|

IPOR v2 introduces the Stake Rate Swap and stETH pools, extended tenors for IPOR rate swaps, and upgraded architecture and risk engine, setting the stage for structured products in DeFi.

ZUG, Switzerland, Oct. 12, 2023 /PRNewswire/ -- IPOR Labs AG, developers of the IPOR Protocol, announced today the launch of IPOR Protocol v2, introducing a suite of yield-focused and interest rate derivatives products to DeFi. The upgrade enables IPOR to tap into the $19 billion Ethereum liquid staking derivatives (LSDs) market offering stETH deposit pools and staking rate swap instruments for various tenors.

LSDs have established themselves as a centerpiece of Proof-of-Stake blockchains. Yet, the growing community of stakers and node operators lacked access to capital efficient risk-management products that Proof-of-Work miners have enjoyed for years.

With its new stETH pool and on-chain interest rate derivatives, the IPOR v2 offers the ability to hedge staking rate volatility via "Stake Rate Swaps (SRS)" - vanilla swap contracts for stETH staking rates.

Starting today, participants holding ETH, wETH, or stETH can boost their staking yields and provide the liquidity the IPOR Protocol requires to begin underwriting the SRS markets.

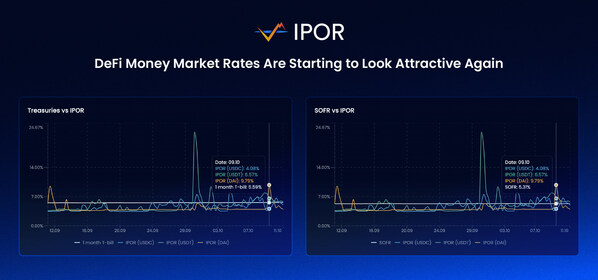

Furthermore, as global markets prepare for "higher-for-longer" rates, DeFi interest rates have reached two year highs in both level and volatility. The v2 upgrade extends swap tenors for USDT, USDC, and DAI from 28 to 90 days, bringing new rate trading strategies and risk management tools to DeFi.

Another major focus for IPOR v2 is user experience. The upgraded IPOR app frontend enables liquidity providers (LPs) to customize their APR with a few clicks.

From a technology point of view, v2 introduces a new, fully audited protocol architecture meant for growth. It enables greater composability, essential gas efficiency improvements and fewer manual actions for users reducing costs.

IPOR v2 is a rolling release with several upcoming products in the pipeline. After the initial upgrade the Stake Rate Swaps will be launched, followed by fixed-rate lending and borrowing, leveraged borrowing against IPOR LP tokens, and a real-world assets bridge that can capture yields from either DeFi or TradFi. All planned for release in the next three quarters.

About IPOR Labs

IPOR Labs AG specializes in the development of blockchain-based derivatives software and is based in Zug, Switzerland. Visit ipor.io for more information.