Highlights:

- Stablecoins are cryptos whose value is pegged to real-world assets.

- Tether (USDT) is the world’s largest stablecoin by market capitalization.

- The BUSD crypto is regulated by the New York State Department of Financial Services.

Stablecoins are among the major players in the crypto economy. For instance, the recent decline in stablecoins has pushed almost all major cryptos into the red. So, what are stablecoins?

Stablecoins are cryptos whose value is tied to real-world assets like fiat currency, commodities, or financial instruments. Stablecoins are relatively less volatile as they are pegged to real-world assets.

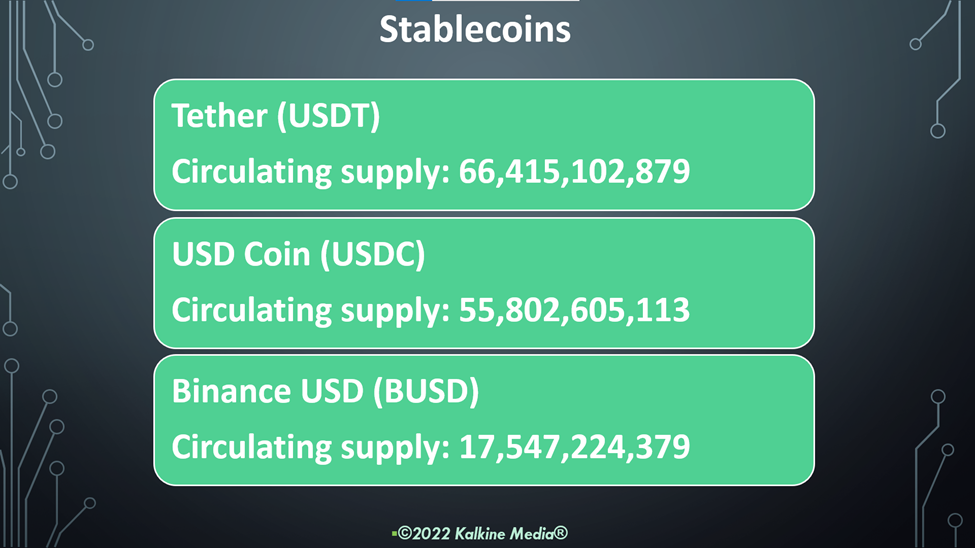

Here we explore the top three stablecoins on investors’ radar.

Data Source: CoinMarketCap.com

Data Source: CoinMarketCap.com

Tether (USDT)

USDT is the world’s largest stablecoin by market capitalization. Its price is pegged to the US dollar. The stablecoin is issued by Tether, a Hong Kong-based firm.

The token maintains its pegged USD price by holding commercial papers, fiduciary deposits, cash, and other assets equivalent to the US dollar value.

The project was originally launched as Realcoin in 2014 by Brock Pierce, Reeve Collins, and Craig Sellars. It trades on crypto exchanges like Binance, HitBTC, Huobi Global, etc.

The USDT price traded flat at US$0.999 at 12:46 pm ET on June 30. Its one-day volume rose 6.96% to US$46.72 billion. Its market cap is US$66.34 billion, and its fully-diluted market cap is US$68.53 billion.

USD Coin (USDC)

USDC price is pegged to the US dollar on a 1:1 ratio. Every circulating token is backed by US$1 held in reserve. Its total reserve is a mix of cash and short-term US Treasury bonds. The Centre consortium, which created USDC, claims the coin is issued by regulated financial institutions.

Binance USD (BUSD)

BUSD is a stablecoin pegged to the US dollar. Binance issued the coin in partnership with Paxos. BUSD is regulated by the New York State Department of Financial Services (NYDFS) and provides its monthly audit report on its website. BUSD is issued as an ERC-20 token that supports BEP-2.

The BUSD price was down 0.25% to US$0.9994, while its one-day volume rose 1.96% to US$$6.16 billion at 1:03 pm ET on June 30. Its market cap is US$17.53 billion, and its fully-diluted market cap is US$17.53 billion.

Bottom line:

Stablecoins are generally considered safe compared to other crypto assets during a market downturn. Given the high volatility in the crypto market, some investors opt to invest in stablecoins as their value is pegged to real-world assets. However, after the TerraUSD crash in March, investors should exercise due diligence before spending on crypto assets.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instruments or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.