Highlights

- DApp developers have yet to finalize which is the most efficient blockchain network

- Polkadot’s consensus method (NPoS) is different from others, besides its cross-chain features

- The DOT token of Polkadot has use within the network for staking and governance

It is possible that the volatility in cryptocurrencies is a product of the sector’s yet-to-be-finalized outlines. Which is the best blockchain network to build decentralized apps (DApps)? Is it Ethereum, or is it Solana, Cardano, Fantom or Polkadot? Which is the best metaverse? Is it The Sandbox, or is it Axie Infinity or Decentraland?

Presently, it can be said that the blockchain world is evolving. Developers have yet to finalize which is the best network to build and deploy their apps. In this light, let’s know where Polkadot stands.

How is Polkadot different from others?

The Polkadot project claims that it allows interoperability, where apps can be moved from one chain to the other with ease. In terms of its consensus mechanism, Polkadot neither uses proof-of-work nor proof-of-chain, but what it calls “nominated” proof-of-stake (NPoS). This consensus, according to one report, defeats other proof-of-stake networks as far as carbon footprint is concerned.

Unlike many others, Polkadot is scalable without a fork. The network also bills itself as a Web 3.0 tool, which is open source.

Also read: What is Talking Ben crypto & is the BEN coin safe?

Polkadot crypto

Polkadot has DOT as its token, just like Ethereum has Ether and Solana has SOL. The DOT crypto can be used for staking and governance within the network. According to CoinMarketCap, over 987 million tokens of DOT are in supply. The token can be traded as an asset on exchanges like Binance and Huobi Global.

Also read: 5 cryptos under one cent to watch in 2022

Polkadot’s price prediction by 2030

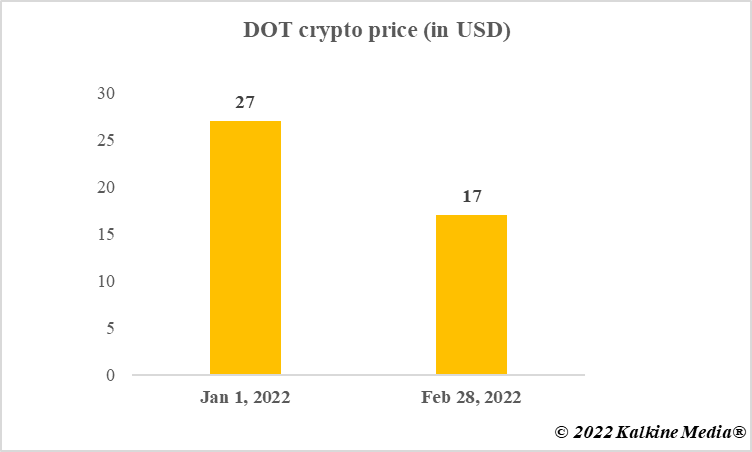

As of writing, the DOT token has a market cap of over US$16 billion, which makes it one of the large cap cryptocurrencies. The Polkadot crypto is trading at nearly US$17, which is low compared to the price of US$27 at the start of this year.

Last year, the Polkadot crypto even crossed US$50 in November, but the rally was short-lived. Keeping in view the volatility Polkadot has manifested -- it even dropped to nearly US$10 at one point in 2021 -- predicting a long-term price is complex.

But if the Polkadot network can establish its utility over other networks like Ethereum, the DOT token may have a fair chance to rise. By the end of 2022, Polkadot may reach US$30 if developers demand more DOT tokens to build new projects. By 2030, Polkadot may touch US$200, but for this, the network would have to show resilience and superiority over others.

Data provided by CoinMarketCap.com

Also read: Russia-Ukraine war: Possible impact on cryptos & can BTC prove utility?

What’s Polkadot’s Consensus Mechanism?

Bottom line

Polkadot has a unique consensus method, which sets it apart from other networks. However, which of the consensus mechanism is the most efficient and which network is the best to build DApps, is not yet clear. If Polkadot emerges as one of the favorites, the DOT crypto might rise due to its demand.