Highlights

- The Consumer Price Index (CPI) surged 1.3 per cent in the December 2021 quarter.

- Annual price inflation of goods was the highest since 2008 in the December quarter.

- New dwelling purchases and automotive fuel primarily contributed to goods inflation.

Inflation has been a long-standing issue in countries across the globe, which became more profound during the pandemic amid changing demand-supply dynamics. As demand rebounded in the pandemic-relief period and supply chain shortages worsened, several economies experienced high inflation, particularly in the property and consumer goods segment.

Do Not Miss: How would inflation further affect sectors? 5 pointers to note

Australia is no different in experiencing the inflation problem in its pandemic recovery journey. The latest data from the Australian Bureau of Statistics (ABS) suggests that the Consumer Price Index (CPI) increased 1.3 per cent in the December 2021 quarter. Meanwhile, the CPI rose 3.5 per cent annually during the last quarter.

Price increases in new dwelling purchases and automotive fuel primarily contributed to goods inflation in the December quarter. However, prices also surged across a broad range of other goods with supply disruptions and strong demand resulting in price rises for goods like motor vehicles and furniture.

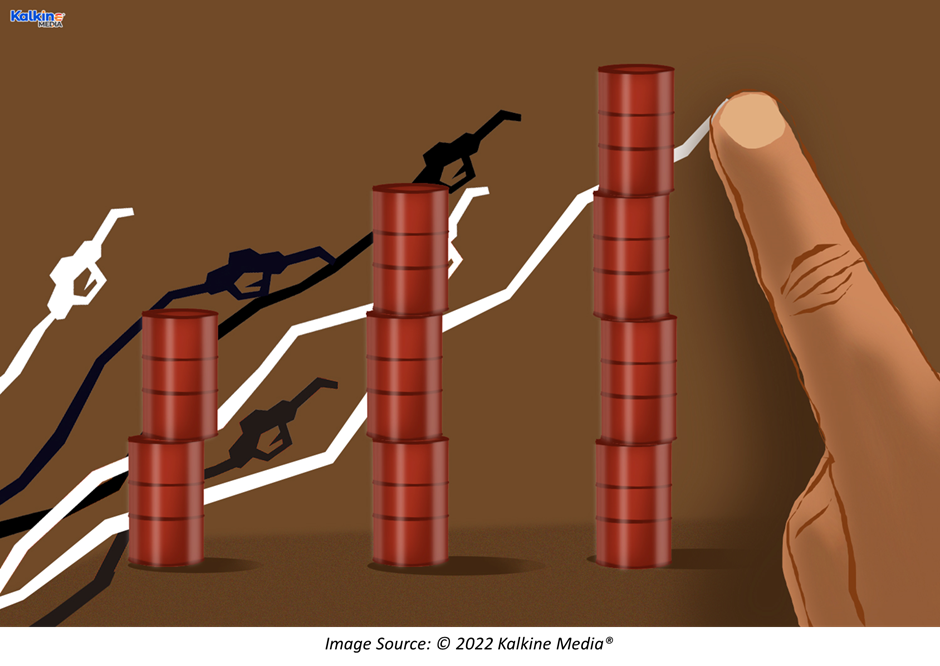

Fuel prices go haywire

Australia saw a price rise of 6.6 per cent in automotive fuel in the December quarter. Automotive fuel prices surged for the sixth consecutive quarter, leading to the strongest annual rise since 1990. During the quarter, annual price inflation of goods exceeded that of services and was the highest since 2008. Meanwhile, fuel prices were the largest contributor to such higher goods inflation.

Good Read: Crude oil rises on falling US oil inventories

The recent uptick in fuel prices can be attributed to higher global oil prices amid lower world supply and economic recovery. In the December quarter, the national quarterly average price for unleaded petrol rose to $1.64 per litre.

New dwellings become expensive

During the December 2021 quarter, prices for new dwelling purchase by owner-occupiers increased by 4.2 per cent.

As per the ABS, strong demand for new dwellings, combined with shortages of building supplies and labour, contributed to price rises for newly built townhouses, built houses, and apartments. In fact, Australia has seen two consecutive quarters of the largest surge in new dwelling prices since September 2000 on the back of rising construction costs and shortages of materials and labour.

Must Read: Is the Australian economy on the brink of hyperinflation?

Fewer payments of government construction grants relative to the last year also contributed to the higher prices for new dwellings in the December quarter. These construction grants hold the potential to reduce out of pocket expenses for new dwellings being bought.

In addition to these forces, domestic holiday travel and accommodation (4.8 per cent up) also contributed to the CPI increase in the December quarter. This reflects improved demand owing to the easing of local border restrictions in late October 2021 and the lead up to the Christmas holiday season.

Bottom Line

It is worth noting that the recent jump in annual inflation to 3.5 per cent in the December quarter has surpassed the central bank’s 2 to 3 per cent target range. It will be interesting to see if the rise in inflation numbers will prompt the central bank to embrace earlier-than-expected rate hikes in 2022 or the bank will continue to retain current policy settings.

Aussies are expected to get further clarity on potential interest rate hikes or other contractionary monetary policies in the upcoming February monetary policy meeting.

Related Article: What to expect from December 2021 quarter inflation data