Summary

- The home sales have surged during the period of 8 July to 31 August 2020: Rightmove

- Housing prices across Britain rise during the months of July and August 2020: Nationwide Building Society

- IHS Construction PMI dropped to 54.6 in August 2020 from 58.1 recorded during the earlier month of July 2020

- Experts feel that this housing sector’s growth momentum might not be sustained beyond the end of March 2021, when the stamp duty holiday gets over

The UK based largest online property website Rightmove has noticed a surge in consumer demand for residential property as a result of the stamp duty holiday announced by the UK government. The property portal said that it analysed sales of around 225,000 homes during the period of 8 July to 31 August 2020 and found out that the weekly rate of sales was recorded to be the highest since the year 2010.

During an ordinary British summer season, home sales generally go down as people are away holidaying. However, this summer was certainly not ordinary, due to the impact of the coronavirus pandemic that kept people glued on to their homes.

The stamp duty holiday helped release the pent-up demand for housing, which was a result of the lockdown and safety restrictions place since the month of March 2020.

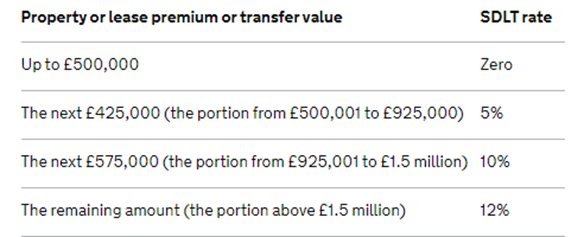

The UK government had announced a temporary stamp duty waiver for residential properties priced below £500,000 if they are being bought during the period of 8 July 2020 to 31 March 2021. The earlier rate band for nil stamp duty on home purchases was £125,000.

Rates of Stamp Duty Land Tax or SDLT (8 July 2020 to 31 March 2021)

(Source: Government of UK)

The Rightmove analysis revealed that three-bedroom houses were sold at the fastest pace during the survey period months of July and August for 2020. Close to 1 million residential properties are listed on the company’s online portal.

Rightmove plc (LON:RMV): The share prices of Rightmove plc have been seen a slow but consistent rise during the past six months. On 5 March 2020, the company shares were trading at GBX 614.20, and have moved up to 630.80 on 4 September at 2.13 PM. The shares had plummeted sharply to a value of 400.10 on 23 March 2020, when a lockdown was imposed across the UK. After that, they have been rising steadily, driven by the slow growth in the housing market activity. The market capitalisation of the stock was recorded at £5,509.27 million on 4 September at 2.13 PM.

Peter Brooks-Johnson, chief executive officer, Rightmove plc had earlier stated that once the housing market was reopened by the government on 13 May 2020, the portal recorded a phenomenal rise in the number of home purchase enquiries. These were further converted into sales when the stamp duty waiver was announced. It is noteworthy that customers have chosen to give precedence to online housing transactions as compared to physical meetings, keeping the health safety issues in mind.

A rise seen in housing prices

The housing prices jumped by 3.7 per cent in August 2020 as compared to the corresponding month in the previous year 2019, according to the Nationwide Building Society estimates. This was the largest year-on-year increase noticed since February 2017.

The yearly rise in home prices was seen to be positive for the previous month of July 2020 as well, when it showed an annual rise of 1.5 per cent.

According to Nationwide, a global building society with a large membership base of 15 million, the residential property prices across Britain averaged at £224,123 for the month of August 2020.

This is higher than the value of £220,936 recorded for the month of July 2020.

Experts warn that this rise in prices is directly linked to the stamp duty waiver and the UK home prices might witness a decline post 31 March 2021, when the term for the waiver expires.

Apart from the pent-up demand, another factor that has led to this rise in home prices for the months of July and August is the re-assessment of home location preferences by the buyers. Many are shifting to the suburbs, happy with a work from arrangement and wishing to live away from the hustle bustle of the busy cities. Some are also moving into bigger houses.

UK Construction PMI declines

While the residential property sales are on the rise, however, the overall UK construction output is witnessing a decline, as seen from the latest IHS Markit/CIPS UK PMI (Purchasing Managers’ Index) numbers for the nation’s construction sector. The Construction PMI witnessed a drop of 3.5 points to reach a value of 54.6 for the month of August 2020, as compared to the previous month of July 2020.

Tim Moore, economics director, IHS Markit explained that production figures for the UK construction fell due to delays in project completion due to the ongoing coronavirus pandemic that has disrupted supply chains. While the raw material supplies were short of the requirement for few, others experienced an increase in their total cost of purchase, said Moore. New work orders were also slow to come by, he added.

A value of PMI index above 50 indicates that the business activity is forecasted to expand in the short-term, as indicated from the order books of the purchase managers of the businesses surveyed.

On the contrary, a value below 50 indicates the opposite, namely a decline in business endeavors.

While the UK construction PMI continues to expand, though at a slower pace than before, however, it still might take a long time to come back to the pre-pandemic levels, lament the experts.

Despite the hopes of an expansion in business activity, job losses continued to take place in the UK construction sector for the month of August 2020.

To sum up, it is a commendable move that the UK government has been able to turnaround the housing sector with its timely stamp duty waiver announcement. This is visible through rising home sales and surging housing prices across the nation, especially during the months of July and August 2020. However, the problems associated with the ongoing coronavirus pandemic such as supply chain disruptions continue to hamper the housing construction activity in the nation, despite optimism for short-term improvement in business activity levels as is evident from the latest IHS Construction PMI figures. The ongoing job losses indicate that the housing construction sector has still not completely come out of its struggling period. Experts also warn that the heightened levels of housing activity in the UK might start to recede, once the period of stamp duty holiday gets over by the end of March 2021.

_09_03_2024_01_03_36_873870.jpg)