NASDAQ is a stock exchange based in New York, United States of America. It is one of the leading stock exchanges in the world where many technology companies aspire to list. It has also pioneered the electronic stock market, being the world’s first stock exchange to commence electronic stock market trading.

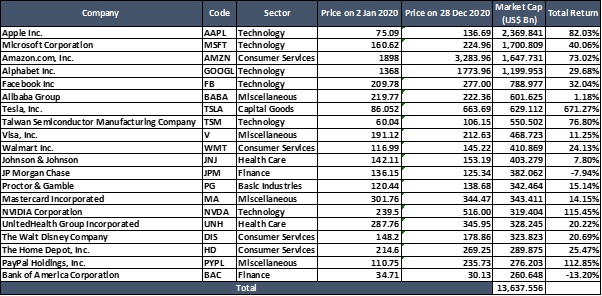

Below is the list of top 20 stocks on NASDAQ. The total market capitalisation of these stocks is around USD 13.63 trillion, which is more than the combined GDP of Japan, Germany, and India. It is also greater than the GDP of China.

Prices as on 28 December 2020

1. Apple Inc.

Apple is the largest company listed on NASDAQ with a market capitalisation of ~USD 2.36 trillion. The consumer electronic company designs computers, mobile phones, gadgets, television and much more.

Image Source: Megapixl

Apple has continued innovating its products in 2020, including 5G phones and internally developed processors for Macs. The remote working environment has also pushed the demand for consumer electronics, and the tech major has reaped rewards of the same.

In FY20, the Cupertino-based company clocked net sales of USD 274.51 billion and net income of USD 57.41 billion. The results reflect an increase of ~USD 14.34 billion in revenue and ~USD 2.14 billion in net income. Apple remains cash rich and continues to grow its bottom line. Also, the recent news about Apple’s electric car has attracted additional investor traction.

2. Microsoft Corporation

At a market capitalisation of ~USD 1.70 trillion, Windows developer Microsoft is the second-largest firm on the exchange. It would be unusual to come across a white-collar worker who is not familiar with Microsoft’s products.

Image Source: Megapixl

Apart from selling operating systems, the company also has substantial cloud business and gaming consoles business. When people are buying computers, they are effectively adding to Microsoft’s revenues.

The rising demand for consumer electronics has also added tailwinds to its topline. In Q1 FY21, its revenues increased 12%, driven by growth in each segment. Revenue for the quarter was USD 37.2 billion and net income stood at USD 13.9 billion.

3. Amazon.com, Inc.

Amazon is a leader in the e-commerce business in many countries. Primarily a technology business, it is engaged in cloud services, digital streaming, artificial intelligence etc. At its website, you can find almost anything you want to purchase. Amazon has also added physical stores with the acquisition of Whole Foods Market.

Image Source: Megapixl

When people buy goods online, watch shows on Prime, and businesses adopt cloud, Amazon is likely to prosper. Jeff Bezos is now the world’s richest person as Amazon’s share price has skyrocketed this year.

4. Alphabet Inc.

Alphabet is the parent company of Google. The google search engine's market penetration is paramount, and it is a market leader in the search engine category. Alphabet is a technology company focusing on disruptive technologies through its private equity, venture capital, tech incubator, and subsidiaries.

Image Source: Megapixl

The traction in online environment is driving the business of Alphabet. While its search business continues to be a major source of revenue, the momentum in Google Play, Cloud and YouTube is also strong,

It continues to make investments for the future and making search better. In 3Q 2020, revenues were up 14% to USD 46.17 billion and net income increased to USD 11.24 billion. In YTD to 3Q, revenues were USD 125.62 billion and net income was USD 25.04 billion.

5. Facebook, Inc.

Facebook Inc. has positioned itself as a global social media goliath over the last decade. In addition to its widely-used social media platform, the company also owns leading networking platforms, WhatsApp, and Instagram.

