Highlights

- Maker crypto is a part of the bigger MakerDAO project, which also has a stablecoin named DAI

- MakerDAO has tweeted about how DAI stablecoin’s price stabilisation and reserves work

- The Maker (MKR) token’s trade volume has picked up, although the price per token is down on a year-to-date basis

The cryptoverse’s total market cap is yet again below the US$1 trillion mark. Individual tokens like Ether and BNB have suffered losses over the past week. That said, the cryptoverse is famous for its ultra-volatile nature, which was on display when Ether surged from nearly US$1,000 to over US$1,700.

However, cryptos can fall in the same fashion, and the fall this year in the price of one of the costliest cryptocurrencies, Maker (MKR), can be cited as an example. Even though Maker crypto has a comparatively low market cap as compared to names like Dogecoin, the per token price is one of the highest. Let us explore how the price has dipped this year, and why has the trade volume suddenly surged.

Maker and DAI cryptos

The blockchain project titled MakerDAO is behind the two tokens, MKR and DAI. The latter is a stablecoin, and as of writing, DAI is one of the top 15 cryptos by market cap. MakerDAO claims to have enough reserves to support the ‘soft peg’ DAI stablecoin. The MKR token is used as the overall governance token of MakerDAO, which means that holders of the token can decide about the issuance of the project’s token and other aspects.

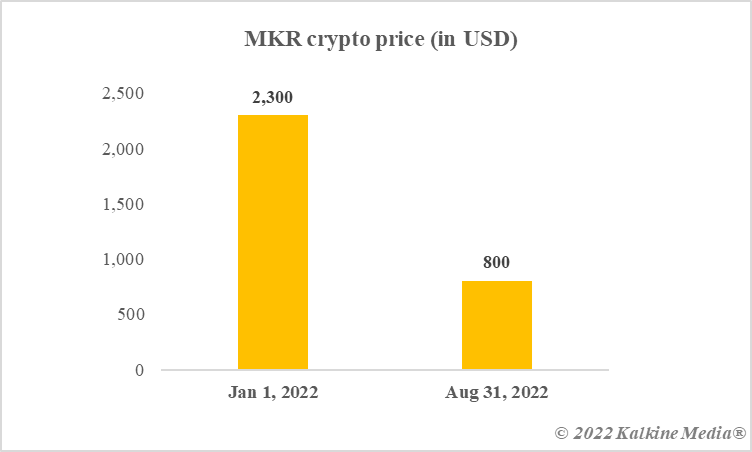

DAO is the acronym for ‘decentralised autonomous organisation’. MakerDAO claims it is not controlled by any central authority, instead, by holders of the MKR token. MKR crypto had a price tag of over US$2,300 on January 1 this year, but similar to Bitcoin and Ether, it has also suffered massive losses.

Data provided by CoinMarketCap.com

Maker crypto’s trading volume

The 24-hour trading volume of the MKR token reflects a jump of nearly 30% as of writing. It is notable that fewer than one million tokens of MKR crypto are in supply as against many other cryptocurrencies, including meme tokens, which can have a supply of billions of tokens. The recent rise in the trade volume has yet to make any positive change in the price of the crypto, which is trading at nearly US$800 as of writing.

One reason behind the rise in the trading volume could be the brief explanation issued by MakerDAO through Twitter with respect to the price of the DAI stablecoin. The project has made an attempt to describe how reserves and price stabilisation of the DAI stablecoin work.

Bottom line

The major focus of any stablecoin project should ideally be on maintaining reserves to back the value of the token at all times. The fall of Terra’s stablecoin ignited fears, and MakerDAO’s explanations on DAI’s price stabilisation and reserves could be a move to reassure backers. This could have lifted the trade volume of the linked MKR crypto.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.