Highlights

- Bitcoin, which is by far the biggest asset in the cryptoverse, is not the most actively traded

- The trading volume of any cryptocurrency can be viewed as an indicator of its adoption

- Stablecoins claim their value is not volatile, thanks to their peg to assets like the USD and gold

Cryptocurrency facts can sometimes come as a shock. Do you know that meme token Dogecoin (DOGE) is older than Ether (ETH), the second biggest crypto today? That said, the biggest crypto, Bitcoin, is not the most actively traded asset in the cryptoverse.

So, which crypto has the highest trading volume? Let us explore this question and also understand the reason that makes the token the most actively traded. Also, the fact that this token is not a regular cryptocurrency, but a fixed-value ‘stablecoin’, can make many curious about this class of cryptos, which came under stress in the wake of TerraUSD’s fall nearly four months back.

Most active cryptocurrency

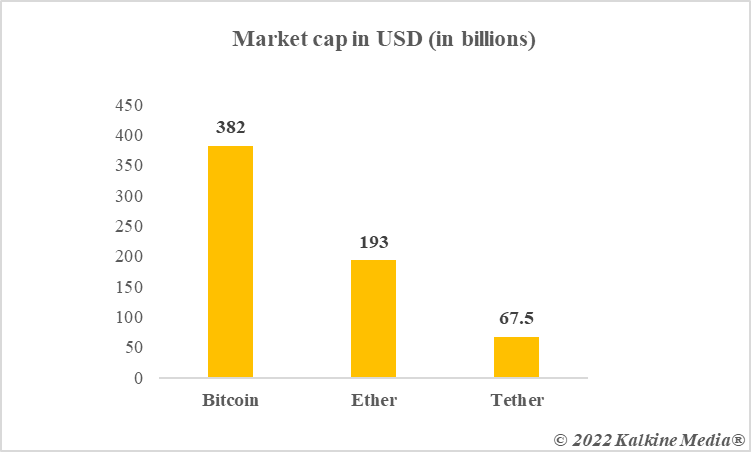

Tether (USDT) is the crypto with the highest trading volume, more than even Bitcoin, let alone altcoins like ETH and DOGE. Tens of billions of dollars’ worth of Tether tokens are being traded in a single day. As of writing, CoinMarketCap suggests that Tether’s 24-hour volume is over US$31 billion, while that of Bitcoin is nearly US$25 billion. That said, Bitcoin tops the list in terms of market cap, where Tether is third and Ether is in number two position.

Tether is listed on almost every major cryptocurrency exchange, and it has a circulating supply of over 67.5 billion tokens as of writing. In fact, the market cap is also roughly the same as the supply because Tether maintains a 1:1 peg with the US dollar.

Why does Tether have such high volume?

Tether’s price stability makes it the most traded cryptocurrency. The project promises to have enough reserves to back up the value of the Tether token at all times. This is in contrast to regular cryptocurrencies, prices of which can be very unpredictable even over a short-term period. It is, however, notable that the USDT token’s price briefly came under stress in May, possibly because of the failure of another stablecoin project, Terra.

Many crypto traders use Tether to trade in regular cryptocurrencies and there is a reason for this. Instead of converting fiat currency into crypto and vice versa every time, it can be considered convenient to hold Tether to undertake to buy and sell in cryptocurrencies.

Data provided by CoinMarketCap.com

Also read: How was September 2021 for the cryptoverse & what to expect now?

Tether is more than USDT

Tether even has tokens that are pegged to the euro, Chinese Yuan, and a few other fiat currencies. Aside from being used to trade cryptos, Tether projects itself as a cryptocurrency that can be adopted for regular trade and commerce because of its blockchain features and ‘stable’ value.

Bottom line

Right now, Tether’s USDT tops in terms of trading volume, thanks to the token’s use in trading other cryptoassets. Analysts even consider the volume of USDT as a gauge of the state of the cryptoverse at any given time. That said, even though Tether claims to have adequate reserves to support the USDT token, some analysts have raised doubts.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.