Highlights

- Capitulation simply means giving up, and it strikes any market when investors lose all hopes of recovery

- The market cap of cryptos, which was once over US$3 trillion, is now not even US$1 trillion

- It is not easy to identify the phase of capitulation, and many feel prices get support from risk-tolerant investors after the exit of risk-averse ones

The crypto market has endured multiple blows and substantial losses this year. Some of the biggest blows included the failure of a big stablecoin project, Terra, and a halt imposed on the withdrawal of crypto holdings by multiple intermediaries, including Voyager and Celsius.

More than that, it was the losses that continued to ail the cryptoverse. In November, the total market cap had hit a whopping US$3 trillion, signalling that backers were extremely bullish on these blockchain-based digital assets. Back then, one Bitcoin token had reached a price of more than US$68,000, something that was unimaginable a few years back.

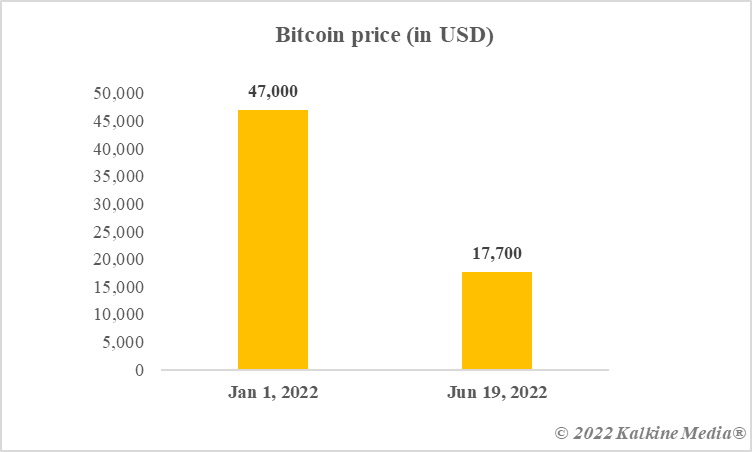

The same Bitcoin fell under US$20,000 by mid-June 2022 after persistent downward pressure since the beginning of the year. Altcoins have also declined sharply in value. As a result, many are finding signs of ‘capitulation’ in the crypto market. Today, let us understand capitulation.

What is market capitulation?

Market capitulation or simply capitulation is a negative phenomenon which means investors giving up any hope of recovering losses made on an asset and deciding to liquidate the holding. It can be understood as a time when sentiments are extremely bearish, and most of the backers of the asset are not convinced that the prices will rise.

It is quite common for investors to sit on their portfolios in the hope that losses will be recovered sometime in the future. Capitulation is a time when many of these investors consider surrendering, not waiting. These risk-averse investors decide to sell their portfolios and book losses.

Capitulation in cryptos, or for that matter, in any other asset, would mean extremely high selling pressure. However, it is never easy to forecast the time of capitulation. Even identifying that the ongoing period is capitulation can be complex. It is, however, considered that prices usually recover after capitulation as risk-tolerant investors might consider it an opportune time to buy.

Cryptos and capitulation

As stated earlier, identifying market capitulation is not easy. Bitcoin, usually considered the bellwether of the overall crypto market, is down almost 60% this year. It could, however, recover some lost ground after dropping under US$18,000 a few months back. Was that the capitulation in cryptos? It cannot be said with certainty.

Data provided by CoinMarketCap.com

Bottom line

Capitulation is a negative phase when the investor decides to give up and no longer wait for any turnaround. Many feel that prices can recover after capitulation with the entry of risk-tolerant investors. That said, identifying a period of capitulation is not easy, and it cannot be said with certainty if it has hit the crypto market.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.