Highlights

- The Keep Network crypto has gained over the past 24 hours, with its trading volume having soared

- The network claims it provides encrypted storage facilities for private data on a blockchain

- The KEEP crypto’s rise over the last 24 hours contrasts with the decline in BTC price during the same period

Large cap or not, popular or not, all cryptocurrencies are volatile. Separate blockchain-based projects are claiming to resolve separate problems.

While BTC aims to make remittances cheaper and quicker, altcoins like Ether and Solana are the native tokens of blockchain networks. In this light, a project titled Keep Network, with its native KEEP crypto, makes for an interesting watch. Let’s know more.

What does the Keep Network do?

The network is said to have storage facilities for private data with blockchain underpinnings. Here, the data is saved in what the project calls ‘keeps’, which are located off-chain.

Off-chain existence allows ‘keeps’ to prevent the exposure of saved data to decentralized public networks. One popular project in the Keep network ecosystem is tBTC. tBTC stores Bitcoin keys in ‘keeps’, while the project harnesses Ethereum’s blockchain network for decentralization.

The private data on the network, the project claims, is encrypted. This way, the data interacts with the blockchain network, without being exposed to the network’s users.

Also read: What is My Neighbor Alice game & its crypto’s price prediction?

What Is Virtual Reality Gaming Bombcrypto ?

KEEP crypto

The network uses KEEP as the native token, which can be staked. Keep Network rewards KEEP stakers by issuing them either new KEEP tokens or in Ether cryptocurrency.

KEEP crypto’s price

The KEEP token, with its over US$490 million as its market cap, is presently not a top 100 crypto asset on the CoinMarketCap list. But over the last 24 hours, KEEP’s trading volume has soared nearly 400 per cent, and the price is also up.

Also read: Russia-Ukraine war: Possible impact on cryptos & can BTC prove utility?

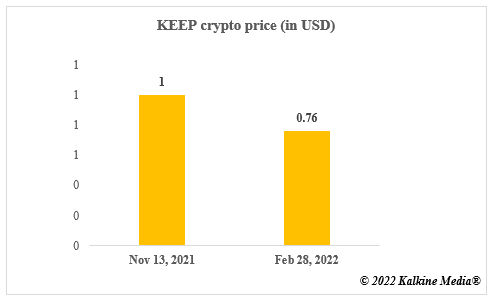

The KEEP coin was trading at nearly US$0.76 as of writing, which is a little above its price at the beginning of this year. This contrasts with Bitcoin and many other large cap cryptos that have lost value in 2022.

KEEP crypto’s price prediction

In mid-November last year, the KEEP crypto breached the US$1 mark, but the surge could not last for long. In 2021, KEEP also fell under US$0.3 on multiple occasions, which depicts the volatility of the token.

The KEEP crypto price in the medium-to-long term could be a product of how the network proves its utility. KEEP, being a native token, has limited use within the project, though it has also become a tradable asset.

Also read: What is Talking Ben crypto & is the BEN coin safe?

By the end of 2022, the KEEP crypto might manage to reclaim the US$1 price tag. For this, the wider crypto universe may have to register gains this year and the Keep Network will have to find more users.

Data provided by CoinMarketCap.com

Also read: Russia-Ukraine war: Possible impact on cryptos & can BTC prove utility?

Bottom line

The Keep Network is an interesting project as it claims to help store private data on a public blockchain with the security of encryption. tBTC, which runs on the Keep Network, is also an interesting union of BTC and Ethereum, which are the biggest and second-biggest assets in the crypto world. The KEEP coin may benefit if developers find value in the project and its ecosystem becomes a preferred network.