Summary

- Under Canada Emergency Response Benefit, individuals affected by COVID eligible to receive C$ 2,000 for a four-week period; the benefits will come to an end from August 29 onwards

- Employment levels have recovered, nowhere near pre-pandemic figures.

- Most CERB recipients will transfer to the Employment Insurance (EI) program or another “parallel benefit” plan in the coming weeks

- Biggest challenge is to wean off Canadians from the monthly aid

- To balance this delicate task, the government’s has hopes pinned on Canada Emergency Wage Subsidy that helps businesses restart and pay staff

A week after Canada imposed sweeping countrywide lockdown to limit the spread of the coronavirus, Prime Minister Justin Trudeau unveiled a fiscal stimulus package which included an income replacement fund called the Canada Emergency Response Benefit or the CERB.

Under the CERB, individuals (both employed and self-employed) who lost their income due to COVID-19 were eligible to receive C$ 2,000 for a four-week period, which could be extended to a total of 24 weeks. The benefits could be claimed regardless unemployment benefits receival status.

The CERB benefits will come to an end August 29 for the first lot of applicants or those who have been receiving payouts since mid-March. The final eligibility period ends on September 26.

For now, there is no clear picture of what comes next – a fact that has complicated matters for federal government, policymakers and millions of CERB recipients.

Canada’s Biggest Challenge: Weaning Off Millions From Federal Support

In 2020, the Canadian government projected a budget deficit C$ 343 billion, which accounted for almost 16 percent of its economic output – depths unseen since the second world war. This deficit included C$ 212 billion in direct support to individuals and businesses affected by the pandemic through programs such as the CERB and the Canada Emergency Wage Subsidy or the CEWS. Going forwards, Canada’s unprecedented fiscal debt due to the coronavirus pandemic will make further monetary dole outs difficult.

National employment levels have recovered but are still nowhere near the pre-pandemic figures. As of July, the country has reclaimed total 1.37 million jobs and is nearing the halfway mark in recovering the three million job losses during the initial onset of coronavirus. Analysts predict, the job recovery numbers won’t be so encouraging in the coming months and may soon plateau.

For now, most CERB recipients will soon transfer to the Employment Insurance (EI) program. However, criteria to qualifying for the EI is long and includes conditions such as must have previously paid EI premiums or worked 420 to 700 hours of insurable hours, etc. The strict EI criteria has invalidated the candidature of millions of Canadians including gig or contract workers.

Trudeau has indicated the launch of another “parallel benefit” plan in the coming weeks for those unable to qualify under the insurance plan. Details of this plan are still sketchy.

The biggest challenge now in front of federal officials is how to wean off Canadians from the monthly aid that has been rapidly depleting the public coffers. Pushing off individuals from benefits program too quickly will cause public dissatisfaction while moving too slowly will impede the economic recovery.

To balance this delicate task, the Trudeau government’s CEWS (Canada Emergency Wage Subsidy) comes into play. The CEWS encourages companies to qualify for the wage subsidies program, helping businesses restart and pay staff. This subsidy program will run till December-end and the federal government is banking on this.

Meanwhile, a sickness and caregivers’ benefit plan allowing workers for 10-days paid sick leave a year will come into force. Rent extension under Canada Emergency Commercial Rent Assistance plan has also been extended till August-end.

Canada has recorded over 1,19,451 COVID-19 cases with 8,981 deaths. Highest active numbers were recorded in Quebec area, followed by Ontario and Alberta.

Impact of COVID on Canadian Economy

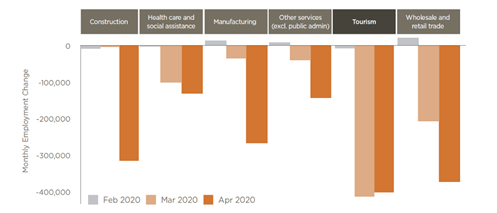

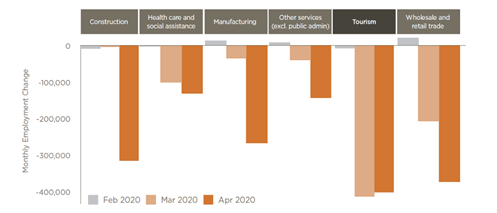

The pandemic and its resultant distancing measures had a diverse effect on the Canadian economy, decimating 3 million jobs and over 88,000+ business closures in March and April.

Travel, tourism, hospitality, retailers, accommodation, restaurants and services industry were the hardest hit hard as demand waned and businesses struggled to adjust to the new normal.

Employment in tourism sector fell over 42 percent between February and April 2020. This sector accounted for 27% of all job losses in the country.

(Source: Labour Market Information Council, Canada)

Overall average hours fell by 15 percent between February and April 2020, informs Statistics Canada.

According to Bank of Canada, the initial impact of the coronavirus was highest in travel, entertainment, food service and sectors with face-to-face personal services like hair salons and dental offices.

Women, on the other hand, have been disproportionately affected by the pandemic and are grappling with childcare over the closures of schools and daycares.

The Bank of Canada does not expect the economy and the business ecosystem to complete recovery before 2022.