Image Source: Megapixl

Its platforms are widely penetrated in the global markets and generate significant advertising revenues for the firm. Along with the above four firms, Facebook is among the largest technology companies in the US.

As online commerce has accelerated during the pandemic, the advertising revenues for Facebook have also shot up. In its latest results, the company noted headwinds from Apple iOS 14 and European regulatory developments.

It also said that deceleration in online commerce could impact ad revenues. Earlier this month, Facebook was summoned by the Federal Trade Commission on antitrust issues. The authority is seeking a breakup of the social media giant.

6. Alibaba Group

Alibaba is a Chinese giant primarily focused on e-commerce, retail, internet, electronic payments and cloud computing. It provides platforms for business-to-business, business-to-customers, and consumer-to-consumer markets.

Image Source: Megapixl

Due to its dominating presence in the domestic market, Alibaba’s operations have surpassed that of many established global multinational firms. The pandemic has accelerated the online commerce, and the company has been a Chinese e-commerce pioneer.

Its core commerce and cloud computing have delivered strong results this year. In what would have been the world’s largest IPO, Ant Group’s IPO was halted by the Chinese authorities as they realised that the lending business was not regulated. Ant Group is Alibaba’s fintech arm.

More recently, Chinese authorities have launched anti-monopoly investigation into Alibaba’s business.

7. Tesla, Inc.

Tesla has made its way to being the world’s most valued car company since late last year. A meteoric rise in its share price has pushed its market capitalisation into top NASDAQ companies. Those who were pessimistic about Tesla have taken a strong beating as the firm has recorded a series of quarterly profits.

Image Source: Megapixl

This meteoric rise in its market capitalisation is also driven by the fact that Tesla has a first-mover advantage in high-performance e-vehicles in major global markets. Its ongoing contribution to sustainability also appeals to investors.

8. Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor is an electronic manufacturing giant based in Taiwan. It is a multinational corporation with operations spanning across continents. Its customers include leading semiconductor companies as well as emerging companies across the world.

Image Source: Megapixl

It does not compete with its customers and never chooses to design. Taiwan Semiconductor serves a range of industries, including automotive electronics, mobile devices, communications, computers, internet of things.

In 2020, TSMC has delivered attractive growth in topline and bottom line, driven by high performance computing, IoT, and 5G smartphones demand. Its gross margins remain above 50% of the revenue.

9. Visa, Inc.

Visa is a global financial services company operating global payments business through its products, including debit cards and credit cards. It enables the ecosystem of payment service world by transferring payments among firms, customers, and governments.

Image Source: Megapixl

The pandemic has impacted the main business drivers of the company, including cross border transactions. The international travel restrictions will likely impact the business in the future as well.

Visa finetuned its growth strategy, and the acceleration in digital payments allowed the firm to offset the impact of cross border volumes, which were down significantly.

10. Walmart Inc.

Multinational retail company Walmart Inc. is a leading firm operating in the US and internationally with thousands of stores and several e-commerce platforms. Apart from the US and some developed markets, the company majorly operates in emerging markets, including Chile, India, Mexico, and China.

Image Source: Megapixl

As an essential retailer, Walmart has been operating through the pandemic lockdowns. The demand for products increased across multiple categories, driving margins and revenues. Its e-commerce business has also witnessed strong demand.

In the nine months to October 2020, its revenues were up 6.5%, but the net income increased by around 45% compared to same period last year.

11. Johnson & Johnson

Johnson & Johnson has been in existence for over a century. It is primarily a pharmaceutical business but also has substantial business in consumer-packaged goods and medical devices. It is a multinational corporation and products are manufactured and sold worldwide.

Image Source: Megapixl

Drug sales have proved to be resilient in the pandemic; medical device and consume product sales remained flat. The pipeline of new drug candidates remains strong, but legal issues continue to weigh on its shares.

