Download Sample Report: https://www.alliedmarketresearch.com/request-sample/5196

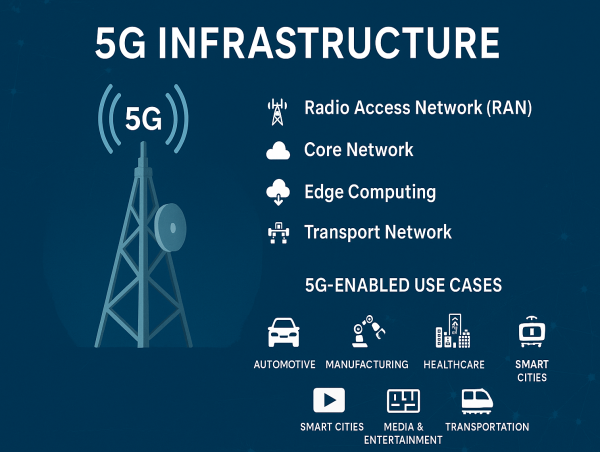

A 5G infrastructure provides edge computing capable services to its end user such as, industrial IoT, smart cities, live multiplayer gaming, telemedicine, autonomous driving, and immersive video-conferencing. Growth of the global 5G infrastructure market is anticipated to be driven by factors such as rise in demand for mobile broadband services and proliferation of M2M/IoT connections.

Moreover, increase in acceptance of virtual networking architecture in telecom industry, lower latency in 5G, and surge in mobile data traffic fuel the growth of 5G infrastructure market. However, high initial investment acts as a major restraint for the global market. On the contrary, high demand from Asia-Pacific especially in consumer electronics and industrial automation segment is expected to create lucrative opportunities for the 5G infrastructure market.

The 5G infrastructure market is segmented on the basis of communication infrastructure, network technology, chipset type, application, and region. By communication infrastructure, the market is classified into small cell, macro cell, radio access network, and distributed antenna system. On the basis of network technology, market is divided into software defined networking, network chipset type virtualization, mobile edge computing, and fog computing. By chipset type, market is segmented into application specific integrated circuit, radio frequency integrated circuit, mmWave integrated circuit, and field programmable gate array.

Based on communication infrastructure, the macro cell segment accounted for nearly two-fifths of the global 5G infrastructure market share in 2020, and is anticipated to rule the roost by 2030. This is due to the fact that with the emergence of 5G, macro cell is expected to play a crucial role to efficiently deliver high-speed broadband and numerous other low latency applications. The Radio Access Network (RAN) segment would also cite the fastest CAGR of 49.0% throughout the forecast period.

Based on network technology, the mobile edge computing segment held more than two-thirds of the global 5G infrastructure market revenue in 2020, and is expected to lead the trail by 2030. The same segment would also manifest the fastest CAGR of 48.3% from 2020 to 2030.

Based on region, Asia-Pacific, followed by Europe and North America, accounted for the major share in 2020, generating around one-third of the global 5G infrastructure market. The same region would also grow at the fastest CAGR of 47.7% by 2030. Rise in government initiatives for building smart cities in Asia-Pacific and upcoming long-term investments in smart technologies drive the growth of the market. Asia-Pacific is expected to be the leading contributor toward the 5G infrastructure market during the forecast period, followed by North America and LAMEA.

The key players profiled in the report include AT&T, Huawei Devices Co. Ltd., Ericsson, Intel Corporation, Mediatek Inc., Nokia Corporation, Qualcomm Technologies Inc., Hewlett Packard Enterprise, Samsung Electronics Co. Ltd., and Verizon. These players have adopted various strategies such as partnership, acquisition, and product launch to strengthen their foothold in the industry.

