Highlights

- Madonna’s NFTs are being auctioned for charitable purpose on SuperRare, a digital asset marketplace

- So far, the bids have not been very high, which may be attributed to the ongoing dull phase in all cryptos

- SuperRare’s native token was itself trading in red, with ETH and BTC also having shed value

Non-fungible tokens, or simply NFTs, were a late entrant in the wider cryptoverse. But in a short span of time, these tokens have arguably become as popular as their fungible peers like BTC and SHIB.

It is this frenzy that is drawing the attention of celebrities like Snoop Dogg and Paris Hilton. The latest addition to the list is singer-songwriter Madonna. Reportedly, Madonna has previously bet on the space by purchasing one of the NFTs of the Bored Ape Yacht Club (BAYC) project. BAYC is one of the top NFT projects by market cap, with a linked ApeCoin crypto token.

What is Madonna NFT?

Madonna is said to have joined forces with Beeple to launch three assets. Beeple’s previous works like Everydays, and HUMAN ONE have sold for multi-million dollars. Madonna’s NFTs, said to be in the form of digitally-made videos, are named “MOTHER OF CREATION”.

Also read: Why are NFTs valuable?

It is being said that all the three NFTs, depicting Madonna as a mother giving birth, are released solely for the purpose of auction. SuperRare, a marketplace for digital assets, has listed Madonna’s NFTs.

According to SuperRare’s website, bidders can submit their bids in ETH token. ETH is the native token of Ethereum, a blockchain on which most NFTs are recorded. As of writing, the highest bids on all three NFTs were in tens of thousands of dollars. This is quite less when compared to previous NFT sales that saw buyers spending millions of dollars.

Cryptoverse’s dull phase

One of the reasons why Madonna’s three NFTs seem to be attracting lower-than-expected bids may be the sustained bearish phase in the wider cryptoverse.

Also read: As another CryptoPunk NFT sells for high price, what to expect?

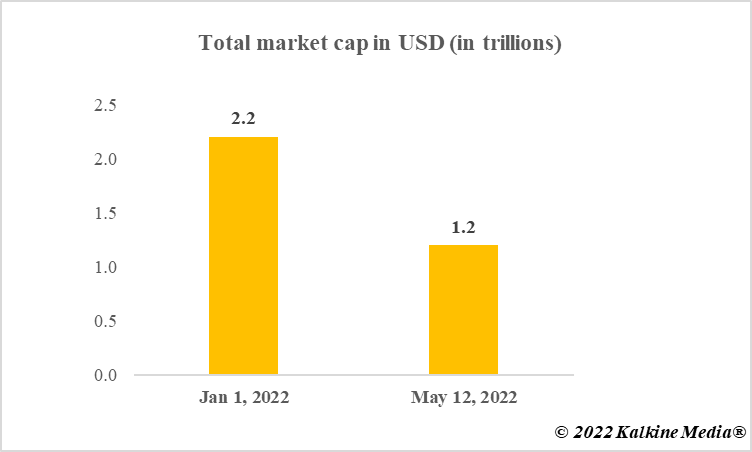

Bitcoin, the most popular cryptoasset, was trading below US$30,000 as of writing. BTC’s year-to-date (YTD) loss stood at nearly 40 per cent. ETH, which is the most commonly used token for NFT trades, was down over 45 per cent on YTD basis. Overall, the total market cap, which at one time was almost US$3 trillion, had plunged below US$1.3 trillion at the time of writing. Besides, SuperRare’s own token RARE had lost almost 40 per cent in the past 24 hours.

Madonna’s NFTs have entered the market during a dull phase, which may negatively impact sentiments.

Data provided by CoinMarketCap.com

Bottom line

Madonna’s NFTs are launched in collaboration with one of the most popular names in the space, Beeple. A few reports are talking about the nudity presented through these digital works. Listed on SuperRare, the three NFTs have not yet attracted very high bids from enthusiasts. This is in contrast to the previous auctions that attracted millions of dollars for some of Beeple’s works. One reason could be the slump in the cryptoverse, which may have taken a little sheen off Madonna’s NFT collection.

Also read: Risks involved when considering NFTs as alternative investment asset

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.