12. JPMorgan Chase & Co.

JPMorgan Chase & Co. is one of the leading financial institutions in the US and the world. It provides traditional banking services to retail customers and businesses, asset and wealth management services, and investment banking services.

Image Source: Megapixl

JPMorgan remains one of the strongest banks in the US and worldwide. It has large capital buffers and ample cash to provide returns to shareholders. Non-core banking business continues to contribute to the topline and bottom line.

13. Proctor & Gamble

Proctor & Gamble operates a plethora of consumer goods brands in the personal care and hygiene market. Its products are found in laundry, kitchens, and bathrooms. The company is over 180 years old and continues to serve worldwide.

Image Source: Megapixl

P&G makes necessary goods for households that have seen strong demand as pandemic forced people into homes. Its positive operating leverage continues to drive double digit increases in the net income on single digit topline growth.

14. Mastercard Incorporated

Mastercard is a global payments company similar to Visa, Inc. It also provides digital payment services through debit cards and credit cards. With secure and smart solutions, it enables digital payments in the economy.

Image Source: Megapixl

Mastercard is also impacted from the pandemic as cross border volumes have fallen significantly. Overall, the business remains resilient due to its digital payment offerings, cyber intelligence, and data services solutions.

15. NVIDIA Corporation

NVIDIA Corporation invented the graphic processing unit, which added fuel to the PC gaming market's growth. Now its GPUs are used in various activities that require high-end graphics support and design, including the automotive market, supercomputing, and mobile computing.

Image Source: Megapixl

NVIDIA has been benefitted by the acceleration in high performance computing and gaming needs. Its market-leading solutions for high performance computing continue to drive demand for its products.

Its acquisition of a dominant mobile chip maker, Arm Holdings has added further growth prospects. Other verticals of the company including data centre, automotive, and professional visualisation are also contributing to growth.

16. UnitedHealth Group Incorporated

UnitedHealth Group is a healthcare company providing health insurance to individuals, employers, retirees, and communities. Optum is a subsidiary of UHG focused on delivering health care service through technology.

Image Source: Megapixl

UHG has delivered topline and bottom line growth in 2020. As the demand for healthcare services has increased, the company has been a big beneficiary of the change. UHG continues to provide voluntary support to customers, impacting the business performance to some extent.

17. The Walt Disney Company

The Walt Disney Company is an entertainment behemoth operating worldwide. It runs many TV channels, entertainment parks, hotels, broadcasting television networks, merchandise licensing, children’s books, comics, and streaming services.

Image Source: Megapixl

The pandemic has impacted some of the business segments of the company that require close contact, including theme parks, cruise lines, retail stores, tours. The production of content was also impacted due to lockdowns.

18. The Home Depot, Inc.

The Home Depot is a large retailer that sells home improvement products, building materials, garden, and lawn products. Home Depot also provides installation services, equipments and tool rentals. It has stores in the US, Mexico and Canada and runs several e-commerce websites as well.

Image Source: Megapixl

In 2020, the company experienced significant demand for its home improvement solutions, resulting in an increase of USD 15 billion in sales over the nine months of FY20. Net income for the nine-month period was around USD 10 billion on sales of ~USD 99.8 billion.

19. PayPal Holdings, Inc.

PayPal is a digital payments company providing mobile payment and acceptance services to consumers and merchants. It operates in over 200 markets worldwide, connecting merchants and consumers.

Image Source: Megapixl

In 2020, the company forayed into the growing ‘buy now pay later’ services, boosting growth prospects. PayPal has been experiencing strong growth in payment volumes, which are driving revenues. This year the company also threw its hat into the cryptocurrency ring.

20. Bank of America Corporation

Bank of America is one of the largest financial institutions in the US and the world. It offers banking, asset management, investment banking, and other financial services to retail customers, businesses, and governments.

Image Source: Megapixl

A recovering economy is boding well for the bank. A strong deposit growth and loan growth are adding to the topline of the bank. Non-banking services are reflecting resilience with strong contribution to net income.