Highlights

- The Australian government has announced that this year’s budget will be presented on 29 March.

- The budget will be tabled earlier than usual on account of upcoming federal elections, which are likely to happen in May.

- Several business organisations, community groups and individuals have already submitted their re-budget recommendations to the government.

This year’s federal budget season has begun and the Australian government has announced that the budget will be presented on 29 March. The budget is usually announced in early May but this time it will be tabled earlier than usual on account of upcoming federal elections, which are likely to happen in May.

The budget 2022-23 would be keenly watched as it would highlight the fiscal policy for the government in the wake of the Omicron attack as well as the ongoing Russia-Ukraine conflict.

In last year’s budget, the government focused on a variety of issues including COVID-19 rollout costs, tax cuts for low-income groups, investment in skills, and other health support measures. However, the budget 2021-22 was presented before the Omicron variant hit the domestic economy.

Several business organisations, community groups and individuals have already submitted their pre-budget recommendations to the government.

On this note, let’s discuss a few key issues that Australia's 2022 Budget must address:

Business investments

The budget needs to address the problems of low business investments amid the ongoing pandemic. The business investment is at its lowest level since the early 1990s recession, as a share of gross domestic product (GDP). According to experts, a boost in investment is needed to boost the efficiency and productivity of businesses. It is also needed to improve wages.

In the last three months of 2021, Australia recorded weaker-than-forecast business investments, recording a fall in spending on equipment, plant, and machinery. The Reserve Bank of Australia (RBA) recently talked about stronger business investment to rev up productivity and wage growth.

Resolving labour shortage

Australia is currently seeing an acute shortage of labour. It has hampered both large and small businesses across the country, contributing to inflationary pressures and hindering the ability to attract investments. The COVID-19 pandemic has left Australia with nearly 300,000 fewer workers than what was expected before the pandemic.

Unless the labour shortage issue is addressed on time, the government would find it challenging to push the economy forward.

Increasing skilled labour pool

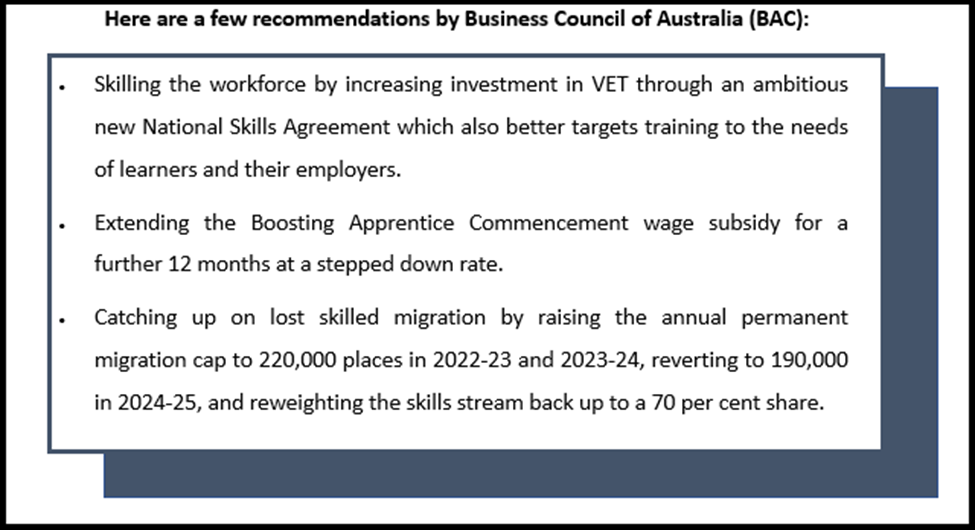

The Australian government needs to focus on increasing the skilled labour pool. The government can focus on increasing vocational education and training investment through a new and more ambitious program.

The federal government may also look towards extending the wage subsidy program to boost the uptake of apprenticeships.

Image Courtesy: Business Council of Australia (BCA) website

Meanwhile, the BAC has also asked for “enhancing the competitiveness of Australian businesses by raising the turnover threshold for the 25% company tax rate to either AU$250 million, AU$500 million or AU$1 billion and switching to a domestic turnover test.”

RELATED ARTICLE: XMR, ZEC & ROSE: Top 3 privacy cryptos by market cap surge

RELATED ARTICLE: What did Janet Yellen say on cryptocurrency & did it have any impact?

RELATED ARTICLE: PM Morrison declares floods a national emergency, vows more support