Buy This Research Report (230 Pages PDF with Insights, Charts, Tables, and Figures): https://www.alliedmarketresearch.com/checkout-final/5d0414f8024b18502e1ee2603348443e

Analyst Review:

The global 5G infrastructure market has flourished at a rapid pace. However, high initial investment and technological & infrastructure challenges in the implementation of 5G network are still major concerns for new entrants. Market players generously invest in R&D activities to develop improved solutions to reduce overall costs of 5G infrastructure products. In addition, according to industry experts, it is essential to optimize affordable prices for 5G infrastructure products for long-term growth.

Growth of the global 5G infrastructure market is anticipated to be driven by factors such as rise in demand for mobile broadband services and proliferation of M2M/IoT connections. Increased acceptance of virtual networking architecture in telecom industry, lower latency in 5G, and surge in mobile data traffic fuels the growth of 5G infrastructure market. However, high initial investment acts as a major restraint for the global 5G infrastructure market. On the contrary, high demand from Asia-Pacific especially in consumer electronics and industrial automation segment is expected to create lucrative opportunities for the 5G infrastructure industry.

Key players of the market focus on introducing technologically advanced products to remain competitive in the market. Partnership, acquisition, and product launches are expected to be the prominent strategies adopted by the market players. Asia-Pacific accounted for a major share of the market in 2020, owing to the presence of major players in the region; Also, Asia-Pacific is expected to grow at the highest CAGR, owing to rise in adoption of 5G infrastructure market in a variety of fields.

Key Findings of the Study:

➢ The small cell segment is projected to be the major communication infrastructure, followed by macro cell.

➢ Asia-Pacific and North America collectively accounted for more than 62% of the 5G infrastructure market share in 2020.

➢ India is anticipated to witness highest growth rate during the forecast period.

➢ U.S. was the major shareholder in the North America 5G infrastructure market, accounting for approximately 64% share in 2020.

➢ Depending on application, the consumer electronics segment generated the highest revenue in 2020. However, the industrial automation segment is expected to witness the highest growth rate in the future.

➢ Region wise, the 5G infrastructure market was dominated by Asia-Pacific.

Key Benefits For Stakeholders:

➢ This study comprises analytical depiction of the global 5G infrastructure market size along with current trends and future estimations to depict imminent investment pockets.

➢ The overall 5G infrastructure market analysis is determined to understand the profitable trends to gain a stronger foothold.

➢ The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

➢ The current 5G infrastructure market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

➢ Porter's five forces analysis illustrates the potency of the buyers and the 5G infrastructure market share of key vendors.

The report includes the market trends and the market share of key vendors.

Enquiry About Report: https://www.alliedmarketresearch.com/purchase-enquiry/5196

Explore AMR's Extensive ongoing Coverage on Semiconductor and Electronics Domain:

➢ Connector Market Opportunity Analysis and Industry Forecast, 2024-2032

https://www.alliedmarketresearch.com/connector-market-A10619

➢ CNC Controller Market Opportunity Analysis and Industry Forecast, 2024-2033

https://www.alliedmarketresearch.com/cnc-controller-market-A34239

➢ Power Over Ethernet Controller Market Opportunity Analysis and Industry Forecast, 2024-2033

https://www.alliedmarketresearch.com/power-over-ethernet-controller-market-A118421

➢ Gallium-Oxide Power Devices Market Opportunity Analysis and Industry Forecast, 2024-2033

https://www.alliedmarketresearch.com/gallium-oxide-power-devices-market-A240392

➢ Power Electronics Market Opportunity Analysis and Industry Forecast, 2024-2033

https://www.alliedmarketresearch.com/power-electronics-market

➢ Fiber Bragg Grating (FBG) Market Opportunity Analysis and Industry Forecast, 2024-2032

https://www.alliedmarketresearch.com/fiber-bragg-grating-market-A64389

➢ Coupled Inductor Market Opportunity Analysis and Industry Forecast, 2024-2032

https://www.alliedmarketresearch.com/coupled-inductor-market-A35222

David Correa

Allied Market Research

email us here

+ 1800-792-5285

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()