Highlights

- Decentralized Finance or DeFi sector has participants offering decentralized exchange services

- IDEX claims it enables automated market making and provides swapping services to users

- IDEX crypto has rebounded of late, but it still has a negative year-to-date return like BTC

A new category of crypto exchanges, DEX, seems to be rivalling what they call ‘centralized exchanges’ like Binance and Coinbase. DEX is an acronym for Decentralized Exchange, a term for platforms that often have a native governance token that allows users to vote on key aspects of the project.

One such Decentralized Exchange is IDEX, the native token of which has recently risen sharply. Let’s know more about IDEX.

What is IDEX cryptocurrency project?

The platform claims to be a “blend” of centralized and decentralized exchange arrangements. Automated market making and liquidity generation are the primary offerings highlighted in the documents available on the website. The exchange states it can prevent users from failed trades, besides enabling protection against sandwich attacks.

Also read: 3 reasons why Bitcoin is going down at any point in time

Its trading engine, IDEX says, is off-chain, and the linked order book also exists off-chain. The platform claims this reduces the gas fee for users. IDEX further mentions that the balances of both the transacting parties are updated in real time, which can enable further trading activity immediately.

IDEX also highlights swapping of assets as one of the functions, besides mentioning smart contracts to make the entire arrangement decentralized.

Also read: CEL token trading volume rises: What are Celsius wallet's services?

What is IDEX crypto?

IDEX exchange has a native token, which is said to be based on ERC-20 standard. IDEX token would find use within the ecosystem, besides being a tradable, though risky, asset listed on other exchanges.

Also read: Is Crypto SuperStar legit? What do its ‘terms of use’ suggest?

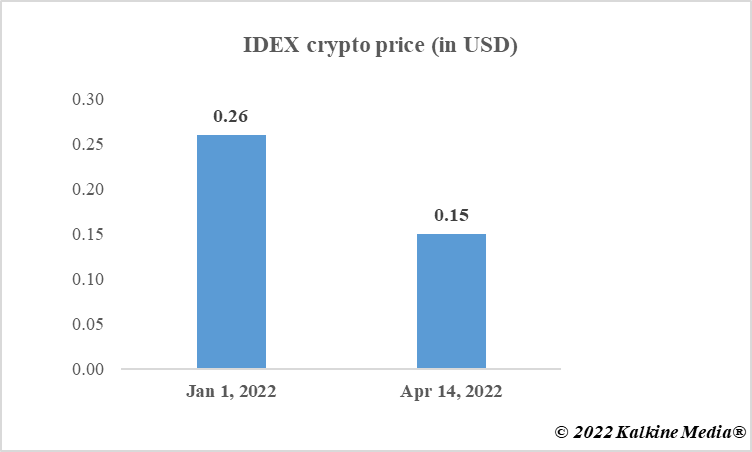

What is IDEX crypto's price?

With a market cap of over US$99 million, IDEX token traded at nearly US$0.15 as of writing. On a year-to-date (YTD) basis, the token has lost value. Having begun at a price of US$0.26 on January 1, IDEX fell to nearly US$0.11 by the end of the month. A brief spike in early February took the price to more than US$0.3.

The volatility of the token makes IDEX crypto price prediction virtually impossible.

Data provided by CoinMarketCap.com

Bottom line

IDEX crypto had registered a spike at the time of writing. However, it has yet to return a positive YTD. The IDEX project comprises a decentralized exchange with automated market-making and liquidity features. Users can also undertake staking, and IDEX claims the balance after any transaction is quickly updated. IDEX, however, has yet to become a large market cap DeFi player in the crypto space.

Also read: What's happening with Shiba Inu? What is the '$1/SHIB token' discussion?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.