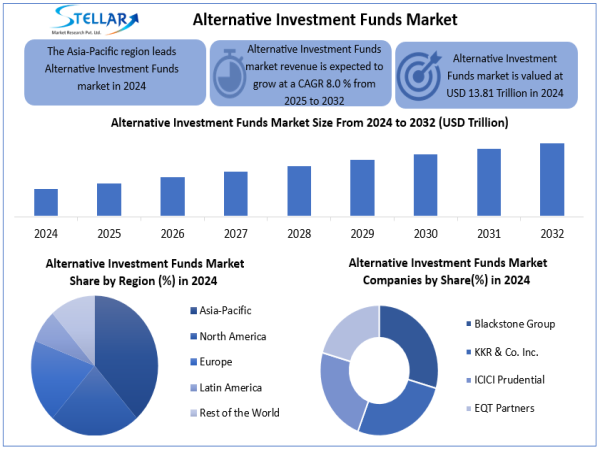

The Alternative Investment Funds Market is projected to grow at a CAGR of approximately 8.0% over the forecast period. The Alternative Investment Funds Market was valued at USD 13.81 billion in 2024 and is expected to reach USD 23.69 billion by 2032. Alternative Investment Funds (AIFs) are pushed by the want for more money, mixing types, rich people growth, big group care, smart money moves, rule help, wild public swings, tech steps up, and more knowing of global investors.

Alternative Investment Funds Market Overview

Alternative Investment Funds (AIFs) are pools of cash set up to put money into non-usual items such as private shares, hedge funds, and real estate. Aimed at high-net-worth folks and big groups, AIFs bring a mix of different assets, high profits, and growth over time. While they are tough to cash out fast and are under strict rules, they are growing in popularity around the world. This is due to more people wanting to invest, new financial ways, and the need for varied portfolios. With strong growth in places like India and the US, AIFs are changing the way we think about investing, moving past just stocks and bonds.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/alternative-investment-funds-market/2693

Alternative Investment Funds Market Dynamics

Drivers

Search for Higher Returns

More and more, people put their money in Alternative Investment Funds (AIFs) to get big gains. They do this because the usual ways, like fixed deposits and stocks, are giving low returns. In 2024, a lot of AIFs did better than the big markets. Private equity and hedge funds made great gains. Now, big companies are adding AIFs to retirement plans, showing they trust these can give high, long-term returns with good safety.

Rising Number of High-Net-Worth Individuals (HNIs) and Family Offices

The growth in rich people and family-run money groups around the world is making people want more custom investment options beyond the usual funds. In India, the count of rich folks went up by 12.2% in 2023, and family money offices have grown six times bigger since 2018. These investors now like using Alternative Investment Funds (AIFs) more for big gains, mixing types of investments, and rare chances. This push has made the market grow a lot.

Financial Innovation and Technology Advancements

New tech in fintech, AI, and data work is changing how we put money into other options, making it easy to enter, work better, and handle risks well. New moves like AI plans and making assets into tokens open doors for more people, not just big groups. In 2024, big names like BlackRock started funds with tokens, and AI-based sites make smart choices on what to buy, pushing growth and changing the AIF market's shape.

Restrain

Regulatory Uncertainty and Overregulation

Rules that keep changing and tough RBI laws have made banks and NBFCs slow to put money in Alternative Investment Funds (AIFs). This has led to forced sales and big money issues. SEBI too has made harder rules for checking details, which cuts down on money from outside. These rules aim to stop wrong use, but they have made the market hard to guess. They shake the trust of those who put in money and bring money problems to many NBFCs.

Innovations and Developments

Technological innovation is a key factor propelling the Alternative Investment Funds Market forward. Notable advancements include:

Blockchain and Tokenization

Asset Tokenization: Blockchain tech turns real things into digital bits, letting people own small parts of them. This opens up chances to put money in things like houses and art that were hard to sell before.

Smart Contracts: Smart contracts on the blockchain make things like sharing profits and checking rules easier. They cut down on office costs and make things clearer.

Alternative Investment Funds Market Segmentation

By Product

By Product, the Alternative Investment Funds Market is further segmented into Private Equity Funds, Hedge Funds, Real Estate Funds, Infrastructure Funds, Venture Capital Funds, Private Debt Funds, and Others. Private Equity Funds lead the Alternative Investment Funds market as they have big money, good past gains, and wide demand from big groups. They gain from old setups, mixing areas, and worldwide growth. New trends show top fundraising, more use of tech, growth in the second-hand market, and more focus on ESG and rules.

Alternative Investment Funds Market Regional Analysis

Asia-Pacific: Asia-Pacific is fast growing in the Alternative Investment Funds area because of strong money growth, more rich people, rule changes, and more startups. Places like India, Singapore, and Japan push private equity, venture money, and private debt. They pull in money from all over the world.

Europe: Europe holds the second spot in the other funds market due to its well-set money hubs, strong big-money backers, ESG lead, many types of assets, and good rules. New trends show more startup money, key joining of firms, and work to let more small buyers into private goods.

Middle East: The Middle East comes in third for AIFs because of key spots like Dubai, strong cash funds, money growth in new areas, more groups taking part, and tech use. More money put in and big plans from the government help it grow.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/alternative-investment-funds-market/2693

Alternative Investment Funds Market Competitive Landscape

The global and regional players in the Alternative Investment Funds Market concentrate on developing and enhancing their capabilities, resulting in fierce competition. Notable players include:

Blackstone Group (USA)

Brookfield Asset Management (Canada)

KKR & Co. Inc. (USA)

Carlyle Group (USA)

Bain Capital (USA)

ICICI Prudential(India)

SoftBank Vision Fund (Japan)

Hillhouse Capital Group (China)

Nippon Life Global Investors (Japan)

Kotak Alternate Asset Managers (India)

Summary

The global Alternative Investment Funds (AIF) market was worth 13.81 billion US dollars in 2024. It is thought to grow to 23.69 billion US dollars by 2032, with an 8.0% increase each year. AIFs are private pools of money that go into rare assets like private equity, hedge funds, and real estate. They are mostly used by rich people and big groups who want more money back and to mix types of investments. The rise is due to more rich people, group money, new money ways, and rules help. Big new things include AI tools, token use, and blockchain.

Private Equity Funds rule the market as they give good returns and big groups want them. In different parts of the world, Asia-Pacific is at the top because its economy grows fast and many new companies start there. Europe and the Middle East follow, both having old markets and support from government changes in rules. Big names in this game are Blackstone, KKR, Brookfield, Carlyle, and ICICI Prudential. Even with chances to grow, problems like unsure rules and too many rules hurt how much people trust these funds and their steadiness.

Related Reports:

Instant Grocery Market: https://www.stellarmr.com/report/instant-grocery-market/2615

Gaming Laptop Market: https://www.stellarmr.com/report/gaming-laptop-market/2605

Bottling Line Machinery Market: https://www.stellarmr.com/report/bottling-line-machinery-market/2604

Rock Climbing Equipment Market: https://www.stellarmr.com/report/Rock-Climbing-Equipment-Market/2541

Lipstick and Lipstains Market: https://www.stellarmr.com/report/lipstick-and-lipstains-market/2539

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

[email protected]

Lumawant Godage

Stellar Market Research

+ +91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()