Highlights

- The Fed has yet again hiked the policy rate, making riskier assets a little less attractive

- Dogecoin (DOGE) is down, and similar sentiment has gripped the other meme coin Shiba Inu (SHIB)

- New cryptos can launch at any time, giving enthusiasts new options to consider

Dogecoin, arguably the most popular meme token, had declined nearly 30 per cent this year at the time of writing. By market cap, Dogecoin was the leading meme crypto. Overall, Dogecoin was among the top 15 assets on the list where Bitcoin (BTC) has always topped.

Much of the focus of Dogecoin enthusiasts is on why is the token down? Why is DOGE losing value is a question that seeks answers. Hereunder are a few probable reasons.

1. Broader bearish phase

It is not Dogecoin alone that has lost in 2022. The biggest asset Bitcoin’s year-to-date loss was nearly as much as Dogecoin as of writing. Other major cryptos like Ether and Solana had even deeper losses.

Shiba Inu ranks second in terms of meme tokens by market cap, and it was down nearly 50 per cent. A closer look at the price data of CoinMarketCap suggested that all top 100 assets, barring a handful, were down. Kadena (KDA) crypto was down nearly 75 per cent on YTD basis.

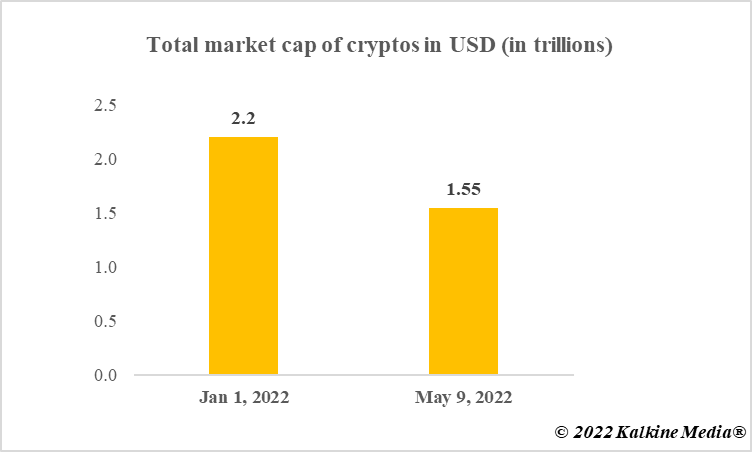

Notably, the overall market cap reported by CoinMarketCap was under US$1.55 trillion. It was nearly US$2.2 trillion on January 1, 2022. The bearish phase seems to have gripped the entire sector.

Also read: 3 most expensive cryptos in cryptoverse by per token price

2. Rate hikes and variable return assets

The Fed and other central banks are more tilted toward raising interest rates. Though the economy has not fully recovered from the pandemic shock, the Fed has hiked rates twice so far this year.

Inflation has become the biggest worry for policymakers, with house prices skyrocketing in the US and Canada. When central banks undertake rate hikes, investors are arguably more inclined toward options like precious metals and government bonds, often called safe haven assets.

Stocks and cryptos are variable return assets, and this year has so far been subdued for both.

Also read: Risks involved when considering NFTs as alternative investment asset

3. New participants in cryptos

ApeCoin (APE) is a new crypto launched in March. According to CoinMarketCap, it had a market cap of nearly US$3.2 billion as of writing. This indicates that a section of crypto enthusiasts may be picking recently launched assets.

The abundance in the crypto market is clear from the fact that CoinMarketCap tracks over 19,000 assets. Among top 100 by market cap, UNUS SED LEO crypto had an over 40 per cent YTD gain at the time of writing. TRON crypto was up over 10 per cent on YTD basis.

Cryptos are expanding with new participants in metaverse, non-fungible tokens (NFTs), decentralized finance (DeFi) and other categories. This may be taking some funds away from Dogecoin.

Data provided by CoinMarketCap.com

Also read: What is Mononoke Inu token? Know about its gaming and NFT services

Bottom line

Dogecoin is down this year, but so are many major cryptoassets including Shiba Inu. From rate hike by the Fed to newer assets drawing enthusiasts’ patronage, the reasons for the fall in Dogecoin are diverse.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.