Highlights

- Many are debating whether there is any steam left in the sector or if this is the end of crypto

- 3AC hedge fund is reportedly facing liquidity concerns, and Celsius has suspended withdrawals

- A negative price trajectory phase has gripped almost all assets that provide variable returns

The crypto market is reeling from multiple jolts. The total market cap has dropped below US$1 trillion, which suggests the bloodbath has gripped virtually all cryptoassets.

This sordid state of affairs has prompted many crypto enthusiasts to wonder if crypto’s days are numbered. The end of crypto is now a trending topic, with arguments swirling from both sides. Before we jump to any conclusion, it is critical to take note of some late developments. Besides, a broader view of the variable-return asset market can also help arrive at a logical conclusion.

The negatives

1. Price movement

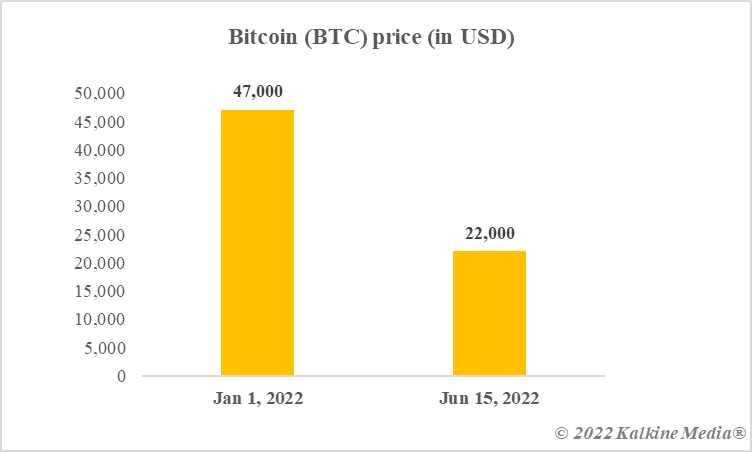

Bitcoin is now at US$22,000, down more than 50% on a year-to-date (YTD) basis. Ether has also lost and so have other major tokens including Solana (SOL) and Shiba Inu (SHIB). Dogecoin (DOGE), which is considered as Elon Musk’s favourite, is down almost 70%. The bearish trend has not spared any cryptocurrency, and it is notable that CoinMarketCap tracks almost 20,000 assets.

2. Project failures

Every cryptoasset is linked to a particular project. Ether, for example, is linked to Ethereum. Ethereum is a blockchain project, with focus on providing decentralised ledger services to developers. There are a few projects that claim to provide crypto lending and borrowing services. Celsius Network is one of these, and it has lately halted withdrawals. Now, rumours about troubles at crypto hedge fund Three Arrows or 3AC are also floating. 3AC is said to be liquidating its crypto holding.

Also read: What future does Celsius Network hold after its suspension?

3. Crypto layoffs

What has made the biggest news recently, aside from sharp price drops, is layoffs at crypto companies. Coinbase is cutting its workforce by 18%, which amounts to nearly 1,100 employees. Some experts are equating these events with what happened during the dot-com bubble bust. Though layoffs are common in any industry, it might further dent the sentiments of crypto enthusiasts, leading to sell-offs.

Data provided by CoinMarketCap.com

The positives

1. A wider sell-off

Cryptos are not the only ones to be in dire straits. Almost all variable-return assets, including stocks listed on world’s biggest exchanges, are subdued. If cryptos are considered as a part of the tech sector, it is notable that many tech giants have lost immense value this year. From the US Fed’s rate hikes to muted economic and job growth, multiple factors are putting pressure on assets that do not have a fixed return. Once all the macro-economic factors are back in shape, there might be a fair chance of revival.

2. Adoption

There is more to cryptos than just being tradable speculative assets. Projects like Ethereum and XRP Ledger provide services to the wider financial market. Gaming is supposedly on the verge of a change, with blockchain as the driver of this change. The metaverse is also gaining traction. Notably, most gaming tokens belong to wider metaverses, with users having a chance to own non-fungible tokens (NFTs) and other assets.

Bottom line

Things are not going very well for cryptos, with halt on withdrawals and job losses adding to the pain. But the dull phase has also gripped other variable-return assets. It could be a very hurried conclusion to say that crypto is dead.

Also read: NikeCraft and PsychoKitties: Why these two NFTs are trending

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.