Highlights

- The Morrison government would be distributing a one-off payment to Aussies by the end of this month.

- The payment would only be paid once irrespective of whether individuals are under the list of vulnerable Aussies and also a concession cardholder.

- Apart from the one-off cash payment, the Morrison government has also announced tax breaks and other incentives for Aussies.

As announced in this year’s federal budget, millions of Australians are set to receive a one-off cash payment soon. The payments, which would become available from 28 April 2022, are a part of the Morrison government’s AU$8.6 billion cost of living package announced in March to ease the cost of living pressures.

Needless to say, the AU$250 payment promised to Australians was the highlight of the whole budget, with citizens eagerly waiting for its dispersal. Speculation is rife that the cash payment has been announced strategically, just a few days before the election, to gather votes. Alongside the cash payment, the Morrison government has also announced a fuel excise cut, which effectively reduces the fuel tax to half its original amount.

ALSO READ: Key takeaways from RBA's April monetary policy meeting

As the one-off payment date comes closer, it is crucial to list out the eligibility criteria for the cash payment.

Who can avail the one-off cash payment?

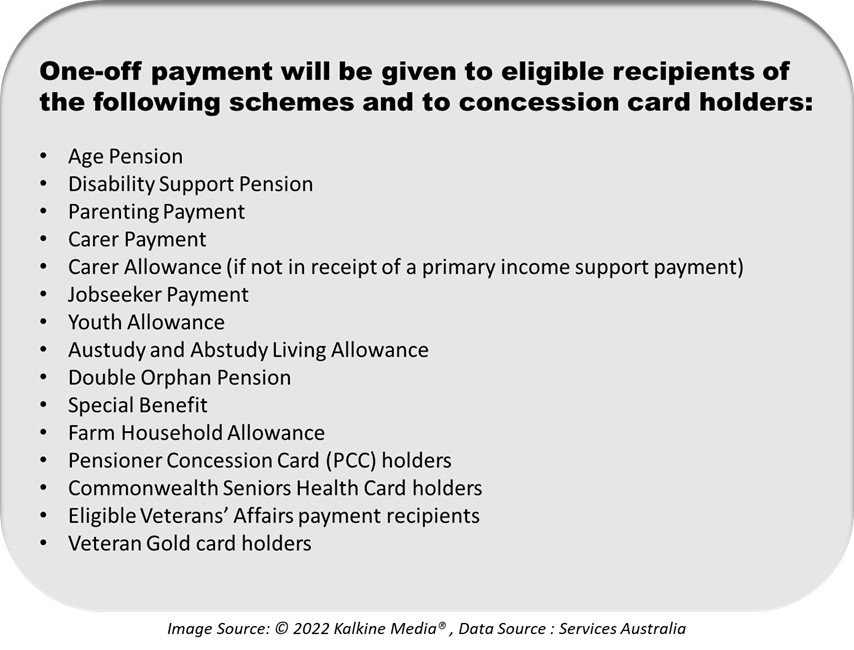

Recipients will receive the AU$250 payment just once regardless of whether they are under the list of vulnerable Aussies and also a concession cardholder. Specifically, people who receive the cost of living payment must be Centrelink or the Department of Veterans’ Affairs customer.

According to Services Australia, the payment will be automatically distributed to the eligible Aussies’ bank accounts, where they receive other government benefits. The slated date of disbursement, 28 April 2022, is subject to legislation, with confirmation arriving to recipients in a letter stating that the payment has been made. Recipients should keep their details up to date to avoid any delays. About six million concession card holders are set to benefit from this cash payment, which would be made only once.

Critics have argued that the one-off payment does little to help Aussies in the long run. Eventually, recipients would have to dig into their own pockets to manage their finances. Additionally, other criticisms revolved around a significant proportion of low-income individuals left out of the cash benefit. Thus, the payment is thought to be not fully inclusive and does not lift the incomes of people with the least.

DO NOT MISS: Will Australia’s budget spending stoke inflation?

What other benefits will Australians get?

The budget announcement included some lucrative tax cuts for Australian citizens. Most notably, the fuel tax was cut from 44.2 cents a litre to 22.1 cents a litre. Additionally, Treasurer Josh Frydenberg announced a one-off AU$420 cost of living tax offset. Aussies earning less than AU$126,000 will get up to AU$1,500 when they file their tax return in the second half of 2022. Over 10 million Australians will receive a cost of living tax offset from 1 July this year.

Why Interest Rate Hike Is A Threat To Australia’s Booming Housing Market?

Adding to the list of incentives is the expansion of the Home Guarantee Scheme, which will now include 50,000 places to support more first home buyers. Moreover, dozens of major infrastructural projects are expected to provide thousands of jobs for tradies, with AU$17.9 billion going towards new and existing infrastructure projects.

The Government is also setting up an Australian Apprenticeships Incentive System to streamline apprentice funding programs. Under the program, wage subsidies would be provided to employers in priority occupations and hiring incentives worth AU$4,000 would be provided to employers in non-priority occupations.

RELATED READ: Budget 2022-23: What's in it for Australia’s digital space?