Highlights

- Stablecoins are stable value tokens that claim to provide a predictable blockchain-based currency system

- Tether is the biggest in the category, and most of the big stablecoins are pegged to the US dollar

- Tokens like USDT are used for trading other cryptocurrencies, but how stablecoins make money is a puzzle

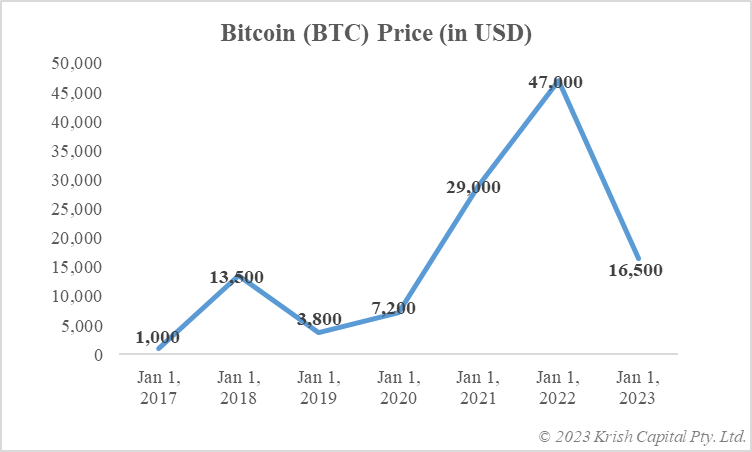

No business can run for long unless it makes money to sustain operations. Bitcoin or BTC was designed to work as a digital currency, which runs on a distributed and decentralised ledger. In order to maintain the network’s everyday operations, the Bitcoin project is expected to make money. Some experts, on the other hand, suggest Bitcoin could be a not-for-profit project with utility as a peer-to-peer controlled currency system.

While Bitcoin is notorious for its unstable value, one category in the cryptoverse touts its stable value at all times as its biggest feature. Stablecoins like Tether’s USDT and Binance’s BUSD claim to provide an alternative blockchain-based currency that maintains a 1-to-1 peg with the US dollar.

The question is: how do stablecoin projects earn money to sustain operations? Let us explore.

Fractional reserve banking?

Banks across the world run on the concept of fractional reserves. This implies that out of the total money deposited by people, the bank only keeps a fraction in liquid reserves to honour regular withdrawals. The rest of the money is used for lending purposes, which generates income for the bank. Most of the big stablecoin projects are pegged to the US dollar. But the question is: do these act like a bank?

The projects maintain that tokens are issued with the backing of adequate reserves in the form of cash and cash equivalents. How any project uses these cash reserves is not yet known. Tether is expected to have tens of billions of dollars in reserve, considering the market cap of USDT stablecoin, but what it does with or intends to do with its reserves has yet to be discovered.

Risks are many

In May 2022, one of the leading stablecoin projects crashed and sparked a steep decline in the value of almost all cryptocurrencies. The project was Terra, which had the USD-pegged USDT token. The token failed to maintain its parity, and the value of one USDT declined to only a few cents. How satisfactorily stablecoin projects maintain reserves to back issued tokens is a subject of controversy, which is why the space is not free from risks.

Data provided by CoinMarketCap.com

Bottom line

Some say, Bitcoin could be a not-for-profit currency system, which exists only to provide a blockchain-supported digital currency to people. Stablecoin projects like Tether, however, might need to make money in order to sustain operations over the long run. Whether they adopt the fractional reserve banking system or use some other measure is a wait-and-watch game.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.