Highlights

- The Voyager Token project comes with a trading app, a debit card, and a native token called VGX

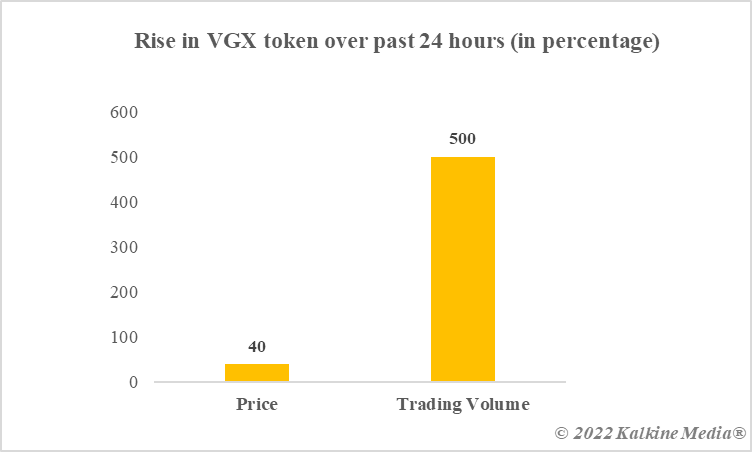

- There has been a spike in the price and trading volume of the VGX token, but it is trading at a year-to-date loss.

- The Voyager ecosystem has loyalty rewards for token holders, with “up to 12% annual rewards”

In the aftermath of the crypto market’s May meltdown, many analysts came out with their versions of “how to survive a bear market”. However, cryptos have apparently begun to bounce back. BTC, as of writing, has gained nearly 5% over the past seven days. However, ETH, the most dominant altcoin, is yet to register gains.

One altcoin, Voyager Token, was up almost 40% as of writing. The price has skyrocketed over the last one day, with trading volume of the token surging 500%. As cryptoassets recover from the deeply subdued month of May, let’s know what’s behind Voyager Token’s rise.

Is Voyager any different?

The project consists of elements like an app to trade cryptoassets, and a debit card. By this measure, the project seems to have at least some utility as compared to assets like meme coins.

The official website of Voyager also mentions “annual rewards” for its trading app users. Besides, over 100 cryptoassets are said to be supported for trade purposes on Voyager. It is also offering “automated” investing services, where users can set recurring purchases of assets. What is highlighted is a banking partner, which voyager claims holds the USD funds of users.

The debit card by Voyager claims to enable spending in USD Coin, a digital stablecoin. It is said that it charges no annual fees from users.

Also read: How does Terra 2.0 differ from Terra? How is Luna 2.0 faring?

Voyager Token (VGX) price

VGX token is said to be used for rewarding and staking within the Voyager ecosystem. The holders of Voyager Token are eligible for rewards in proportion to the number of tokens held.

The token has had a rough 2022, with its price showing a continuous downward trend. From US$3 at the beginning of 2022 to under US$2 by the end of March, Voyager’s Q1 was subdued. The token’s price fell further and dropped under US$1 last month. As of writing, the token has recovered, and the price is above US$1.

Data provided by CoinMarketCap.com

Why is Voyager Token rising now?

Some believe that the token’s recovery has to do with the announcement regarding an upgrade to the loyalty program. It might make Voyager app a serious contender for popular crypto exchanges like Binance.

Bottom line

Voyager is providing services like a USD Coin debit card and an app to trade other assets. VGX, native to the project, has had a bad run over the past five months. The recent surge in price is being attributed by some to an announced upgrade to the rewards program. Separately, the wider crypto market has also seen a positive movement over the past couple of days.

Also read: What are stablecoins? Top 3 assets by market cap in this category

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.