Summary

- Housing prices saw second consecutive gains in November amid the coronavirus pandemic.

- Prices are expected to now overtake pre-COVID-19 levels by early next year.

- Building approvals for private houses reached its two-decade record level in October.

- In October, the value of new home loan commitments surged to a record high of A$22.7 billion.

Housing prices saw second successive gains in the month of November, according to CoreLogic's national index, following gains recorded in October. The dwelling values have risen 0.8 per cent month-on-month and 3.1 per cent year-on-year. Housing prices are on rise in Australia and if coronavirus pandemic remains under control, prices may increase even more by next year.

Earlier property analysts were of the view that property prices may fall 10 per cent to 20 per cent across Australia amid the ongoing coronavirus pandemic. Interestingly, the prices are expected to now overtake pre-COVID-19 levels by early next year.

CoreLogic’s head of research, Tim Lawless, said that the recovery could very much be in place by as early as January or February 2021. It comes after housing prices recorded a fall of 2.1 per cent between April and September.

ABS data supports recovery

According to the latest data by the Australian Bureau of Statistics (ABS), the demand for property is seeing a continuous rise. In October, the value of new home loan commitments surged to a record high of A$22.7 billion. Even as the figures are just 0.7 per cent higher when compared with the last month, there is a steep upward jump of 23.3 per cent as against the corresponding period last year.

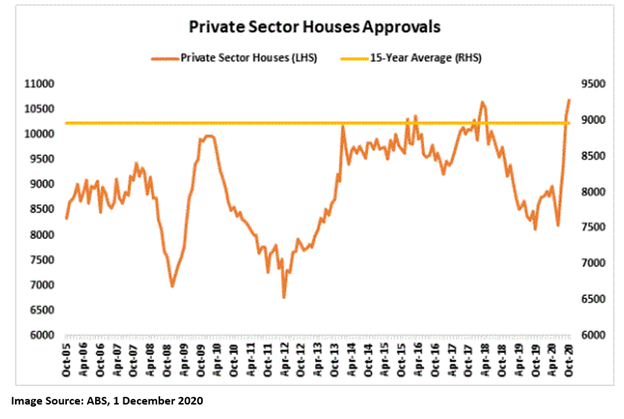

Looking at building approvals October data by ABS, it is astonishing to see approvals for private houses reaching its two-decade record level. The total number of dwellings approved marked an uptick of 3.8 per cent in October (seasonally adjusted level).

READ MORE: Residential real estate regains its shine as house approvals hit a 20-year high

Divergence in property prices

Some divergence has been noted in the rate of apartments and stand-alone houses, according to the data by CoreLogic. The house values have mainly boosted the growth in the market, a rise of 1.1 per cent across capitals during the last three months. On the other hand, apartments have continued to see a fall in price, representing a decline of 0.6 per cent in the same time.

In Sydney and Melbourne markets, the prices of houses have touched the levels last seen in the early 2017. Similarly, prices in Perth are similar to that in 2006 and Darwin’s house prices to march 2007 levels. Brisbane, Adelaide and Canberra witnessed record prices last month.