Highlights

- Total market cap of cryptoassets has now slipped below US$1.5 trillion, with BTC leading the fall

- Terra (LUNA) crypto, linked to UST stablecoin, had lost over 50 per cent in the past 24 hours as of writing

- It is being said that how the Luna Foundation Guard maintains its reserves may be behind the dip

The crypto market is reeling under a slew of factors. The total market cap, according to price tracking website CoinMarketCap, was under US$1.5 trillion as of writing.

While a few experts are pinning the blame on the Fed’s shift toward sucking liquidity from the economy by hiking rates, others are pointing fingers at the inherent hyper-volatile nature of cryptoassets. Bitcoin (BTC), arguably the heart of the cryptoverse, has lost nearly 35 per cent since the start of 2022. From metaverse cryptos to meme tokens, the bearish trend has gripped virtually all crypto categories.

But the steep fall in one asset has many talking. The token is Terra (LUNA), which had lost more than 50 per cent as of writing. Let’s know more.

Why is Terra LUNA crypto down?

Though it is quite complex to discover the precise factor behind a sudden fall in any cryptoasset, a few reports are talking about the fall in the value of TerraUSD (UST), which might be the factor.

TerraUSD, the stablecoin of the Terra ecosystem, is pegged to the US dollar. By that measure, per token value should match with the value of USD at all times. However, at the time of writing, UST stablecoin had a value of under US$0.8. Reportedly, the decline in the value of UST is attributable to the way the LUNA ecosystem maintains its reserves.

It is said that other stablecoins like Tether, which has the highest market cap in the category, maintain USD reserves to back the stablecoin. By contrast, the LUNA ecosystem is said to have crypto reserves to back the value of UST. Reports say that Luna Foundation Guard has recently liquidated some of its BTC holding. That, some say, may also be one of the factors behind BTC’s sharp fall of late.

Also read: Why is Dogecoin down? 3 likely reasons

Terra (LUNA) crypto price

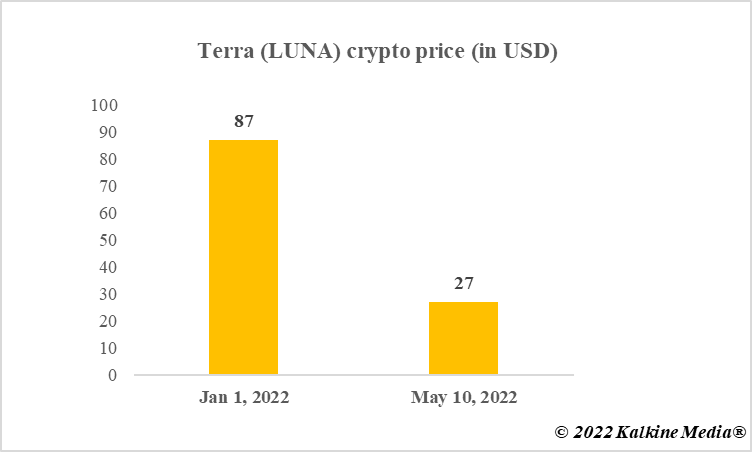

Notably, LUNA started this year at a price of nearly US$87, and by the end of January it had lost almost half its value.

By early April, however, a consistent bullish trend took LUNA crypto price to over US$110. Just a few days back, LUNA crypto was trading at over US$80. The price as of writing was under US$30.

Also read: 3 most expensive cryptos in cryptoverse by per token price

Data provided by CoinMarketCap.com

Bottom line

Terra (LUNA) crypto was one of the top 15 cryptocurrencies by market cap as of writing. The ranking had slipped due to the recent plunge in the value of the token. Reports say that Luna ecosystem’s reserve strategy for its UST stablecoin may be the biggest factor. How stablecoins maintain their reserves has always been a subject of controversy. The decline in the values of UST stablecoin and LUNA token is a reminder of the risks that continue to ail the cryptoverse.

Also read: Risks involved when considering NFTs as alternative investment asset

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.