., and Wipro Limited.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/automotive-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Automotive Software Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Application Software, Middleware, and Operating System. The Application Software is projected to witness significant market share during forecast period.

Based on Application, market is studied across Infotainment & Telematics, Powertrain, and Safety System. The Powertrain is projected to witness significant market share during forecast period.

Based on Vehicle, market is studied across Commercial Vehicles and Passenger Vehicle. The Commercial Vehicles is projected to witness significant market share during forecast period.

Based on End-User, market is studied across Dealer and OEMs. The OEMs is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 36.99% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Automotive Software Market, by Product

7. Automotive Software Market, by Application

8. Automotive Software Market, by Vehicle

9. Automotive Software Market, by End-User

10. Americas Automotive Software Market

11. Asia-Pacific Automotive Software Market

12. Europe, Middle East & Africa Automotive Software Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Automotive Software Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Automotive Software Market?

3. What is the competitive strategic window for opportunities in the Automotive Software Market?

4. What are the technology trends and regulatory frameworks in the Automotive Software Market?

5. What is the market share of the leading vendors in the Automotive Software Market?

6. What modes and strategic moves are considered suitable for entering the Automotive Software Market?

Read More @ https://www.360iresearch.com/library/intelligence/automotive-software?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

[email protected]