Summary

- The number of approved dwellings surged 2.6 per cent in November, according to the latest data by the Australian Bureau of Statistics.

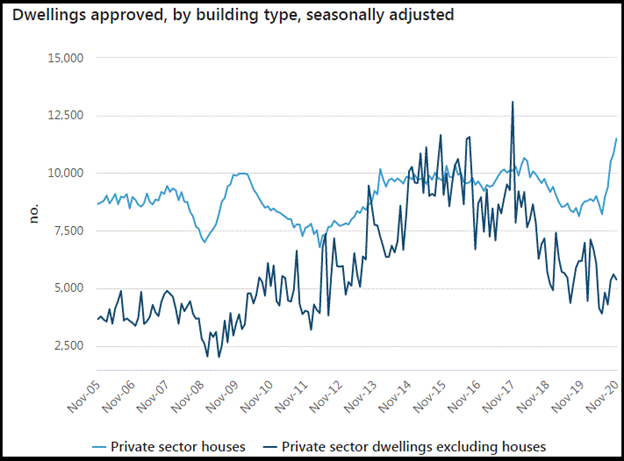

- While the private sector houses jumped 6.1 per cent in November to a 21-year high, private sector dwellings excluding houses declined 3.9 per cent.

- In seasonally adjusted terms, the value of total building approved declined 8.4 per cent in November.

Continuing the upward streak, private sector house approvals shot up for fifth straight month in November, clocking a 21-year high. The number of dwellings approved surged 2.6 per cent in November, supported by strength in Queensland and South Australia markets.

As illustrated by the Australian Bureau of Statistics (ABS) data, the private sector houses jumped 6.1 per cent, rocketing to a 21-year high, in the seasonally adjusted terms. Whereas, private sector dwellings excluding houses declined 3.9 per cent. The value of non-residential building approved dropped 27.4 per cent.

Image Source: Shutterstock

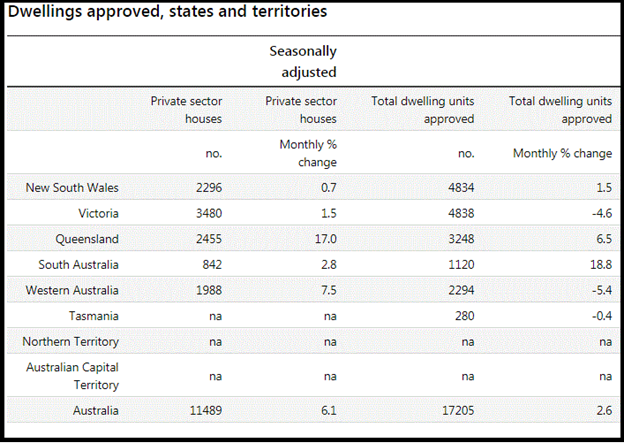

States and territories

While the dwelling approvals surged in South Australia (18.8 per cent), Queensland (6.5 per cent) and New South Wales (1.5 per cent), declines were recorded in Western Australia (5.4 per cent), Victoria (4.6 per cent) and Tasmania (0.4 per cent). On the other hand, the approvals for private sector houses rose in all states - Queensland (17 per cent), Western Australia (7.5 per cent), South Australia (2.8 per cent), Victoria (1.5 per cent) and New South Wales (0.7 per cent).

Image Source: ABS update, 14 January 2021

READ MORE: What is driving Sydney’s luxury housing market?

Value of building approved

Supported by a surge in both the value of new residential building (5.7 per cent) and the value of residential alterations and additions (5.6 per cent), the value of total residential building jumped 5.7 per cent in November.

Image Source: ABS update, 14 January 2021

The value of residential alterations and additions reached an all-time high of $857.2 million in November, while the value of total building approved declined by 8.4 per cent. The non-residential building propelled the decline, falling 27.4 per cent after having risen 59.3 per cent in October.

READ MORE: ABS data revealed surge in International trade and housing loan commitments

Meanwhile, property prices marked an uptick of 0.8 per cent in the September quarter, according to the earlier released ABS data. All capital cities except Melbourne, recorded price rise.