Summary

- BoE is unlikely to pull the interest rates down to the negative territory in its forthcoming MPC meet

- The UK economy grew by 6.6 per cent during the month of July 2020, according to latest government data

- By the end of 2020, a second round of quantitative easing worth 75 billion pounds might be in offing

The Bank of England (BoE) is expected to leave the interest rates untouched at 0.1 per cent as the British economy is moving on a slow but steady path to economic recovery. The next review of the interest rates is due on Thursday 17 September 2020 during the central bank’s monetary policy meeting (MPC).

The BoE might also hold off from providing any further quantitative easing at this point in time.

Howard Archer, chief economic adviser, EY Item Club said that any immediate monetary policy stimulus might not be required by the BoE, at least for the time being. He emphasised that the British economy could grow by around 15 per cent for the third quarter of the year 2020 (July to September period).

Also Read: Bank Of England Sees The British Economy Making A Sharp Turnaround

At the same time, experts predict that the economy could slow down in the last quarter of the year 2020 (October to December period). That could in fact might also be the correct time to being in monetary stimulus measures, suggest the experts. In fact, there are speculations that by the end of 2020, a second round of quantitative easing worth 75 billion pounds might be in offing.

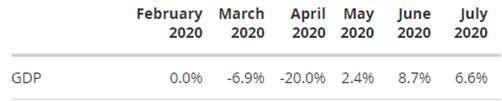

The British economy grew at positive rates during the months of May, June, and July for the year 2020, after shrinking during the months of March and April 2020.

UK economy: Monthly GDP growth estimates

(Source: Office for National Statistics, UK)

While the July GDP growth (6.6 per cent) is lesser than that of June 2020 (8.7 per cent), experts estimates indicate that the next month of August 2020 is expected to bring in a double-digit growth rate for the country’s economic output.

Also Read: UK Economy On The Path To Recovery: July Shows 6.6% Growth

However, there are certain concerns which could dampen the optimism over May, June, and July GDP growth figures for the year 2020. Let us take a look at them.

Worries over mass unemployment

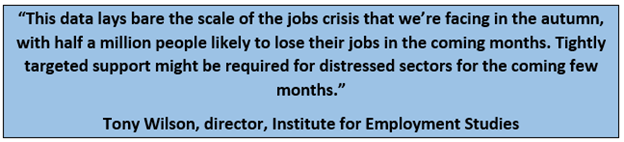

It is pertinent to note that the BoE interest rate decision will be coming at a time when mass job losses are being feared after the furlough scheme comes to an end in October 2020.

A latest analysis from the Institute for Employment Studies (IES) revealed that a maximum of 7,00,000 jobs could be at the risk of getting redundant once the government furlough scheme expires on 31 October 2020. Around 4,50,000 job losses seem imminent within weeks of the end of furlough scheme, but if the layoff announcements keep going on for a longer period, the number could rise further.

Covid-19: second wave feared

Medical experts have warned that unless strict measures are undertaken now, the country could get into another wave of exponentially rising coronavirus infections. Some experts also suggest imposing another lockdown to avoid a rapid spread of infections.

Adhering to the ‘rule of six’ for large gatherings is very crucial in this regard, suggested Peter Openshaw, respiratory expert, Imperial College London. The rule came into effect from 14 September 2020 and it limits the number of people for social gatherings to six across the UK. Defaulters would be liable to pay a fine of £100.

Future of UK-EU trade deal uncertain

Both Britain and the European Union have been unable to timely resolve the disagreements over key areas such as fishing rights, state aid, and the dispute resolution mechanism.

The UK government has come out with a new internal market bill, that might over ride international laws, and has been criticized by the EU as well as the US.

Starling Bank’s announcement

Amid all these speculations with respect to the MPC’s new stand on interest rates, Starling Bank, the UK based digital bank, announced that it is introducing negative interest rates for its high-worth customers.

The bank will be imposing a negative monthly rate of interest of 0.5 per cent for its high-valued euro accounts worth more than 50,000 euros. The rate will be applicable with effect from 4 November 2020.

In fact, the negative interest rate discussions might just intensify during the next year 2021 once clarity emerges over UK-EU trade relations going forward and the path of the economic growth also stablises.

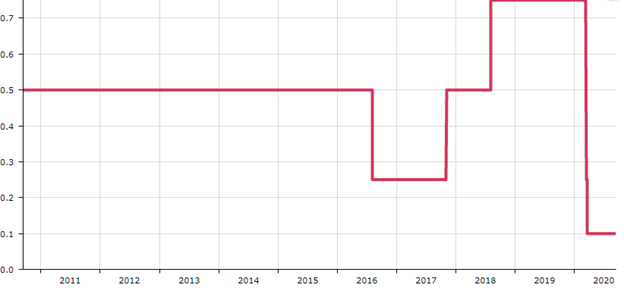

UK Official Bank Rate

(Source: Bank of England)

The official bank rate was reduced to 0.25 per cent on 18 March 2020, down from 0.75 per cent prevailing earlier by the central British bank. It was further lowered to 0.1 per cent on 23 March 2020, to promote investments and push consumer spending across the nation. Since then it has been retained at the same level, despite talks of the BoE considering lowering the rate further, even into the negative territory.

Theoretically, negative interest rates encourage spending since it actually costs to save your money in a bank. However, in an emergency coronavirus pandemic situation, people might still not spend and hold on to their money (may be just save it in the home lockers) unless they feel secure about their future income stream and health prospects.

Also Read: Can Negative Interest Rates Become A Reality For The British Economy?

According to estimates from the Janus Henderson Investment Trusts, Britons are collectively holding close to £ 1.5 trillion in the form of bank savings. All this huge sum of money stands to be impacted in case the interest rates go down, as its account holders will have to pay their banks for keeping this money with them. In such a scenario, it will definitely become discouraging to hold cash at the banks.

Currently the base rate set by the Bank of England is 0.1 per cent, the lowest in British history. This rate in turn impacts all other interest rates set by the retail banks, hence it is importance.

The central bank can use negative interest rates as a tool to push the dried-up private investments across the country, if needed.

To sum up, the upcoming MPC meeting of the Bank of England is expected to keep the interest rates same, given the fact that the British economy had begun to recover modestly. However, the last quarter of the year 2020 could see slower growths and the bank might have to revisit its decision again.