- Endorsed by 40+ global business leaders and 700+ financial institutions, the Industrial Transition Accelerator (ITA) has issued an open letter urging governments to use policy to stimulate demand for green products

- Uncertain demand and a lack of incentives is stalling industrial decarbonisation, with producers and customers at a stalemate due to lower priced higher carbon products

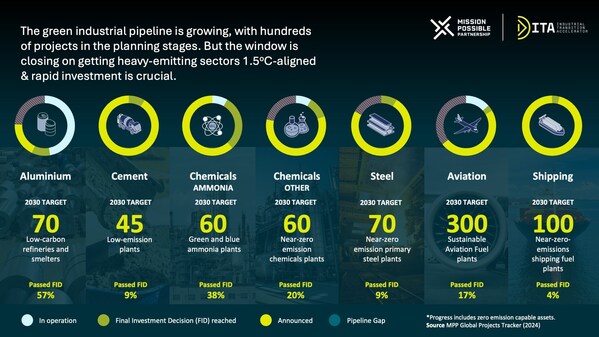

- New data shows growth in the overall number of planned large-scale, green industrial facilities in 2024, but only eight projects have secured finance since April

BAKU, Azerbaijan, Nov. 14, 2024 /PRNewswire/ -- Governments must urgently act to stimulate demand for green materials, chemicals and fuels to accelerate the decarbonisation of the world's highest-emitting industries[1], according to 40+ business/ finance leaders and coalitions, representing more than 1,000 companies and financial institutions, in a new open letter. Doing so could unlock up to $1tn[2] of investment and bring more than 500 green industrial plants to construction by 2030. This would enable the emissions reduction needed from aluminium, cement, chemicals, steel, aviation and shipping - to align with a 1.5°C pathway in the next decade.

New MPP Global Projects Tracker data shows the green industrial pipeline is growing and planned projects represent an investment opportunity of $1 trillion

New data from the ITA and the Mission Possible Partnership (MPP) reveals a growing pipeline of industrial projects. However, < 20% are operational or have the finance and approvals necessary to begin construction. Since April 2024, only eight facilities globally have reached Final Investment Decision (FID), leaving 561 announced but not yet definitively confirmed. 300 of these have been awaiting investment decisions for at least two years. If this rate continues linearly, it would take around 35 years for enough facilities to begin construction[3].

To move to a 1.5°C-aligned trajectory the full pipeline of projects must be financed and begin construction within the next two years[4].

A lack of policies has led to insufficient demand for green products leaving corporations and financiers without the certainty needed for long-term investments. Consequently, projects are stalling. Buyers are unable to commit to long-term offtake agreements at scale due to the continued availability of cheaper, higher-carbon equivalents and lack of incentives to opt for the cleaner option.

Led by the ITA and endorsed by The Glasgow Finance Alliance for Net Zero (GFANZ), the coalition from more than 50 countries, calls for governments to deploy policy measures in the open letter:

- Supporting global carbon pricing and fuel standard measures

- Setting and enforcing mandatory quotas for low- and near-zero-carbon fuels and products

- Setting mandatory targets for low- and near-zero-carbon materials in public procurement

- Setting stringent and progressively tightening limits on whole life carbon

- Implementing mechanisms that help bridge the price gap between green commodities and potential buyers

Alongside the letter, the ITA has published a Green Demand Policy Playbook setting out evidence-based policy measures available to governments to increase demand for low- and near-zero-carbon materials, chemicals and fuels so as to unlock supply.

[1] Aluminium, cement, chemicals, steel, aviation and shipping

[2] The total investment figures in USD (global and regional) have been calculated using the number of identified projects in the MPP's Global Project Tracker - which uses aggregated data to chart investment progress into net-zero-aligned projects - and publicly available investment data and insight on the amount of investment required for a green industrial plant to reach FID . Sources include: MPP, RMI, Systemiq and BNEF.

[3] 40 years for 552 projects at the pace of 7 projects over 6 months (552/7)/2

[4] The Tracker compares actual investment progress against the MPP's 2030 pipeline targets, representing around 70% of the emissions abatement needed to keep the sectors within their sectoral carbon budgets for 2030 and on track for net zero 2050. The remaining 30% can be achieved through energy and materials efficiency

Infographic: https://mma.prnasia.com/media2/2556879/ITA_Infographic.jpg?p=medium600